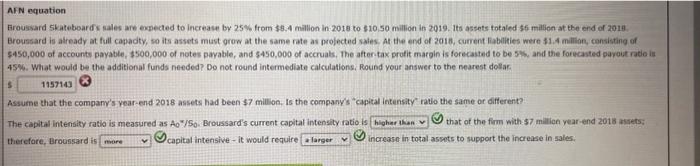

Question: pls show work if able to answer so i can understand Froussard 5kateboards sales are expected to increase by 25% from $8.4 mallon in-2018 to

Froussard 5kateboards sales are expected to increase by 25% from $8.4 mallon in-2018 to 510.50 million in 2019.1 . Broussard is already at full capadty, so its assets must grow at the same rate as profected sales. At the end of 2018 , cument labblities were 11.4 million, consisting of 5450,000 of accounts payable, $500,000 of notes payable, and 5450,000 of accruals, The afteritax protit margin is forecasted to be 54h, and the formasted payout ratio is 45\%. What would be the additional funds needed? Do not round intermediate calculations, Round your answer to the nearest dollak. Assume that the compam's year-end 2018 assets had been $7 million. Is the company's "capital intensity" ratio the same or different? The capital intensity ratio is measured as A0 /50. Broussard's current capital intensity ratio is that of the firm with-57 milicen vear-end 2018 assets: therefore. Broussard is capital intensive - it would require increase in total assets to support the increase in sales

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts