Question: (PLS USE EXCEL FUNCTION TO SHOW WORK) It plans to purchase a new machine for $1,000,000.00 Depreciation will use the MACRS rates for 4 years:

(PLS USE EXCEL FUNCTION TO SHOW WORK)

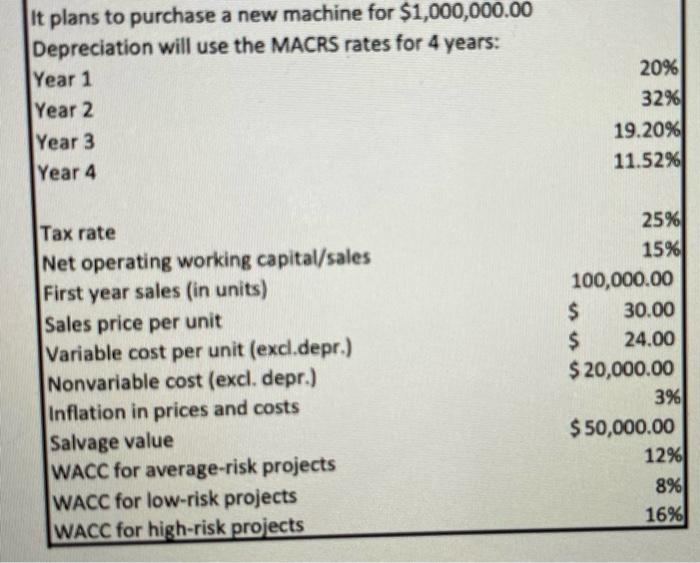

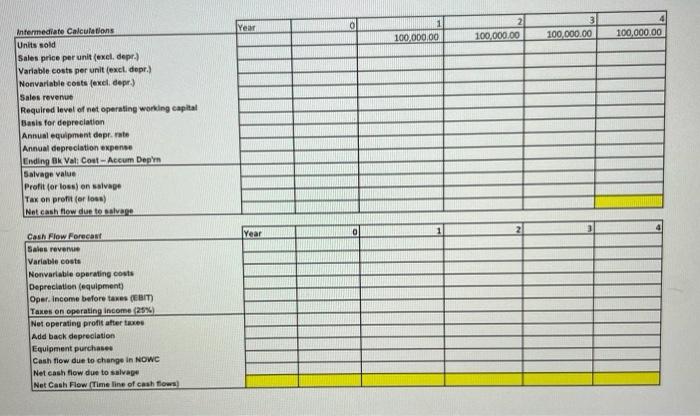

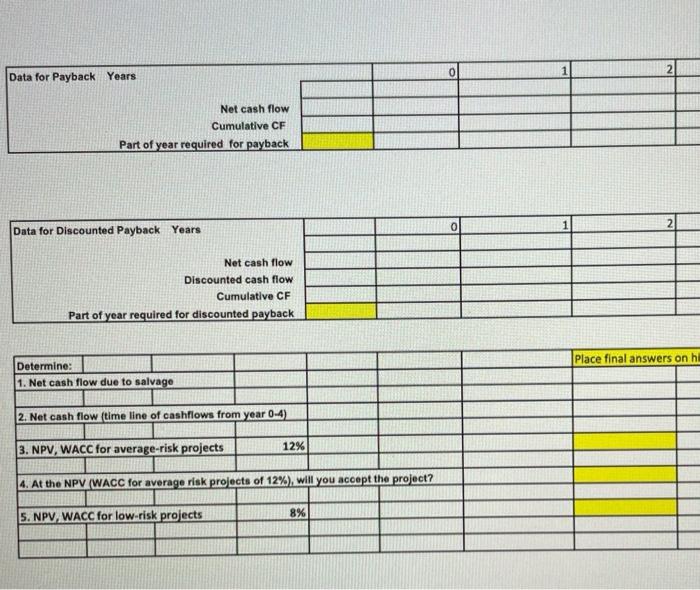

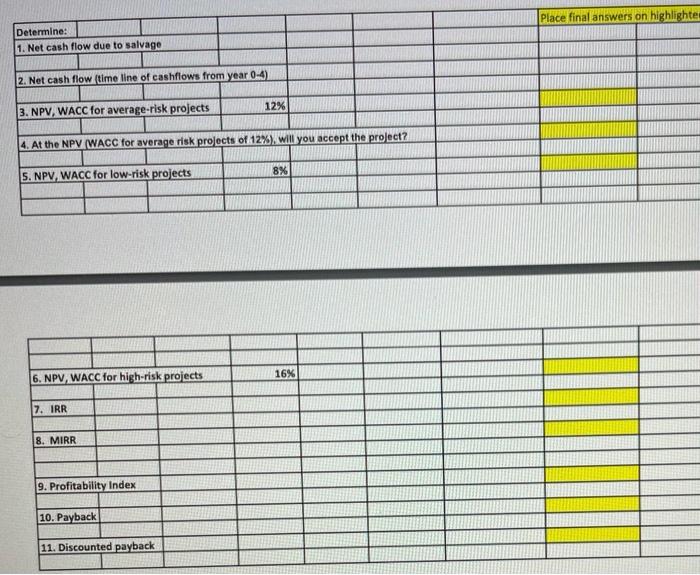

It plans to purchase a new machine for $1,000,000.00 Depreciation will use the MACRS rates for 4 years: Year 1 Year 2 Year 3 Year 4 20% 32% 19.20% 11.52% Tax rate Net operating working capital/sales First year sales (in units) Sales price per unit Variable cost per unit (excl.depr.) Nonvariable cost (excl. depr.) Inflation in prices and costs Salvage value WACC for average-risk projects WACC for low-risk projects WACC for high-risk projects 25% 15% 100,000.00 $ 30.00 $ 24.00 $ 20,000.00 3% $50,000.00 12% 8% 16% Year 0 1 100,000.00 100,000.00 100,000.00 100,000.00 Intermediate Calculations Units sold Sales price per unit (excl. depr.) Variable costs per unit (excl. depr.) Nonvariable costs (excl. dopr.) Sales revenue Required level of net operating working capital Basis for depreciation Annual equipment depr. rate Annual depreciation expense Ending Ok Val: Cout-Accum Depen Salvage value Profit (or loss on salvage Tax on profit (or loss) Not cash flow due to salvage Year 0 Cash Flow Forecast Sales rever Variable costs Nonvariable operating costs Depreciation (equipment) Oper. Income before taxes (EBIT) Takes on operating income (25%) Net operating profit after taxes Add back depreciation Equipment purchase Cash flow due to change in NOWC Net cash flow due to salvage Net Cash Flow (Timeline of cash flows) Data for Payback Years Net cash flow Cumulative CF Part of year required for payback 1 2 0 Data for Discounted Payback Years Net cash flow Discounted cash flow Cumulative CF Part of year required for discounted payback Place final answers on hi Determine: 1. Net cash flow due to salvage 2. Net cash flow (time line of cashflows from year 0-4) 3. NPV, WACC for average-risk projects 12% 4. At the NPV (WACC for average risk projects of 12%), will you accept the project? S. NPV, WACC for low risk projects 8% Place final answers on highlighter Determine: 1. Net cash flow due to salvage 2. Net cash flow (time line of cashflows from year 0-4) 3. NPV, WACC for average-risk projects 12% 4. At the NPV (WACC for average risk projects of 12%), will you accept the project? 8% 5. NPV, WACC for low-risk projects 6. NPV, WACC for high-risk projects 16% 7. IRR 8. MIRR 9. Profitability Index 10. Payback 11. Discounted payback It plans to purchase a new machine for $1,000,000.00 Depreciation will use the MACRS rates for 4 years: Year 1 Year 2 Year 3 Year 4 20% 32% 19.20% 11.52% Tax rate Net operating working capital/sales First year sales (in units) Sales price per unit Variable cost per unit (excl.depr.) Nonvariable cost (excl. depr.) Inflation in prices and costs Salvage value WACC for average-risk projects WACC for low-risk projects WACC for high-risk projects 25% 15% 100,000.00 $ 30.00 $ 24.00 $ 20,000.00 3% $50,000.00 12% 8% 16% Year 0 1 100,000.00 100,000.00 100,000.00 100,000.00 Intermediate Calculations Units sold Sales price per unit (excl. depr.) Variable costs per unit (excl. depr.) Nonvariable costs (excl. dopr.) Sales revenue Required level of net operating working capital Basis for depreciation Annual equipment depr. rate Annual depreciation expense Ending Ok Val: Cout-Accum Depen Salvage value Profit (or loss on salvage Tax on profit (or loss) Not cash flow due to salvage Year 0 Cash Flow Forecast Sales rever Variable costs Nonvariable operating costs Depreciation (equipment) Oper. Income before taxes (EBIT) Takes on operating income (25%) Net operating profit after taxes Add back depreciation Equipment purchase Cash flow due to change in NOWC Net cash flow due to salvage Net Cash Flow (Timeline of cash flows) Data for Payback Years Net cash flow Cumulative CF Part of year required for payback 1 2 0 Data for Discounted Payback Years Net cash flow Discounted cash flow Cumulative CF Part of year required for discounted payback Place final answers on hi Determine: 1. Net cash flow due to salvage 2. Net cash flow (time line of cashflows from year 0-4) 3. NPV, WACC for average-risk projects 12% 4. At the NPV (WACC for average risk projects of 12%), will you accept the project? S. NPV, WACC for low risk projects 8% Place final answers on highlighter Determine: 1. Net cash flow due to salvage 2. Net cash flow (time line of cashflows from year 0-4) 3. NPV, WACC for average-risk projects 12% 4. At the NPV (WACC for average risk projects of 12%), will you accept the project? 8% 5. NPV, WACC for low-risk projects 6. NPV, WACC for high-risk projects 16% 7. IRR 8. MIRR 9. Profitability Index 10. Payback 11. Discounted payback

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts