Question: Plz answer both a. b. ) What is the Black-Scholes price of a European call option on a non-dividend- paying stock when the stock price

Plz answer both

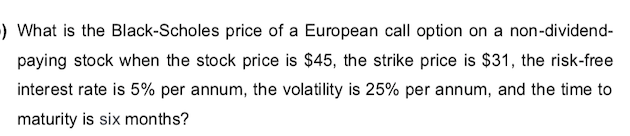

a.

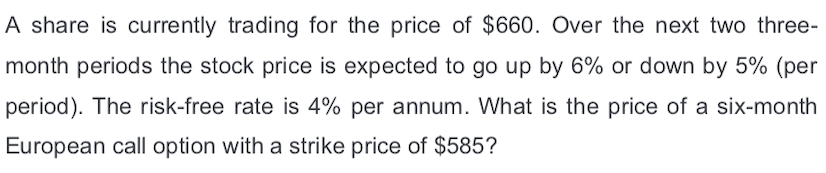

b.

) What is the Black-Scholes price of a European call option on a non-dividend- paying stock when the stock price is $45, the strike price is $31, the risk-free interest rate is 5% per annum, the volatility is 25% per annum, and the time to maturity is six months? A share is currently trading for the price of $660. Over the next two three- month periods the stock price is expected to go up by 6% or down by 5% (per period). The risk-free rate is 4% per annum. What is the price of a six-month European call option with a strike price of $585

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts