Question: PLS SHOW YOUR SOLUTION AND ANSWER Problem 15-14 (AICPA Adapted) On July 1, 2015, Karma Company sold equipment to a customer for P1,000,000. The entity

PLS SHOW YOUR SOLUTION AND ANSWER

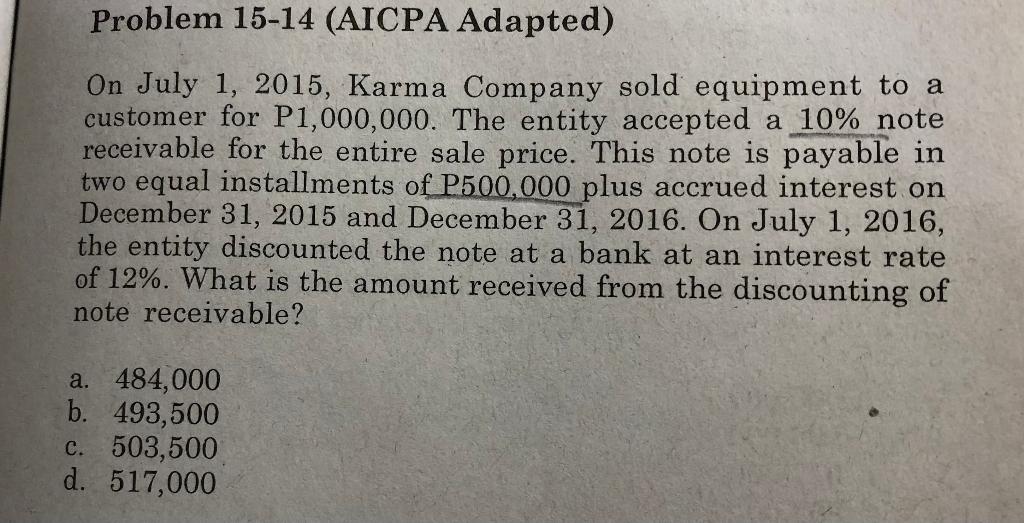

Problem 15-14 (AICPA Adapted) On July 1, 2015, Karma Company sold equipment to a customer for P1,000,000. The entity accepted a 10% note receivable for the entire sale price. This note is payable in two equal installments of P500,000 plus accrued interest on December 31, 2015 and December 31, 2016. On July 1, 2016, the entity discounted the note at a bank at an interest rate of 12%. What is the amount received from the discounting of note receivable? a. 484,000 b. 493,500 c. 503,500 d. 517,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts