Question: (pls use excel cell if possible to explain solution) a) b) Using the Black-Scholes option pricing model, determine the following: a) the value of the

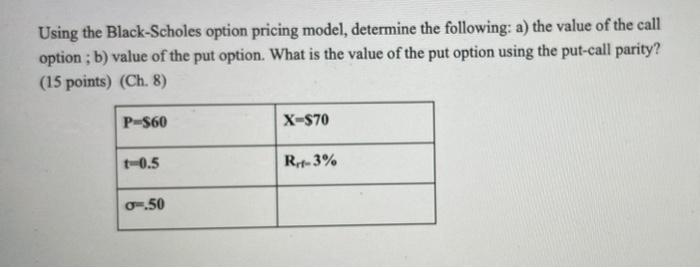

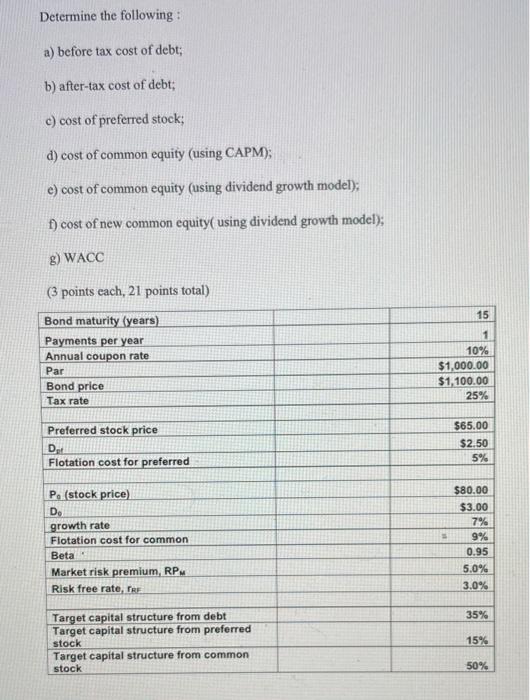

Using the Black-Scholes option pricing model, determine the following: a) the value of the call option; b) value of the put option. What is the value of the put option using the put-call parity? (15 points) (Ch.8) P-S60 X-S70 t-0.5 Rcf-3% 0.50 Determine the following: a) before tax cost of debt; b) after-tax cost of debt; c) cost of preferred stock; d) cost of common equity (using CAPM); e) cost of common equity (using dividend growth model); f) cost of new common equity using dividend growth model); g) WACC (3 points each, 21 points total) 15 Bond maturity (years) Payments per year Annual coupon rate Par Bond price Tax rate 1 10% $1,000.00 $1,100.00 25% Preferred stock price DR Flotation cost for preferred $65.00 $2.50 5% $80.00 $3.00 7% P. (stock price D. growth rate Flotation cost for common Beta Market risk premium, RPM Risk free rate, TRE 9% 0.95 5.0% 3.0% 35% Target capital structure from debt Target capital structure from preferred stock Target capital structure from common stock 15% 50%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts