Question: Plw Please answer the ones I got wrong. Make the Answer highlighted in BOLD so it's easy to understand. Understanding Relationships, Master Budget, Comprehensive Review

Plw

Plw

Please answer the ones I got wrong. Make the Answer highlighted in BOLD so it's easy to understand.

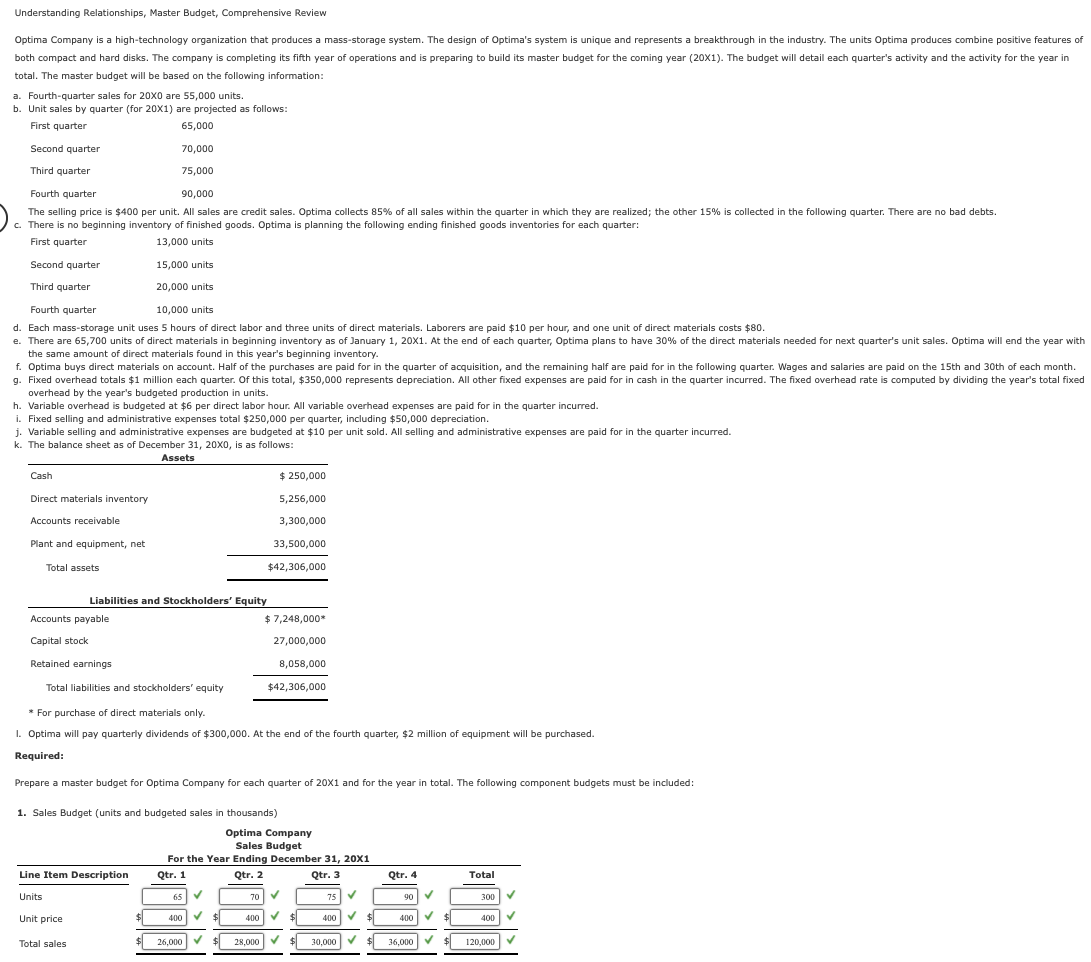

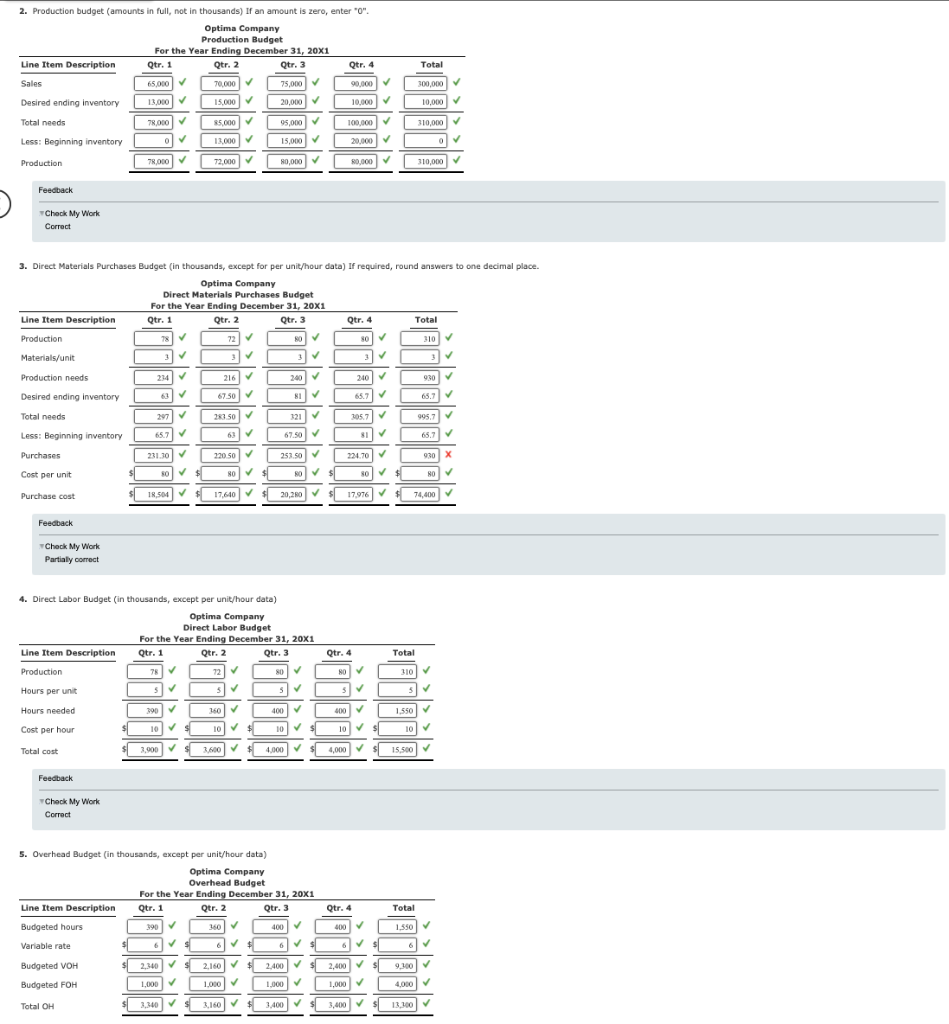

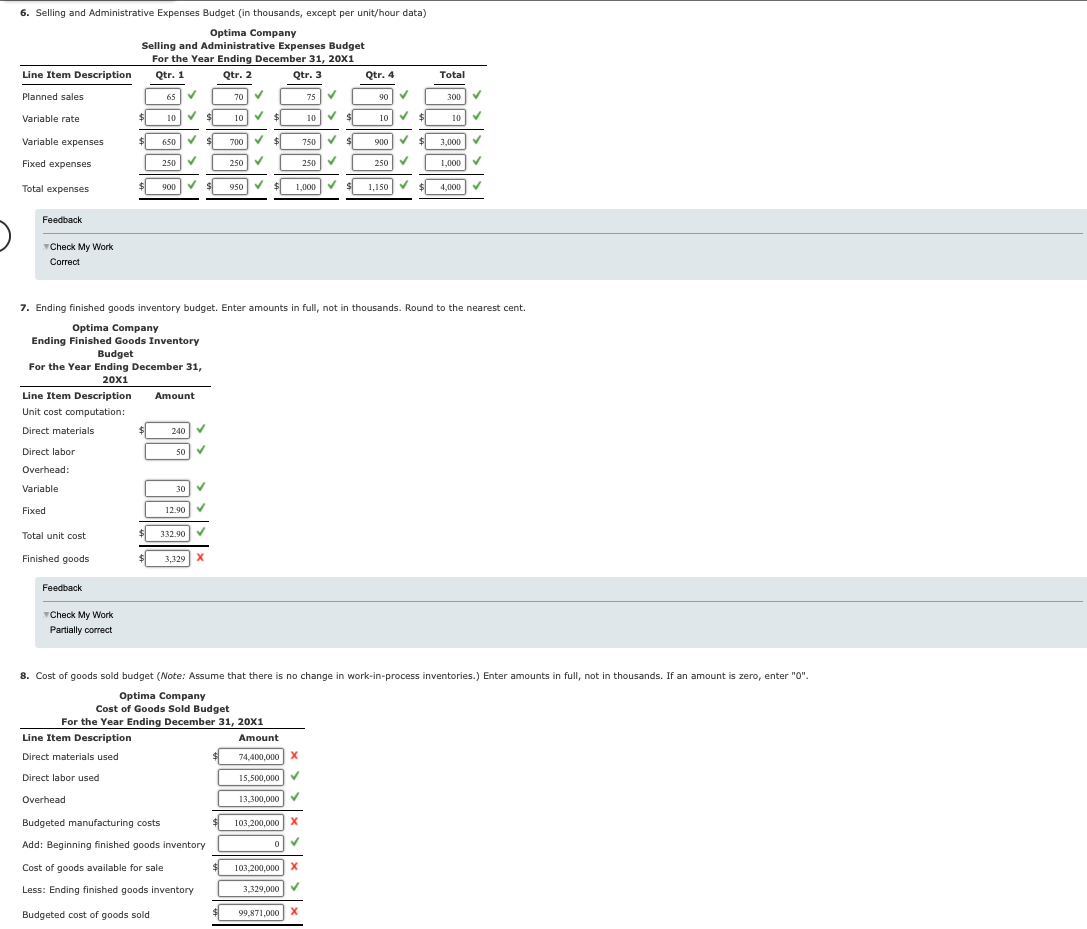

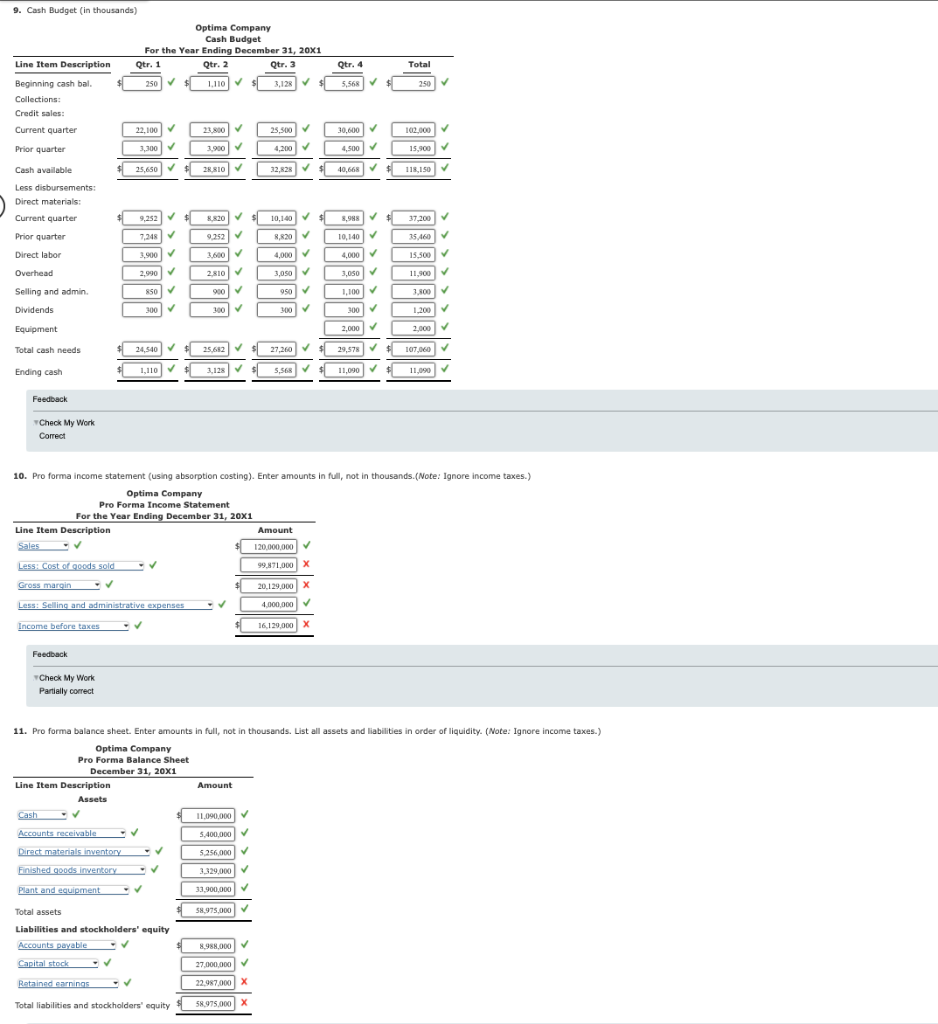

Understanding Relationships, Master Budget, Comprehensive Review total. The master budget will be based on the following information: a. Fourth-quarter sales for 200 are 55,000 units. b. IInit caloe hu nuartar (fne 20I1 ) ara nmiortad as follows: c. There is no beginning inventory of finished goods. Optima is planning the following ending finished goods inventories for each quarter: the same amount of direct materials found in this year's beginning inventory. overhead by the year's budgeted production in units. h. Variable overhead is budgeted at $6 per direct labor hour. All variable overhead expenses are paid for in the quarter incurred. i. Fixed selling and administrative expenses total $250,000 per quarter, including $50,000 depreciation. k. The balance sheet as of December 31 , 20x0, is as follows: I. Optima will pay quarterly dividends of $300,000. At the end of the fourth quarter, $2 million of equipment will be purchased. Required: Prepare a master budget for Optima Company for each quarter of 201 and for the year in total. The following component budgets must be included: 2. Production budget (amounts in full, not in thousands) If an amount is zero, enter " 0 ". Feecback Thock My Work Correct 3. Direct Materials Purchases Budget (in thousands, except for per unit/hour data) If requ Feecback w Chock My Work Partialy correct 4. Direct Labor Budget (in thousands, except per unit/hour data) Feedback Fheck My Work Correct 5. Overhead Budget (in thousands, except per unit/hour data) 6. Selling and Administrative Expenses Budget (in thousands, except per unit/hour data) Feedback Check My Work Correct 7. Ending finished goods inventory budget. Enter amounts in full, not in thousands. Round to the nearest cent. 9. Cash Budget (in thousands) w Check My Work Correct 10. Pro forma income statement (using absorption costing). Enter amounts in full, not in thousands.(Note: lgnore income taxes.) Feedback w Check My Work Partially correct 11. Pro forma balance sheet. Enter amounts in full, not in thousands. List all assets and liabilities in order of liquidity. (Note: Ignore income taxes.) Understanding Relationships, Master Budget, Comprehensive Review total. The master budget will be based on the following information: a. Fourth-quarter sales for 200 are 55,000 units. b. IInit caloe hu nuartar (fne 20I1 ) ara nmiortad as follows: c. There is no beginning inventory of finished goods. Optima is planning the following ending finished goods inventories for each quarter: the same amount of direct materials found in this year's beginning inventory. overhead by the year's budgeted production in units. h. Variable overhead is budgeted at $6 per direct labor hour. All variable overhead expenses are paid for in the quarter incurred. i. Fixed selling and administrative expenses total $250,000 per quarter, including $50,000 depreciation. k. The balance sheet as of December 31 , 20x0, is as follows: I. Optima will pay quarterly dividends of $300,000. At the end of the fourth quarter, $2 million of equipment will be purchased. Required: Prepare a master budget for Optima Company for each quarter of 201 and for the year in total. The following component budgets must be included: 2. Production budget (amounts in full, not in thousands) If an amount is zero, enter " 0 ". Feecback Thock My Work Correct 3. Direct Materials Purchases Budget (in thousands, except for per unit/hour data) If requ Feecback w Chock My Work Partialy correct 4. Direct Labor Budget (in thousands, except per unit/hour data) Feedback Fheck My Work Correct 5. Overhead Budget (in thousands, except per unit/hour data) 6. Selling and Administrative Expenses Budget (in thousands, except per unit/hour data) Feedback Check My Work Correct 7. Ending finished goods inventory budget. Enter amounts in full, not in thousands. Round to the nearest cent. 9. Cash Budget (in thousands) w Check My Work Correct 10. Pro forma income statement (using absorption costing). Enter amounts in full, not in thousands.(Note: lgnore income taxes.) Feedback w Check My Work Partially correct 11. Pro forma balance sheet. Enter amounts in full, not in thousands. List all assets and liabilities in order of liquidity. (Note: Ignore income taxes.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts