Question: pls respond asap Consider a bitcoin (BTC) swap contract calling for the exchange of 1 BTC at the end of each year for a period

pls respond asap

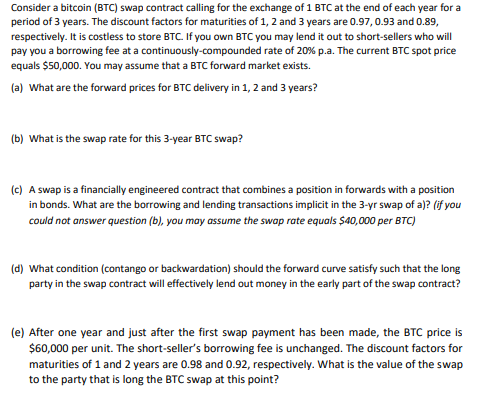

Consider a bitcoin (BTC) swap contract calling for the exchange of 1 BTC at the end of each year for a period of 3 years. The discount factors for maturities of 1, 2 and 3 years are 0.97, 0.93 and 0.89, respectively. It is costless to store BTC. If you own BTC you may lend it out to short-sellers who will pay you a borrowing fee at a continuously-compounded rate of 20% p.a. The current BTC spot price equals $50,000. You may assume that a BTC forward market exists. (a) What are the forward prices for BTC delivery in 1, 2 and 3 years? (b) What is the swap rate for this 3-year BTC swap? (c) A swap is a financially engineered contract that combines a position in forwards with a position in bonds. What are the borrowing and lending transactions implicit in the 3-yr swap of a)? (if you could not answer question (b), you may assume the swap rate equals $40,000 per BTC) (d) What condition (contango or backwardation) should the forward curve satisfy such that the long party in the swap contract will effectively lend out money in the early part of the swap contract? (e) After one year and just after the first swap payment has been made, the BTC price is $60,000 per unit. The short-seller's borrowing fee is unchanged. The discount factors for maturities of 1 and 2 years are 0.98 and 0.92, respectively. What is the value of the swap to the party that is long the BTC swap at this point? Consider a bitcoin (BTC) swap contract calling for the exchange of 1 BTC at the end of each year for a period of 3 years. The discount factors for maturities of 1, 2 and 3 years are 0.97, 0.93 and 0.89, respectively. It is costless to store BTC. If you own BTC you may lend it out to short-sellers who will pay you a borrowing fee at a continuously-compounded rate of 20% p.a. The current BTC spot price equals $50,000. You may assume that a BTC forward market exists. (a) What are the forward prices for BTC delivery in 1, 2 and 3 years? (b) What is the swap rate for this 3-year BTC swap? (c) A swap is a financially engineered contract that combines a position in forwards with a position in bonds. What are the borrowing and lending transactions implicit in the 3-yr swap of a)? (if you could not answer question (b), you may assume the swap rate equals $40,000 per BTC) (d) What condition (contango or backwardation) should the forward curve satisfy such that the long party in the swap contract will effectively lend out money in the early part of the swap contract? (e) After one year and just after the first swap payment has been made, the BTC price is $60,000 per unit. The short-seller's borrowing fee is unchanged. The discount factors for maturities of 1 and 2 years are 0.98 and 0.92, respectively. What is the value of the swap to the party that is long the BTC swap at this point

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts