Question: pls show excel work :) DataPoint Engineering is considering the purchase of a new piece of equipment for $350,000. It has an eight-year midpoint of

pls show excel work :)

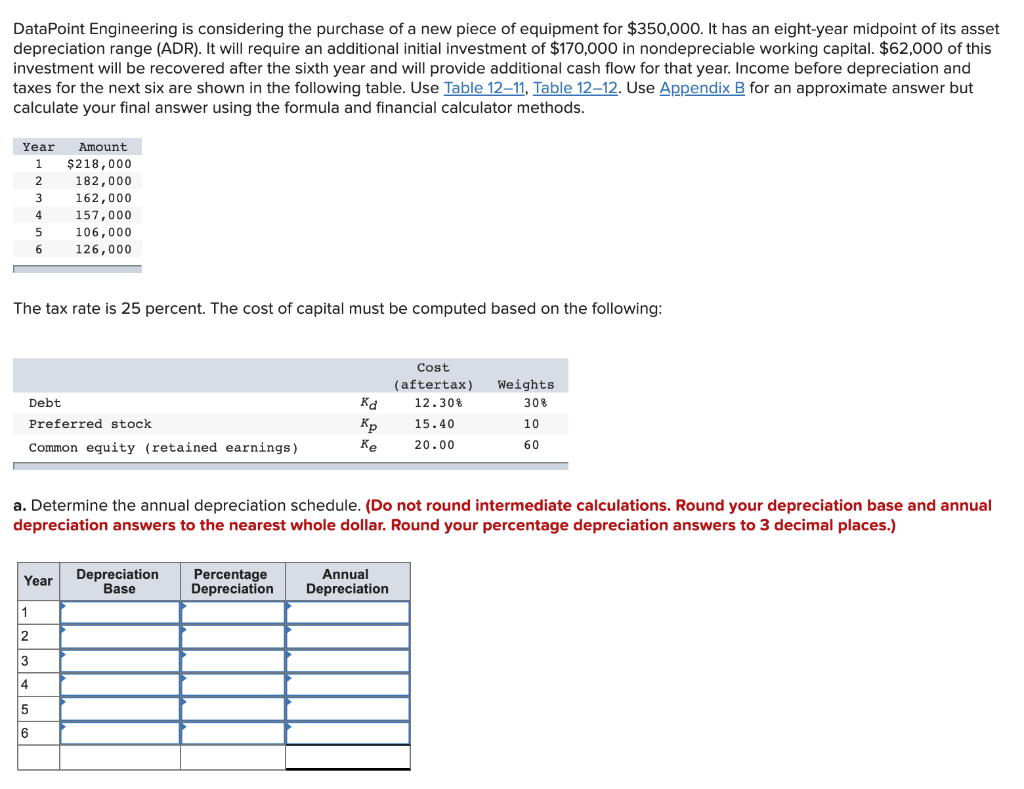

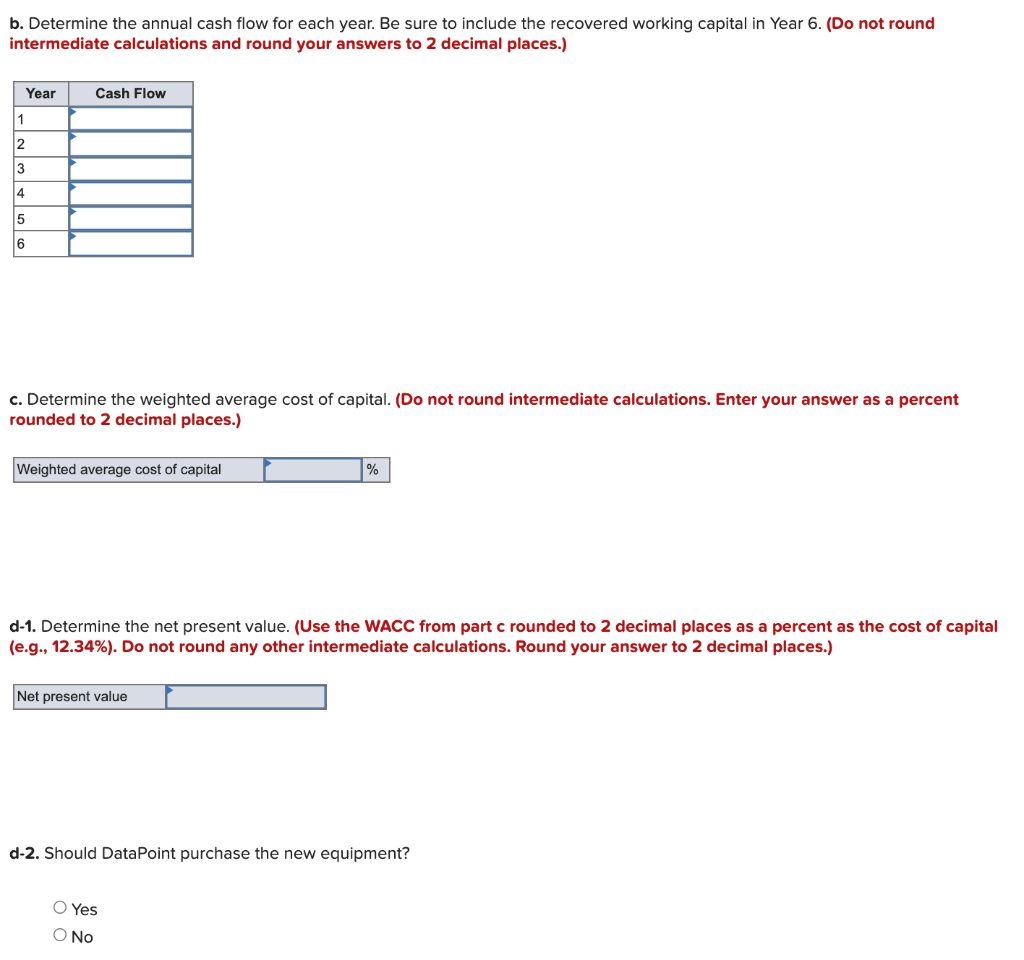

DataPoint Engineering is considering the purchase of a new piece of equipment for $350,000. It has an eight-year midpoint of its asset depreciation range (ADR). It will require an additional initial investment of $170,000 in nondepreciable working capital. $62,000 of this investment will be recovered after the sixth year and will provide additional cash flow for that year. Income before depreciation and taxes for the next six are shown in the following table. Use Table 1211, Table 12-12. Use Appendix B for an approximate answer but calculate your final answer using the formula and financial calculator methods. Year 1 2 3 Amount $218,000 182,000 162,000 157,000 106,000 126,000 4 5 6 The tax rate is 25 percent. The cost of capital must be computed based on the following: Debt Cost (aftertax) 12.308 15.40 20.00 Kd Weights 30% 10 Preferred stock Common equity (retained earnings) 60 a. Determine the annual depreciation schedule. (Do not round intermediate calculations. Round your depreciation base and annual depreciation answers to the nearest whole dollar. Round your percentage depreciation answers to 3 decimal places.) Year Depreciation Base Percentage Depreciation Annual Depreciation 1 2 3 4 5 6 b. Determine the annual cash flow for each year. Be sure to include the recovered working capital in Year 6. (Do not round intermediate calculations and round your answers to 2 decimal places.) Year Cash Flow 1 2 3 4 5 6 c. Determine the weighted average cost of capital. (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Weighted average cost of capital % d-1. Determine the net present value. (Use the WACC from part c rounded to 2 decimal places as a percent as the cost of capital (e.g., 12.34%). Do not round any other intermediate calculations. Round your answer to 2 decimal places.) Net present value d-2. Should DataPoint purchase the new equipment? O Yes O No

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts