Question: pls write explanation/computation. thanks Kendrick, whose tax rate is 32%, had the following results from transactions during the year: Collectibles gain $20,000 Short-term capital loss

pls write explanation/computation. thanks

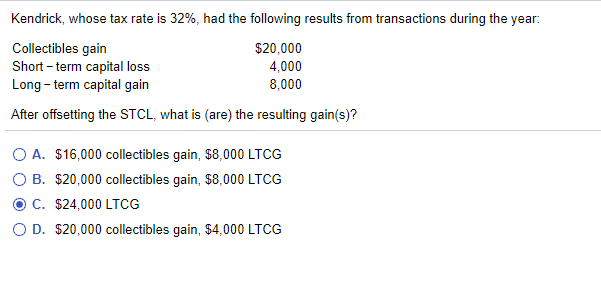

Kendrick, whose tax rate is 32%, had the following results from transactions during the year: Collectibles gain $20,000 Short-term capital loss 4,000 Long-term capital gain 8,000 After offsetting the STCL, what is (are) the resulting gain(s)? O A. $16,000 collectibles gain, $8,000 LTCG O B. $20,000 collectibles gain, $8,000 LTCG C. $24,000 LTCG OD. $20,000 collectibles gain, $4,000 LTCG

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts