Question: pls take your time, need to undertand and do it right, thank you Aubrae and Tyor Witamson began operations of their furntture repair shop (Fumture

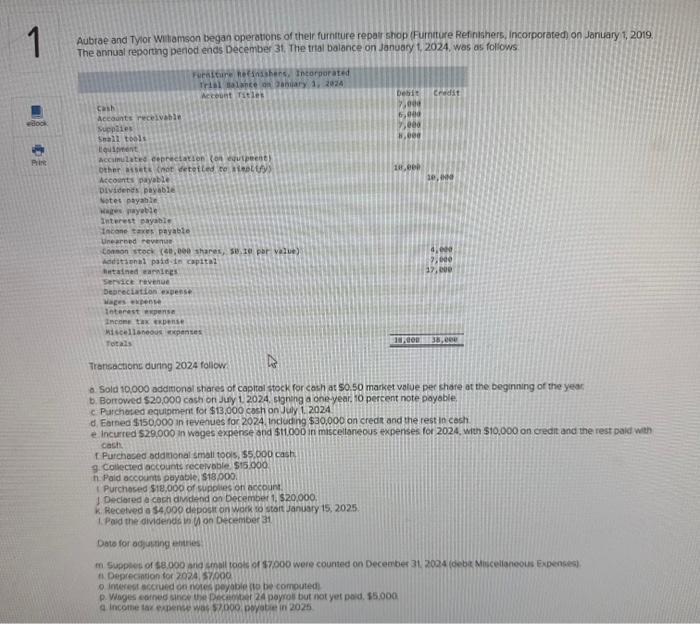

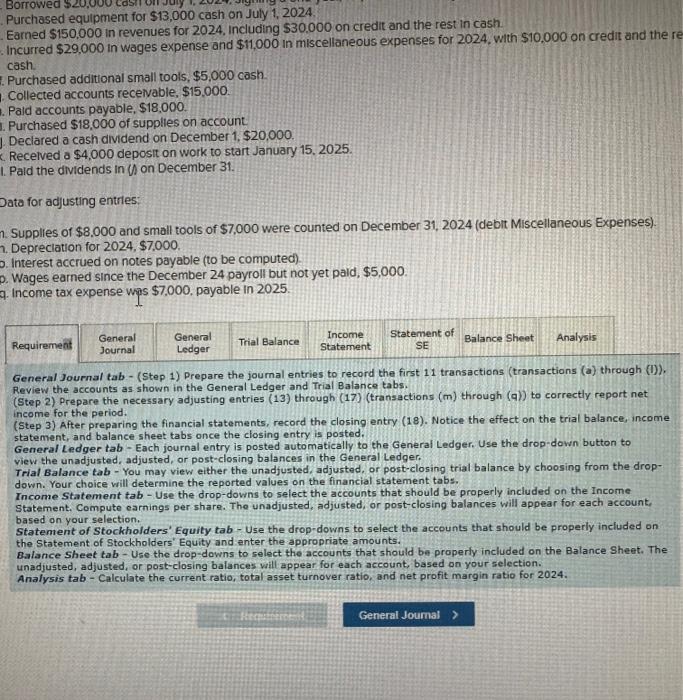

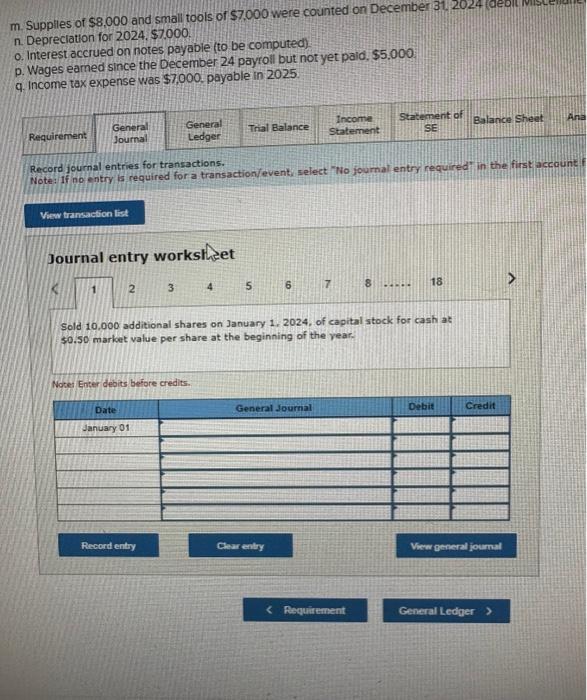

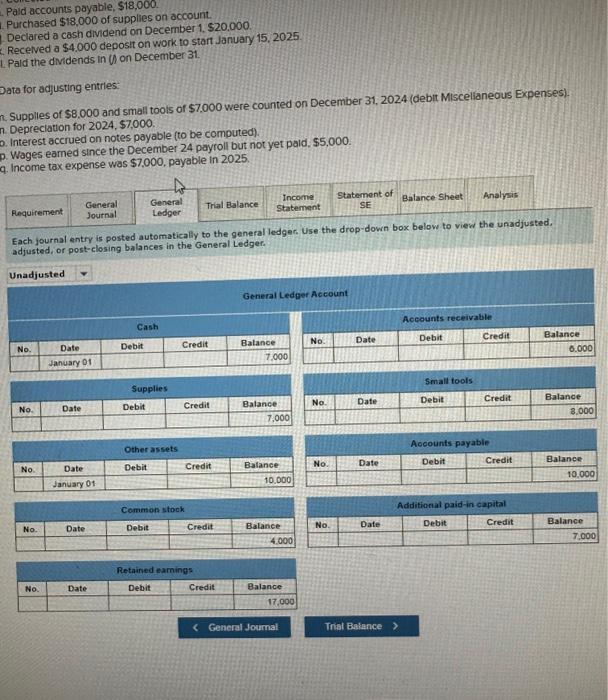

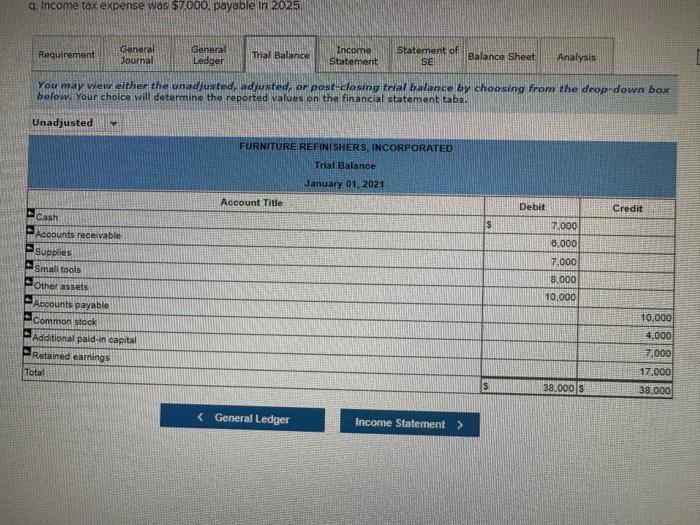

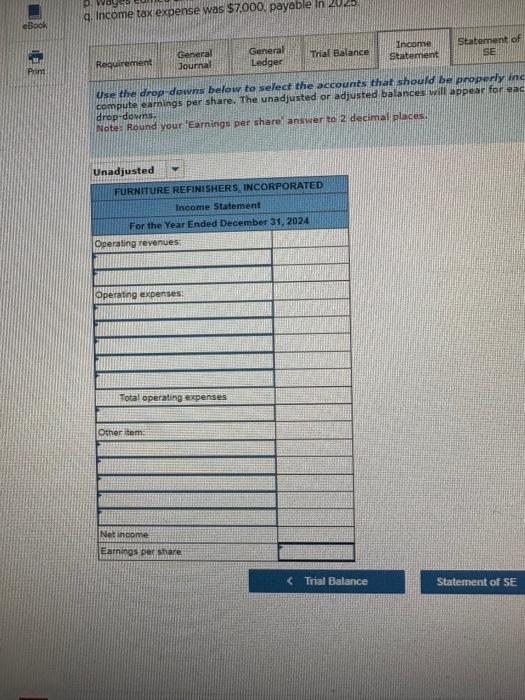

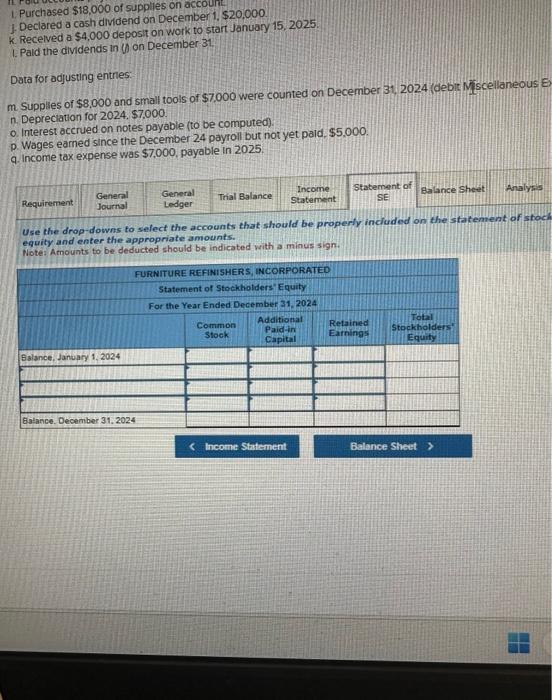

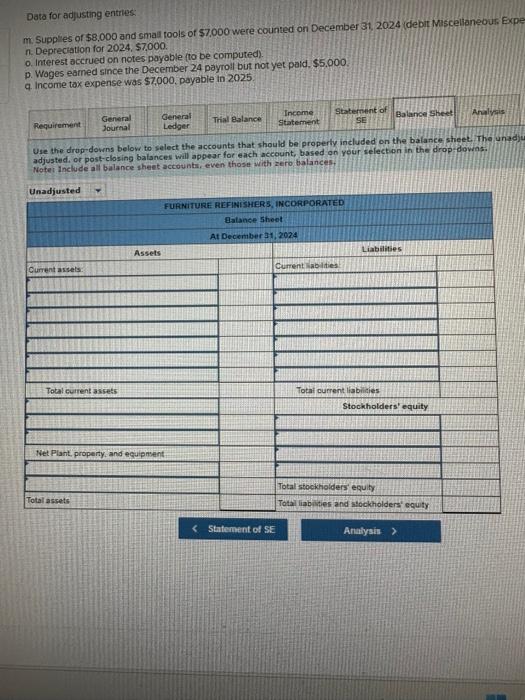

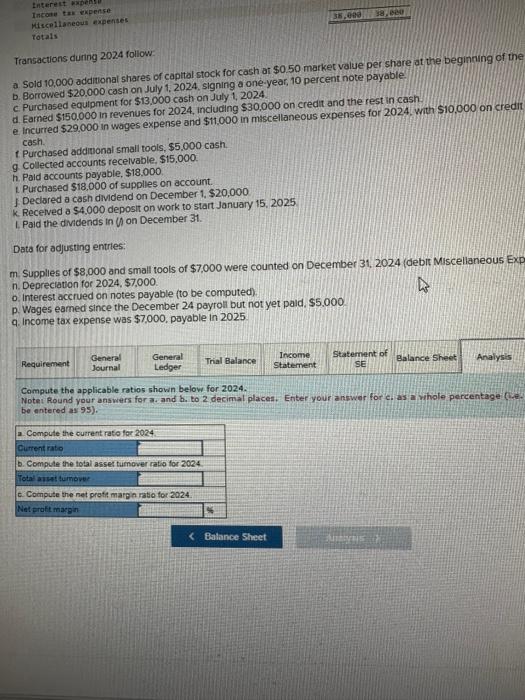

Aubrae and Tyor Witamson began operations of their furntture repair shop (Fumture Refinishers, incorporated) on January i, 2019 The arnual reporting penod ends December 3t, The trai balance on January t,2024, was as foliows. Transections durng 2024 follow - Sold 10,000 additional shares of capital stock for cath at $0.50 market value per share at the beginning of the year b. Borrowed $20,000 cash on July 1 2024, signeng a one year, fo percent note payoble. c. Purchoted equigmert for $13,000 cosh on Jwe 1.2024 of Earned $150,000 in tevenues for 2024 , induding $30,000 on credi and the restin cosh e incurred $29,000 in wages experse and $11,000 in misceltaneous expenses for 2024, with $10,000 on credit and the rest paid weh cash f. Purchosed adamonal small toos, 55,000 cash 9. Cotected accounts recelvoble $15,000 in Pald occounts poyable, $18,000. i purchosed sig,0op of wipplies on arcount. k. Recetved a $4,000 deposit on Work io start Janusry 15,2025. Oate for odjuting entres A. Deprecintion for 2024,57000 p. Wages epined since tine Pecinted 24 poyroi but not yet pod, 55,000 . Q incolte tac expense was 57000 povatie in 2025 Purchased equipment for $13,000 cash on July 1,2024 Earned $150,000 in revenues for 2024 , Including $30,000 on credit and the rest in cash Incurred $29,000 in wages expense and $11,000 in miscellaneous expenses for 2024 , with $10,000 on credit and the re cash. Purchased additional small tools, $5,000 cash . Collected accounts receivable, $15,000. Pald accounts payable, $18,000. Purchased $18,000 of supplies on account: Declared a cash dividend on December 1,$20,000. Recelved a $4,000 deposit on work to start January 15,2025. i. Paid the dividends in () on December 31. Data for adjusting entries: 1. Supplies of $8.000 and small tools of $7,000 were counted on December 31,2024 (debit Miscellaneous Expenses). . Depreclation for 2024,$7,000. . Interest accrued on notes payable (to be computed). . Wages earned since the December 24 payroll but not yet pald, $5,000. q. Income tax expense wps \$7,000, payable in 2025. General Journal tab - (Step 1) Prepare the journal entries to record the first 11 transactions (transactions (a) through (I)). Review the accounts as shown in the General Ledger and Trial Balance tabs. (Step 2) Prepare the necessary adjusting entries (13) through (17) (transactions (m) through ( q )) to correctly report net income for the period. (Step 3) After preparing the financial statements, record the closing entry (18). Notice the effect on the trial balance, income statement, and balance sheet tabs once the closing entry is posted. General Ledger tab - Each journal entry is posted automatically to the General Ledger. Use the drop-down button to view the unadjusted, adjusted, or post-closing balances in the General Ledger. Trial Balance tab - You may view either the unadjusted, adjusted, or post-closing trial balance by choosing from the dropdown. Your choice will determine the reported values on the financial statement tabs. Income Statement tab-Use the drop-downs to select the accounts that should be properly included on the Income Statement. Compute earnings per share. The unadjusted, adjusted, or post-closing balances will appear for each account, based on your selection. Statement of Stockholders' Equity tab-Use the drop-downs to select the accounts that should be properly included on the Statement of Stockholders' Equity and enter the appropriate amounts. Balance Sheet tab - Use the drop-downs to select the accounts that should be properly included on the Balance Sheet. The unadjusted, adjusted, or post-closing balances will appear for each account, based on your selection. Analysis tab-Calculate the current ratio, total asset turnover ratio, and net profit margin ratio for 2024 . n. Depreciation for 2024,$7.000. o. Interest accrued on notes payable (to be computed) p. Wages earned since the December 24 payroll but not yet pald, $5,000 q. Income tax expense was $7,000, payable in 2025 Record journal entries for transactions. Note: if no entry is required for a transaction/event, select "No joumal entry required' in the first account Journal entry workshet Sold 10,000 additional shares on January 1, 2024, of capital stock for cash at 50.50 market value per share at the beginning of the vear: Notes Enter debits before credits. Paid accounts payable, $18,000. Purchased $18,000 of supplies on account. Declared a cash dividend on December 1, $20,000 Recelved a $4.000 deposit on work to start January 15,2025. L. Pald the dividends in () on December 31. Data for adjusting entries: n. Supplies of $8,000 and small tools of $7,000 were counted on December 31, 2024 (debit Miscelianeous Expenses). n. Depreciation for 2024, $7,000. p. Interest accrued on notes payable (to be computed). p. Wages eamed since the December 24 payroll but not yet paid, $5,000. q. Income tax expense was $7,000, payable in 2025 . Each journal entry is posted automatically to the general ledger. Use the drop-down box below to view the unadjusted, adjusted, or post-closing balances in the General Ledger. q. Income taxexpense was $7000, payable in 2025 You may view either the unadjusted, adjusted, or post-closing trial balance by choosing from the drop-down box below. Your choice will determine the reported vafues on the financial statement tabs. 9. Income tax expense was $7,000, payable in 2020 Use the drop dourns below to select the accounts that should be properiy inc compute earnings per share. The unadjusted or adjusted balances will appear for eac drop-downs. Note Round your 'Earnings per share' answer to 2 decimal places. 1. Purchased $18,000 of supplies on account 1. Declared a cash dividend on December 1, $20,000 k. Recelved a $4,000 deposit on work to start January 15, 2025. 1. Pald the dividends in (4) on December 31 Data for adjusting entres: m Supplies of $8,000 and small tools of $7,000 were counted on December 31,2024 (debit Miscellaneous E: n. Depreciation for 2024,$7,000. o. Interest occrued on notes payable (to be computed). p. Wages earned since the December 24 payroll but not yet paid, $5,000. q. Income tax expense was $7,000, payable in 2025. Use the drop-downs to select the accounts that should be properly inciuded on the statement of stoch equity and enter the appropriate amounts. equity and enter the appropriate amounis. Notes Amounts to be deducted should be indicated with a minus sign. Data for adfusting entries. m. Supplies of $8,000 and small rools of $7,000 were counted on December 31,2024 (depit Misceltianeour. Exp n. Depreciation for 2024,$7,000. 0. Interest accrued on notes payable (to be computed). p. Woges earned since the December 24 payroil but not yet pald, $5,000. q. Income tax expense was $7,000, payable in 2025. Use the drup-downs below to select the accounts that should be properfy included on the balance sheet. Tho unad adjusted, or post-closing balances will appear for each account, based on your selection in the drop-dowins: Noter Include all balance sheet accounts, even those with zero, balances. Transactions duing 2024 follow. a. Sold 10,000 additional shares of capital stock for cash ar $0.50 market value per share at the beginning of the b. Borrowed $20,000 cash on July 1,2024 , signing a one-year, 10 percent note payable: c. Purchased equipment for $13,000 cash on July 1,2024. d. Eamed $150,000 in revenues for 2024 , including $30,000 on credit and the rest in cash: e. incurred $29,000 in wages expense and $11,000 in mascellaneous expenses for 2024 , with $10,000 on credit cash. t Purchased addmonal small tools, $5,000cash. g. Collected accounts recelvable, $15,000. h. Paid accounts payable, $18.000. 1. Purchased $18,000 of supplies on account. f. Declared a cash dividend on December 1,$20,000 k. Recelved a $4,000 deposit on work to start January 15,2025 1. Paid the dividends in ( ) on December 31. Data for adjusting entrles: m. Supplies of $8,000 and small tools of $7,000 were counted on December 31, 2024 (deblt Miscellaneous Exp n. Depreciation for 2024,$7,000. 0 . Interest accrued on notes payable (to be computed) p. Wages earned since the December 24 payroll but not yet pald. $5.000 q. income tax expense was $7,000, payable in 2025 Compute the applicable ratios shown below for 2024 . Notet Round your answers for 3 . and b. to 2 decimal places. Enter your answer for c. as a vihole percentage (Ce. be entered as 95)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts