Question: plwase answer both questions !! Question 15 (0.5 points) Schnusenberg Corporation just paid a dividend of D -$0.75 per share, and that dividend is expected

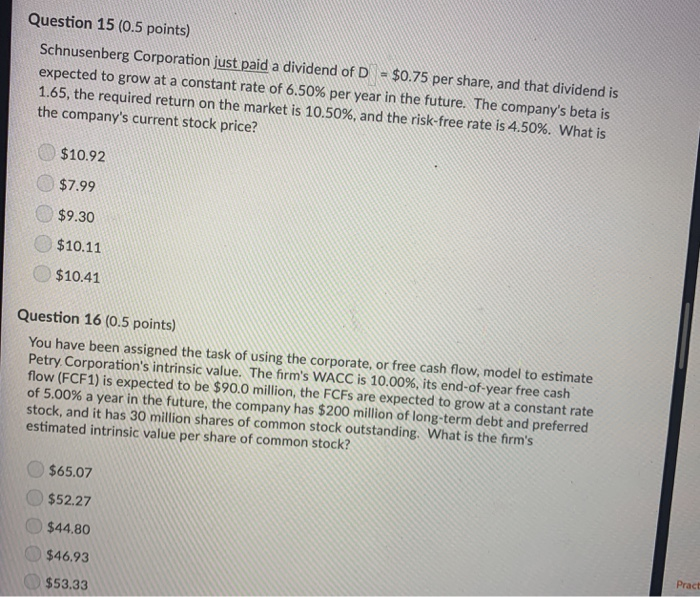

Question 15 (0.5 points) Schnusenberg Corporation just paid a dividend of D -$0.75 per share, and that dividend is expected to grow at a constant rate of 6.50% per year in the future. The company's beta is 1.65, the required return on the market is 10.50%, and the risk-free rate is 4.50%, what is the company's current stock price? $10.92 $7.99 $9.30 $10.11 $10.41 Question 16 (0.5 points) You have been assigned the task of using the corporate, or free cash flow, model to estimate Petry Corporation's intrinsic value. The firm's WACC is 10.00%, its end-of-year free cash flow (FCF1) is expected to be $90.0 million, the FCFs are expected to grow at a constant rate of 5.00% a year in the future, the company has $200 million of long-term debt and preferred stock, and it has 30 million shares of common stock outstanding. What is the firm's estimated intrinsic value per share of common stock? $65.07 $52.27 $44.80 $46.93 $53.33 Pract

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts