Question: pls show work for the calculations and interpretation for these questions. thanks a lot . 1. calculate Debt to Equity for 2017 and 2018. 2.

pls show work for the calculations and interpretation for these questions. thanks a lot.

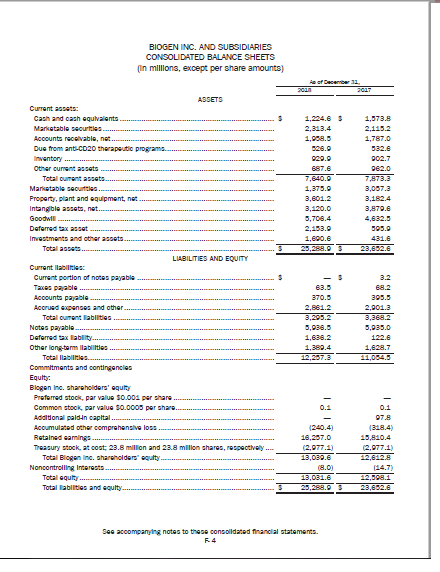

1. calculate Debt to Equity for 2017 and 2018.

2. calculate Debt to Total Net Worth for 2017 and 2018

3. calculate Assets to Equity for 2017 and 2018

BIOGEN INC. AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (in millions, except per share amounts) Re of December 31 2011 2017 1,224.6 5 2,313.4 1,968.5 529. 929.0 687.6 7,840.0 1,375.0 3,601.2 3,120.0 3,708.4 2.153.0 1.690.6 1.573.8 2,115.2 1,787.0 532.6 902.7 962.0 7,873.3 3,067.3 3,182.4 3,879.6 4,632.5 395.0 431.6 23,682.6 $ > ASSETS Current assets: Cash and cash equivalents Marketable securities Accounts receivable, net Due from anti-CD20 therapeutic programs Inventory Other current assets Total current assets Maritable securities Property, plant and equipment, net Intangible assets, net. Goodwil. Deferred tax asset Investments and other assets Total 2005 LIABILITIES AND EQUITY Current abilities: Current portion of notes payable Taxes payable Accounts payable Accrued expenses and other Total current liabilities Notes payable Deferred tax tablity. Other long-term abilities Total abilities. Commitments and contingencies Equity: Blogen Inc. shareholders' equity Preferred stock, par value $0.001 per share. Common stock, par value 50.0005 per share. Additional paldin capital Accumulated other comprehensive loss Retained earnings Treasury stock, at cost: 23.8 million and 23.8 million shares, respectively Total Blogen Inc. shareholders'ulty Noncontrolling Interests Total equity... Total abilities and equity 63.5 370.5 2.861.2 3,295.2 5,988.5 1.636.2 1,389,4 12,207.3 3.2 68.2 395.5 2,901.3 3,368.2 5,035.0 122.6 1,028.7 11,064.3 (240.4 16,267.0 (2,977.1) 13,039.6 (8.03 13,031.6 0.1 07.8 (318.4) 15.810. (2,977.1) 12.612.8 (14.7 12.698.1 23,682.6 See accompanying notes to these consolidated financial statements. F.4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts