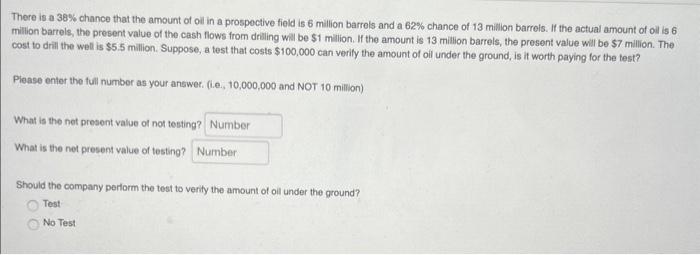

Question: pls solve! There is a 38% chance that the amount of oil in a prospoctive field is 6 million barrels and a 62% chance of

There is a 38% chance that the amount of oil in a prospoctive field is 6 million barrels and a 62% chance of 13 million barreis. If the actual amount of oil is 6 million barrels, the present value of the cash flows from drlling will be $1million. If the amount is 13 million barrels, the present value will be $7 million. The cost to drili the well is $5.5 million. Suppose, a test that costs $100,000 can verily the amount of oil under the ground, is it worth paying for the fest? Piease enter the full number as your answer. (i.e., 10,000,000 and NOT 10 milion) What is the net present value of not testing? What is the net present value of testing? Should the company pertorm the test to verity the amount of oll under the ground? Test No Test

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts