Question: pls solve all! thank you Real Time Analytics reported the following balances for 2021. Calculate gross profit that will appear on Real Time Analytics' income

pls solve all! thank you

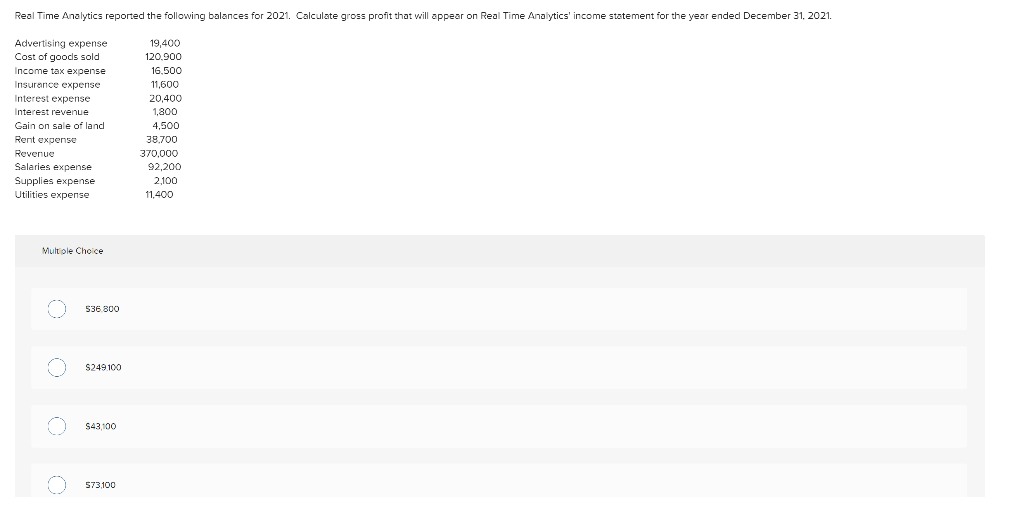

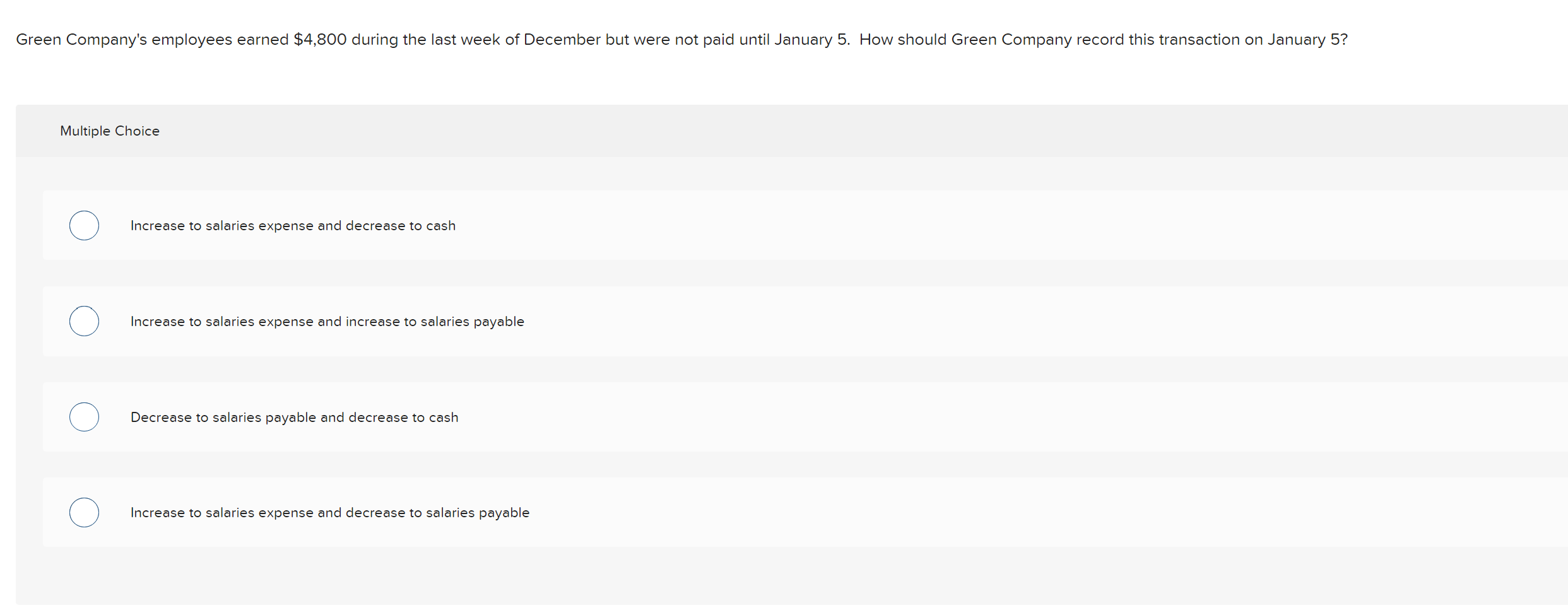

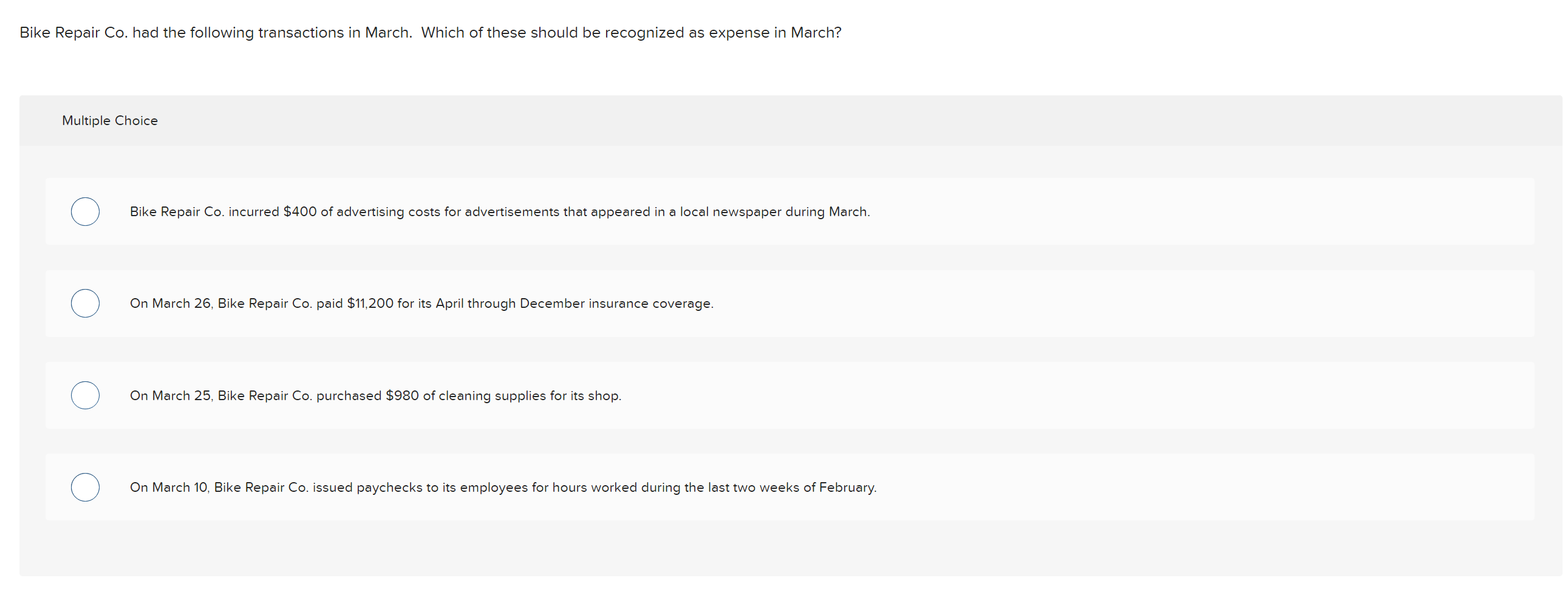

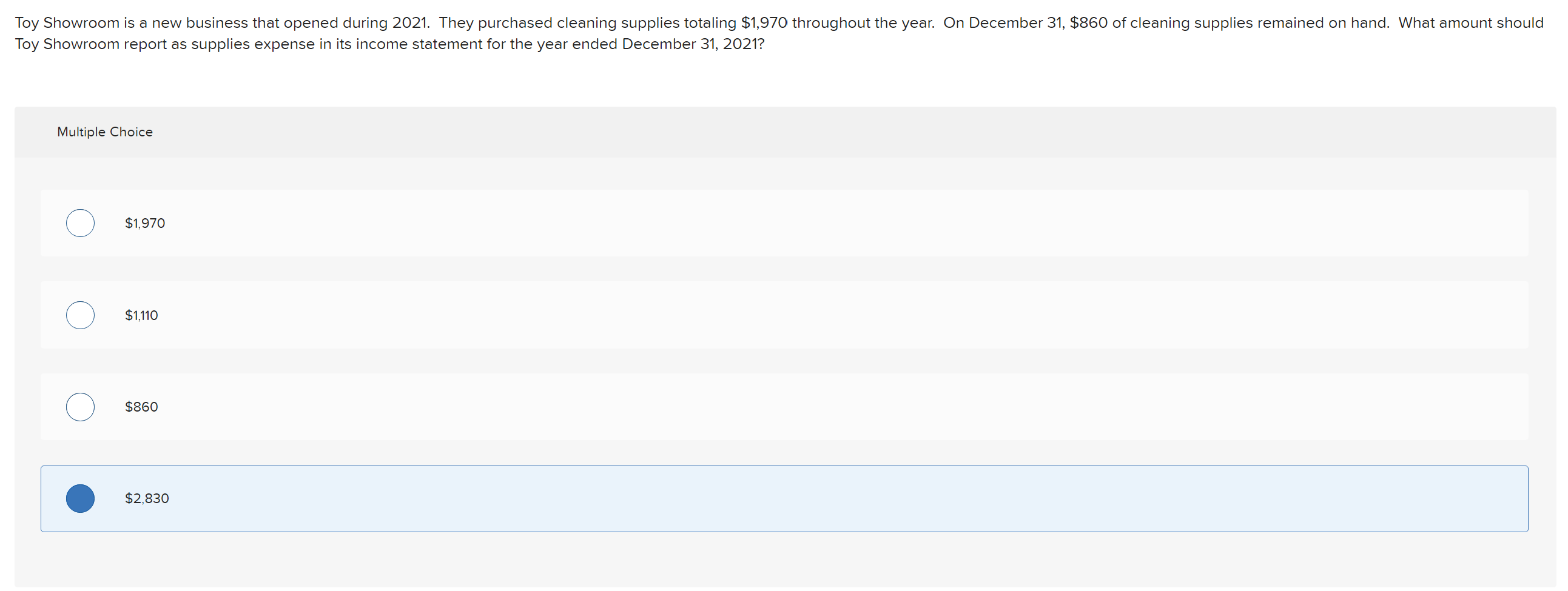

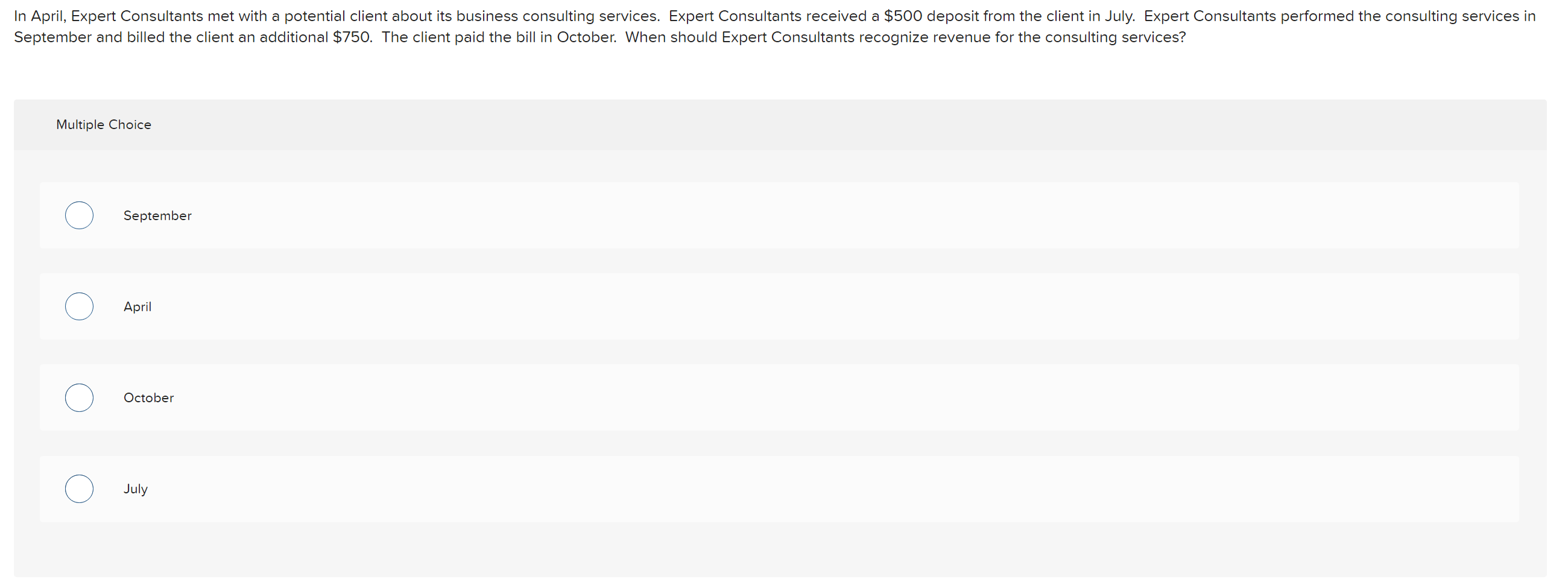

Real Time Analytics reported the following balances for 2021. Calculate gross profit that will appear on Real Time Analytics' income statement for the year ended December 31, 2021. Advertising expense Cost of goods sold Income tax expense Insurance expense Interest expense Interest revenue Gain on sale of land Rent expense Revenue Salaries expense Supplies expense Utilities expense Multiple Choice 000 $36.800 $249100 $43,100 573,100 19,400 120.900 16,500 11,600 20,400 1.800 4,500 38,700 370,000 92,200 2,100 11,400 Green Company's employees earned $4,800 during the last week of December but were not paid until January 5. How should Green Company record this transaction on January 5? Multiple Choice Increase to salaries expense and decrease to cash Increase to salaries expense and increase to salaries payable Decrease to salaries payable and decrease to cash Increase to salaries expense and decrease to salaries payable Bike Repair Co. had the following transactions in March. Which of these should be recognized as expense in March? Multiple Choice Bike Repair Co. incurred $400 of advertising costs for advertisements that appeared in a local newspaper during March. On March 26, Bike Repair Co. paid $11,200 for its April through December insurance coverage. On March 25, Bike Repair Co. purchased $980 of cleaning supplies for its shop. On March 10, Bike Repair Co. issued paychecks to its employees for hours worked during the last two weeks of February. Toy Showroom is a new business that opened during 2021. They purchased cleaning supplies totaling $1,970 throughout the year. On December 31, $860 of cleaning supplies remained on hand. What amount should Toy Showroom report as supplies expense in its income statement for the year ended December 31, 2021? Multiple Choice $1,970 $1,110 $860 $2,830 In April, Expert Consultants met with a potential client about its business consulting services. Expert Consultants received a $500 deposit from the client in July. Expert Consultants performed the consulting services in September and billed the client an additional $750. The client paid the bill in October. When should Expert Consultants recognize revenue for the consulting services? Multiple Choice September April October July

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts