Question: plz answer all questions correlate Datta Computer Systems is considering a project that has the following cash flow data. What is the project's TRR? Note

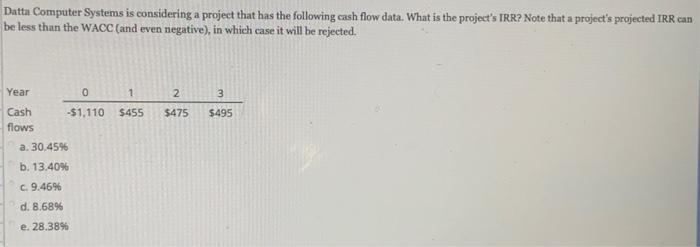

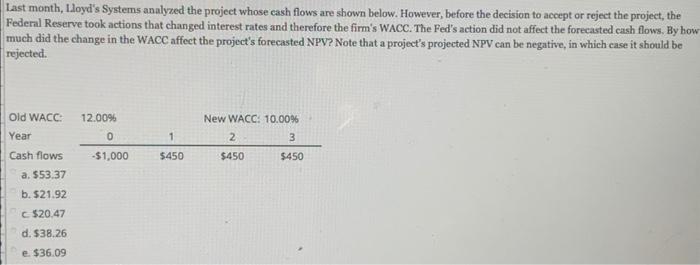

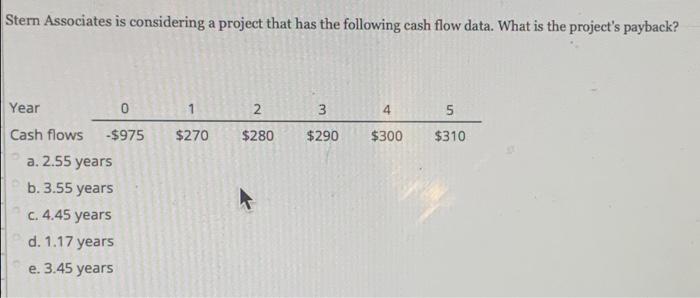

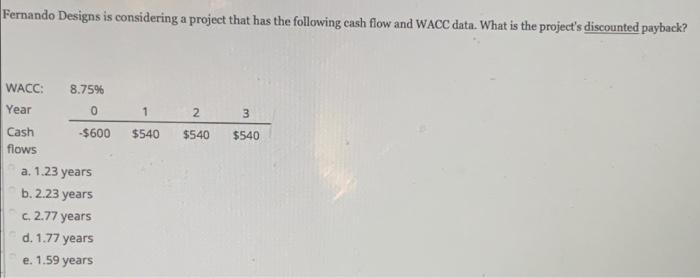

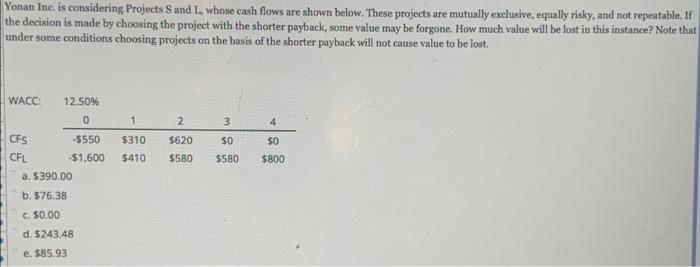

Datta Computer Systems is considering a project that has the following cash flow data. What is the project's TRR? Note that a project's projected IRR can be less than the WACC (and even negative), in which case it will be rejected. Year 0 1 2 3 -$1.110 $455 $475 $495 Cash flows a. 30.4596 b. 13.40% c. 9.46% d. 8.68% e. 28.38% Last month, Lloyd's Systems analyzed the project whose cash flows are shown below. However, before the decision to accept or reject the project, the Federal Reserve took actions that changed interest rates and therefore the firm's WACC. The Fed's action did not affect the forecasted cash flows. By how much did the change in the WACC affect the project's forecasted NPV? Note that a project's projected NPV can be negative, in which case it should be rejected. 12.00% New WACC: 10.00% 2 3 0 1 Old WACC Year Cash flows a. 553.37 -$1,000 $450 $450 $450 b. $21.92 $20.47 d. $38.26 e $36.09 Stern Associates is considering a project that has the following cash flow data. What is the project's payback? Year 0 1 3 4 5 N Cash flows -$975 $270 $280 $290 $300 $310 a. 2.55 years b. 3.55 years C. 4.45 years d. 1.17 years e. 3.45 years Fernando Designs is considering a project that has the following cash flow and WACC data. What is the project's discounted payback? 8.75% WACC: Year 0 1 2 3 $540 $540 $540 Cash $600 flows a. 1.23 years b.2.23 years c.2.77 years d. 1.77 years e. 1.59 years Yonan Inc. is considering Projects S and I, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. If the decision is made by choosing the project with the shorter payback, some value may be forgone. How much value will be lost in this instance? Note that under some conditions choosing projects on the basis of the shorter payback will not cause value to be lost. WACC: 12.50% 0 1 2 3 4 $620 $0 $310 $410 SO $580 $580 $800 CFS -$550 CFL -$1,600 a. $390.00 b. 576.38 C$0.00 d. 5243,48 e. $85.93

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts