Question: plz answer all ques this is my final assignment CASE STUDY CA20-1 Crown Inc. (CI) is a private company that manufactures a special type of

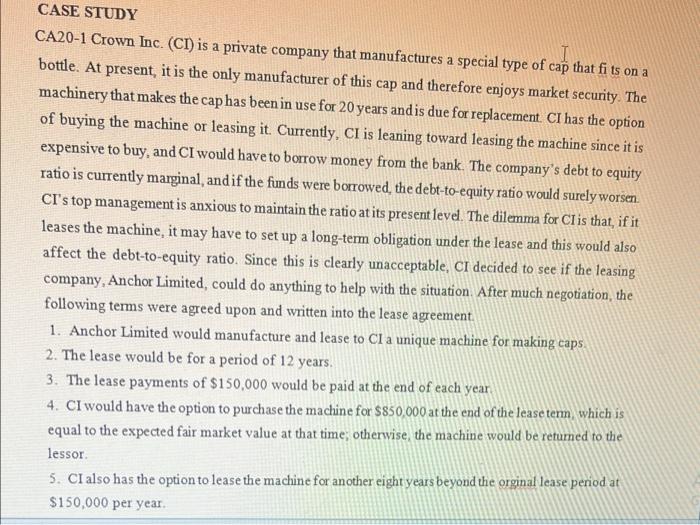

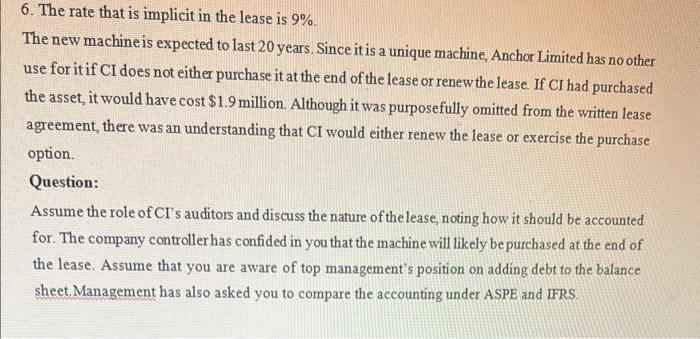

CASE STUDY CA20-1 Crown Inc. (CI) is a private company that manufactures a special type of cap that fits on a bottle. At present, it is the only manufacturer of this cap and therefore enjoys market security. The machinery that makes the cap has been in use for 20 years andis due for replacement. CI has the option of buying the machine or leasing it. Currently, CI is leaning toward leasing the machine since it is expensive to buy, and CI would have to borrow money from the bank. The company's debt to equity ratio is currently marginal and if the funds were borrowed the debt-to-equity ratio would surely worsen CI's top management is anxious to maintain the ratio at its present level. The dilemma for CI is that, if it leases the machine, it may have to set up a long-term obligation under the lease and this would also affect the debt-to-equity ratio. Since this is clearly unacceptable, CI decided to see if the leasing company, Anchor Limited, could do anything to help with the situation. After much negotiation, the following terms were agreed upon and written into the lease agreement. 1. Anchor Limited would manufacture and lease to Cl a unique machine for making caps 2. The lease would be for a period of 12 years. 3. The lease payments of $150,000 would be paid at the end of each year 4. CI would have the option to purchase the machine for $850.000 at the end of the lease term which is equal to the expected fair market value at that time, otherwise, the machine would be returned to the lessor 5. CI also has the option to lease the machine for another eight years beyond the orginal lease period at $150,000 per year 6. The rate that is implicit in the lease is 9%. The new machine is expected to last 20 years. Since it is a unique machine, Anchor Limited has no other use for itif CI does not either purchase it at the end of the lease or renew the lease. If I had purchased the asset it would have cost $1.9 million. Although it was purposefully omitted from the written lease agreement, there was an understanding that CI would either renew the lease or exercise the purchase option Question: Assume the role of CI's auditors and discuss the nature of the lease, noting how it should be accounted for. The company controller has confided in you that the machine will likely be purchased at the end of the lease. Assume that you are aware of top management's position on adding debt to the balance sheet. Management has also asked you to compare the accounting under ASPE and IFRS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts