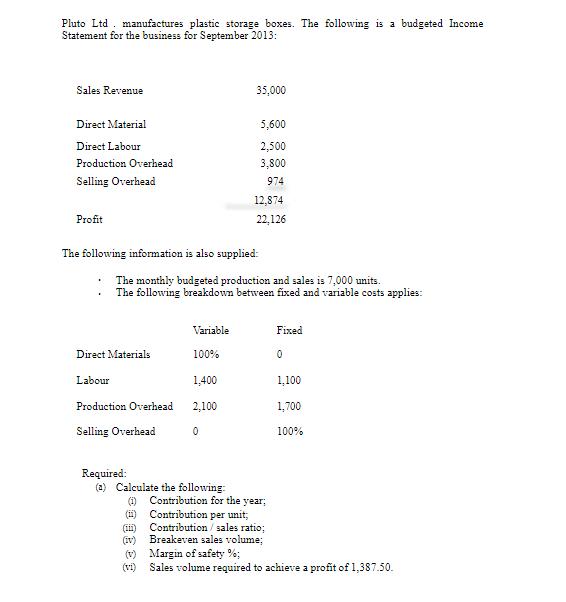

Question: Pluto Ltd. manufactures plastic storage boxes. The following is a budgeted Income Statement for the business for September 2013: Sales Revenue 35,000 Direct Material

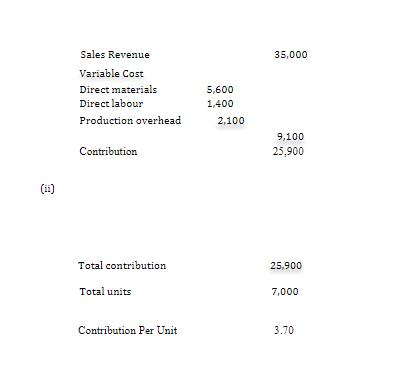

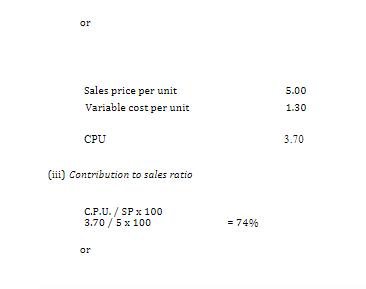

Pluto Ltd. manufactures plastic storage boxes. The following is a budgeted Income Statement for the business for September 2013: Sales Revenue 35,000 Direct Material 5,600 Direct Labour 2,500 Production Overhead 3,800 Selling Overhead 974 12,874 Profit 22,126 The following information is also supplied: The monthly budgeted production and sales is 7,000 units. The following breakdown between fixed and variable costs applies: Variable Fixed Direct Materials 100% Labour 1,400 1,100 Production Overhead 2,100 1,700 Selling Overhead 100% Requirad: (a) Calculate the following: () Contribution for the year; (i) Contribution per unit; (i) Contribution / sales ratio; Breakeven sales volume; (iv) (v) Margin of safety %; (vi) Sales volume required to achieve a profit of 1,387.50. Sales Revenue 35,000 Variable Cost Direct materials 5,600 Direct labour 1,400 Production overhead 2,100 9,100 Contribution 25,900 (i) Total contribution 25,900 Total units 7,000 Contribution Per Unit 3.70 or Sales price per unit 5.00 Variable cost per unit 1.30 CPU 3.70 (iii) Contribution to sales ratio C.P.U. / SP x 100 3.70 / 5 x 100 = 74% or

Step by Step Solution

There are 3 Steps involved in it

Q a Calculate the following Contribution for the year Answer Total Contribution for the year Total S... View full answer

Get step-by-step solutions from verified subject matter experts