Question: pls solve In this activity, you will put your knowledge about the asset disposal to the test. Instructions Foster Incorporated, a registered VAT vendor, bought

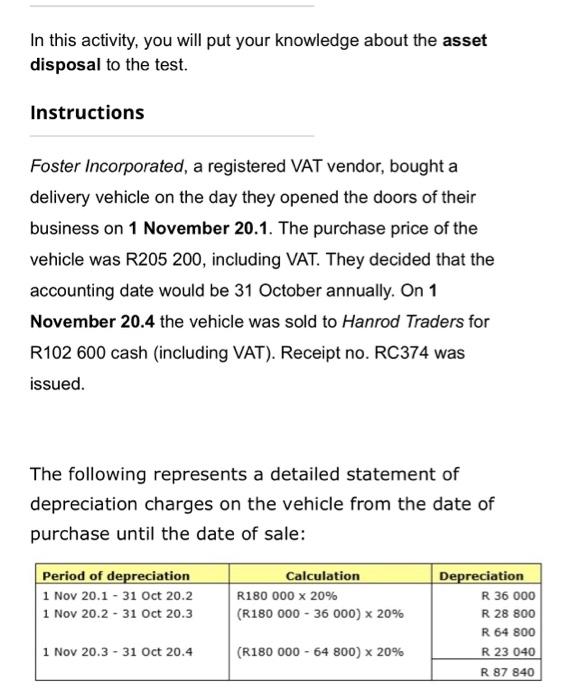

In this activity, you will put your knowledge about the asset disposal to the test. Instructions Foster Incorporated, a registered VAT vendor, bought a delivery vehicle on the day they opened the doors of their business on 1 November 20.1. The purchase price of the vehicle was R205 200, including VAT. They decided that the accounting date would be 31 October annually. On 1 November 20.4 the vehicle was sold to Hanrod Traders for R102 600 cash (including VAT). Receipt no. RC374 was issued. The following represents a detailed statement of depreciation charges on the vehicle from the date of purchase until the date of sale

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts