Question: pls solve it quickly expert the great Question No. 3 Estimated Time: 20 minutes 6 Marks AT&T has the following two mutually exclusive projects The

pls solve it quickly expert the great

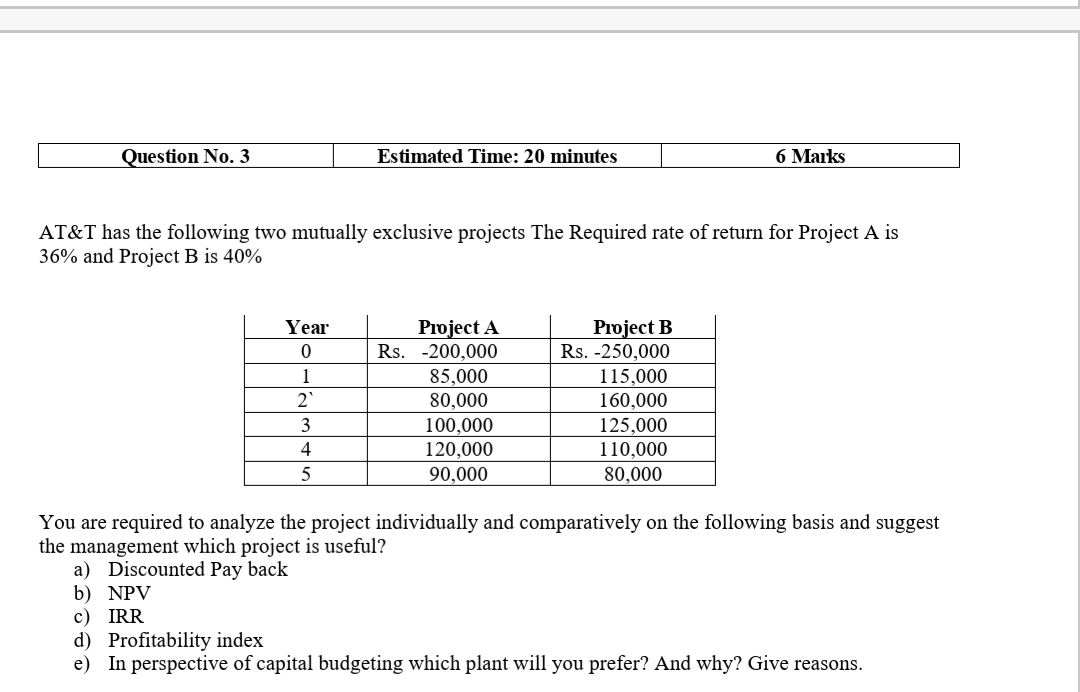

Question No. 3 Estimated Time: 20 minutes 6 Marks AT&T has the following two mutually exclusive projects The Required rate of return for Project A is 36% and Project B is 40% Year 0 1 2 3 4 5 Project A Rs. 200,000 85,000 80,000 100,000 120,000 90,000 Project B Rs. -250,000 115,000 160,000 125,000 110,000 80,000 You are required to analyze the project individually and comparatively on the following basis and suggest the management which project is useful? a) Discounted Pay back b) NPV c) IRR d) Profitability index e) In perspective of capital budgeting which plant will you prefer? And why? Give reasons

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts