Question: pls solve this indicated question. Now look up information about your company: (1) Go to nance.yahoo.com. (2) Type in the ticker symbol for your company

pls solve this indicated question.

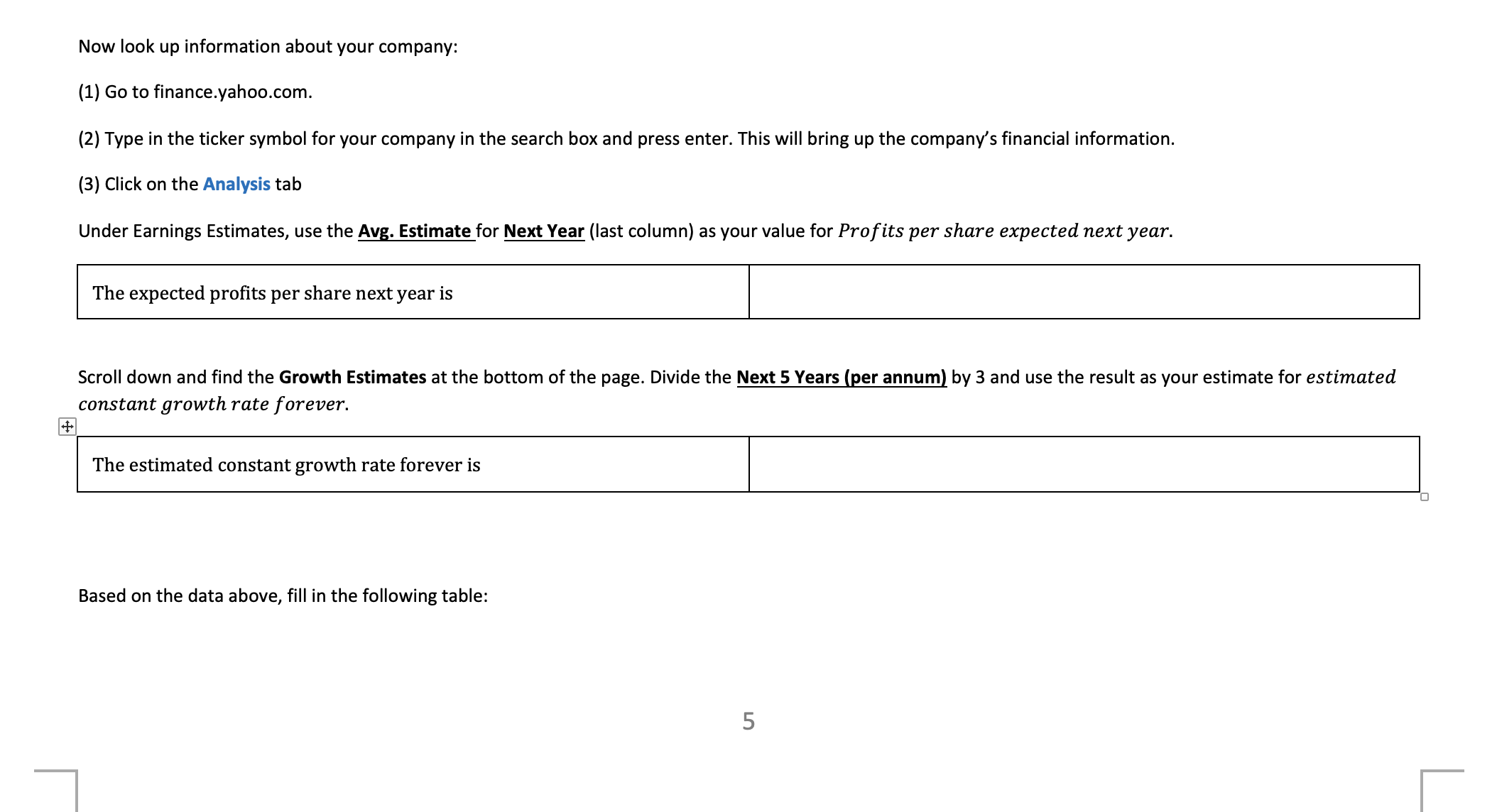

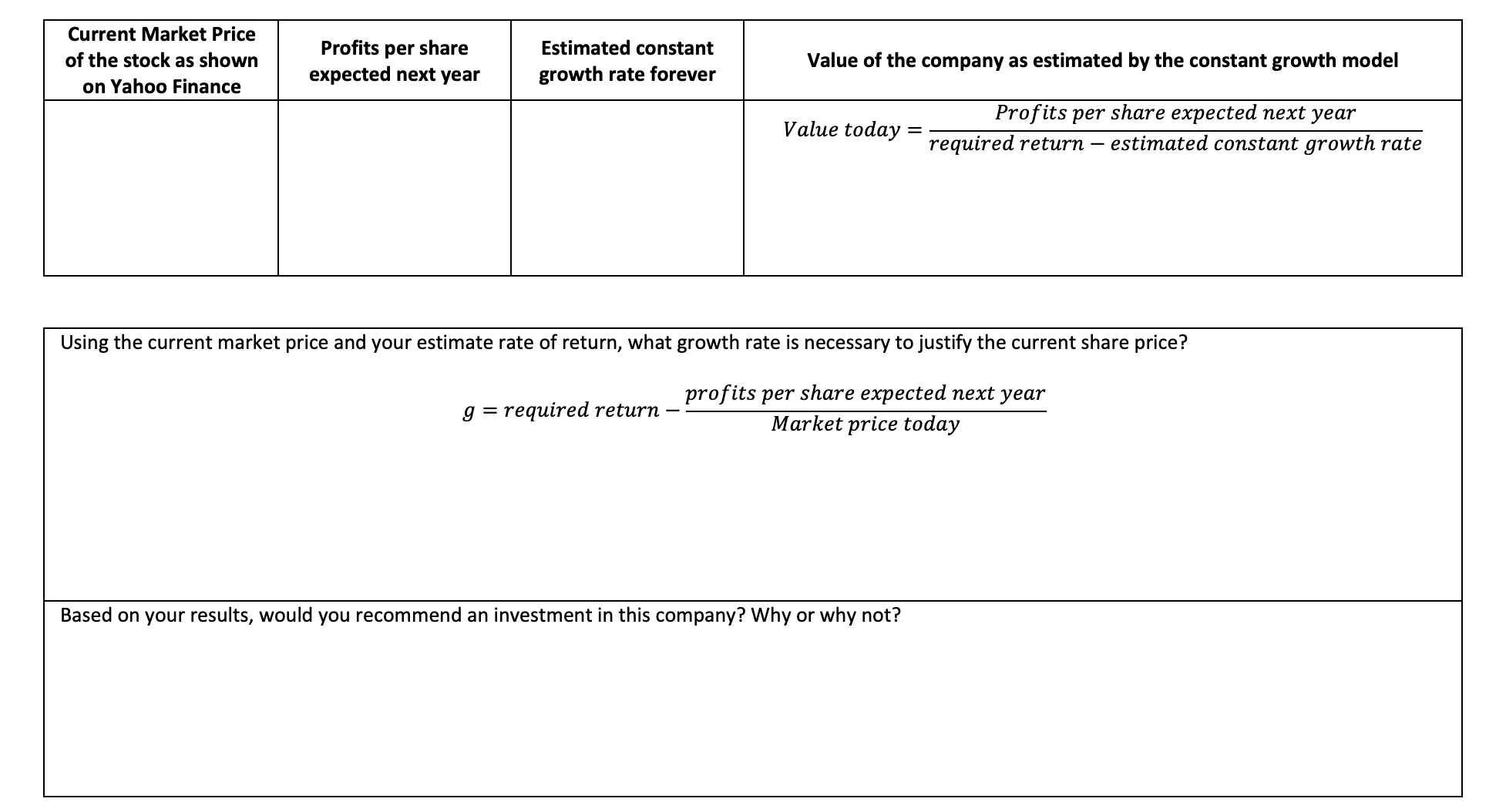

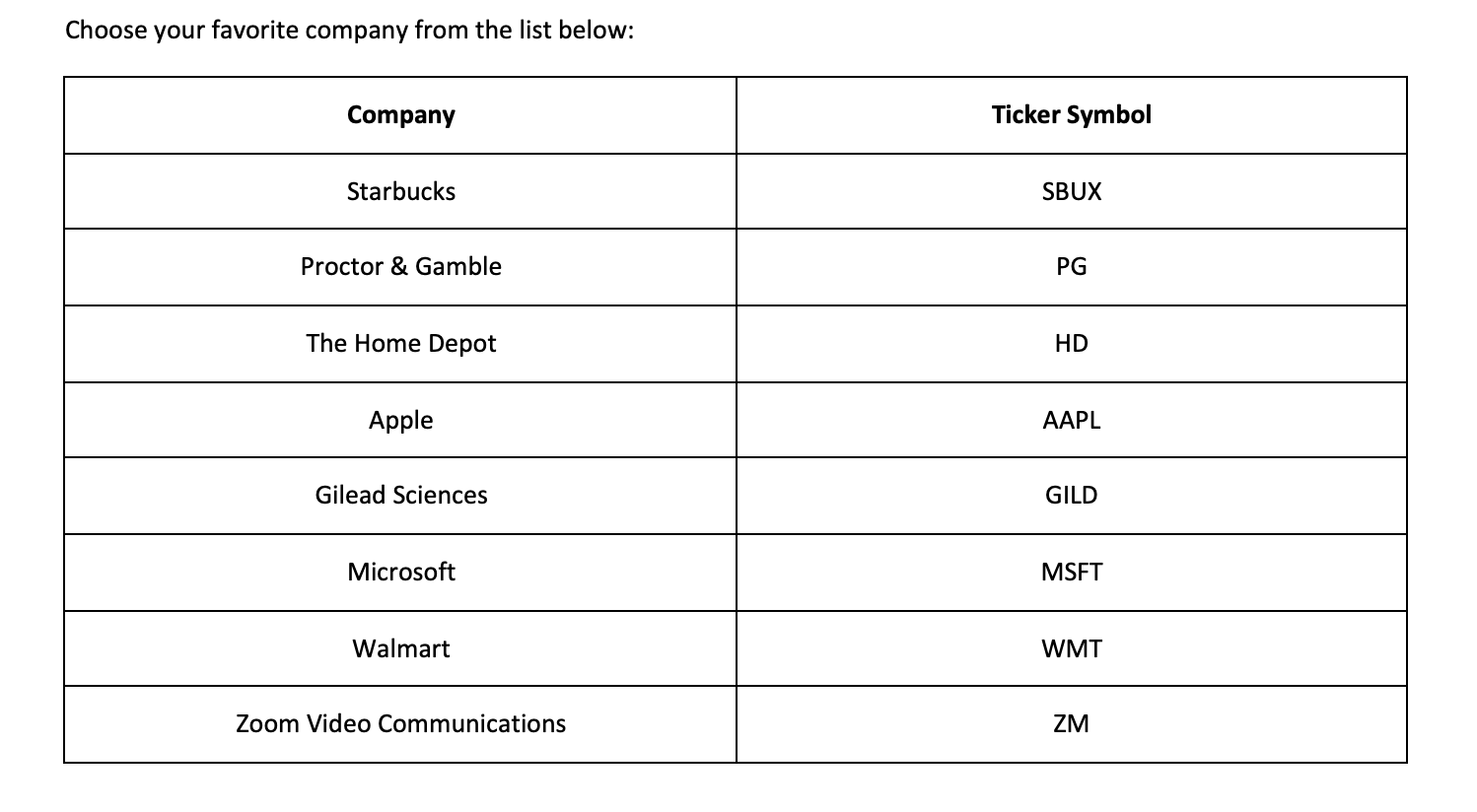

Now look up information about your company: (1) Go to nance.yahoo.com. (2) Type in the ticker symbol for your company in the search box and press enter. This will bring up the company's nancial information. (3) Click on the Analysis tab Under Earnings Estimates, use the Avg. Estimate for Next Year (last column) as your value for Profits per share expected next year. The expected prots per share next year is Scroll down and find the Growth Estimates at the bottom of the page. Divide the Next 5 Years [per annum[ by 3 and use the result as your estimate for estimated constant growth rate forever. The estimated constant growth rate forever is Based on the data above, ll in the following table: _| Current Market Price of the stock as shown Profits per share Estimated constant Value of the company as estimated by the constant growth model on Yahoo Finance expected next year growth rate forever Profits per share expected next year Value today = required return - estimated constant growth rate Using the current market price and your estimate rate of return, what growth rate is necessary to justify the current share price? profits per share expected next year g = required return Market price today Based on your results, would you recommend an investment in this company? Why or why not?Choose your favorite company from the list below: Company Ticker Symbol Starbucks SBUX Proctor & Gamble PG The Home Depot HD Apple AAPL Gilead Sciences GILD Microsoft MSFT Walmart WMT Zoom Video Communications ZM

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts