Question: pls solve the problem if you know perfectly i will upvote with three members You can take USA or Indian tax either is okay manpower

pls solve the problem if you know perfectly i will upvote with three members

You can take USA or Indian tax either is okay

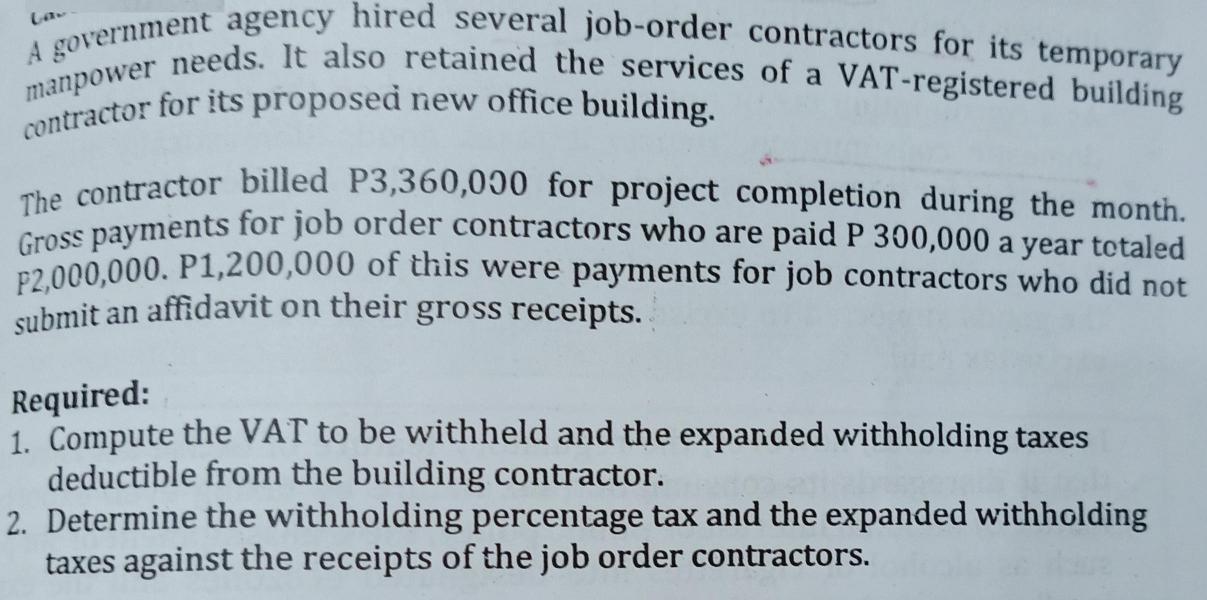

manpower A government agency hired several job-order contractors for its temporary needs. It also retained the services of a VAT-registered building contractor for its proposed new office building. The contractor billed P3,360,000 for project completion during the month. Gross payments for job order contractors who are paid P 300,000 a year totaled P2,000,000. P1,200,000 of this were payments for job contractors who did not submit an affidavit on their gross receipts. Required: 1. Compute the VAT to be withheld and the expanded withholding taxes deductible from the building contractor. 2. Determine the withholding percentage tax and the expanded withholding taxes against the receipts of the job order contractors. manpower A government agency hired several job-order contractors for its temporary needs. It also retained the services of a VAT-registered building contractor for its proposed new office building. The contractor billed P3,360,000 for project completion during the month. Gross payments for job order contractors who are paid P 300,000 a year totaled P2,000,000. P1,200,000 of this were payments for job contractors who did not submit an affidavit on their gross receipts. Required: 1. Compute the VAT to be withheld and the expanded withholding taxes deductible from the building contractor. 2. Determine the withholding percentage tax and the expanded withholding taxes against the receipts of the job order contractors

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts