Question: Pls use Excel to solve. and send excel file if possible and step by step solution Part 2 (40 points) Xeret Industries manufactures and sells

Pls use Excel to solve. and send excel file if possible and step by step solution

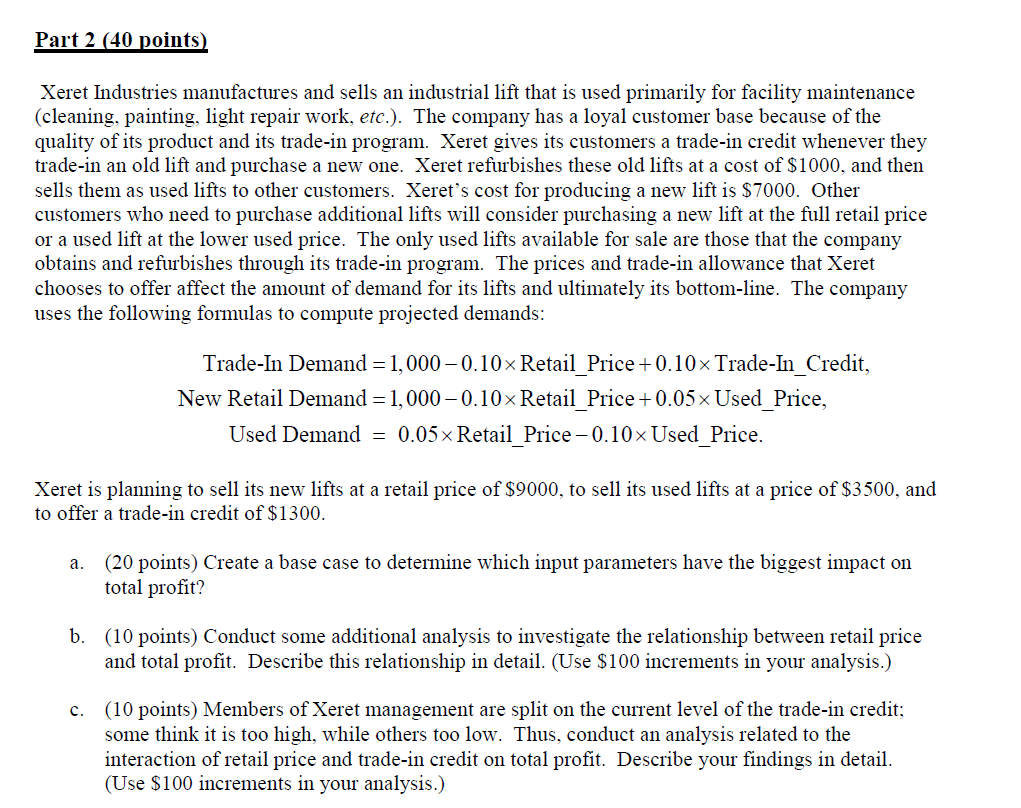

Part 2 (40 points) Xeret Industries manufactures and sells an industrial lift that is used primarily for facility maintenance (cleaning, painting, light repair work, etc.). The company has a loyal customer base because of the quality of its product and its trade-in program. Xeret gives its customers a trade-in credit whenever they trade-in an old lift and purchase a new one. Xeret refurbishes these old lifts at a cost of $1000, and then sells them as used lifts to other customers. Xeret's cost for producing a new lift is $7000. Other customers who need to purchase additional lifts will consider purchasing a new lift at the full retail price or a used lift at the lower used price. The only used lifts available for sale are those that the company obtains and refurbishes through its trade-in program. The prices and trade-in allowance that Xeret chooses to offer affect the amount of demand for its lifts and ultimately its bottom-line. The company uses the following formulas to compute projected demands: Trade-In Demand = 1,000 -0.10Retail Price +0.10 Trade-In Credit, New Retail Demand = 1,000 -0.10Retail Price +0.05x Used Price, Used Demand = 0.05x Retail Price -0.10 x Used Price. Xeret is planning to sell its new lifts at a retail price of $9000, to sell its used lifts at a price of $3500, and to offer a trade-in credit of $1300. a. (20 points) Create a base case to determine which input parameters have the biggest impact on total profit? b. (10 points) Conduct some additional analysis to investigate the relationship between retail price and total profit. Describe this relationship in detail. (Use $100 increments in your analysis.) C. (10 points) Members of Xeret management are split on the current level of the trade-in credit; some think it is too high, while others too low. Thus, conduct an analysis related to the interaction of retail price and trade-in credit on total profit. Describe your findings in detail. (Use $100 increments in your analysis.) Part 2 (40 points) Xeret Industries manufactures and sells an industrial lift that is used primarily for facility maintenance (cleaning, painting, light repair work, etc.). The company has a loyal customer base because of the quality of its product and its trade-in program. Xeret gives its customers a trade-in credit whenever they trade-in an old lift and purchase a new one. Xeret refurbishes these old lifts at a cost of $1000, and then sells them as used lifts to other customers. Xeret's cost for producing a new lift is $7000. Other customers who need to purchase additional lifts will consider purchasing a new lift at the full retail price or a used lift at the lower used price. The only used lifts available for sale are those that the company obtains and refurbishes through its trade-in program. The prices and trade-in allowance that Xeret chooses to offer affect the amount of demand for its lifts and ultimately its bottom-line. The company uses the following formulas to compute projected demands: Trade-In Demand = 1,000 -0.10Retail Price +0.10 Trade-In Credit, New Retail Demand = 1,000 -0.10Retail Price +0.05x Used Price, Used Demand = 0.05x Retail Price -0.10 x Used Price. Xeret is planning to sell its new lifts at a retail price of $9000, to sell its used lifts at a price of $3500, and to offer a trade-in credit of $1300. a. (20 points) Create a base case to determine which input parameters have the biggest impact on total profit? b. (10 points) Conduct some additional analysis to investigate the relationship between retail price and total profit. Describe this relationship in detail. (Use $100 increments in your analysis.) C. (10 points) Members of Xeret management are split on the current level of the trade-in credit; some think it is too high, while others too low. Thus, conduct an analysis related to the interaction of retail price and trade-in credit on total profit. Describe your findings in detail. (Use $100 increments in your analysis.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts