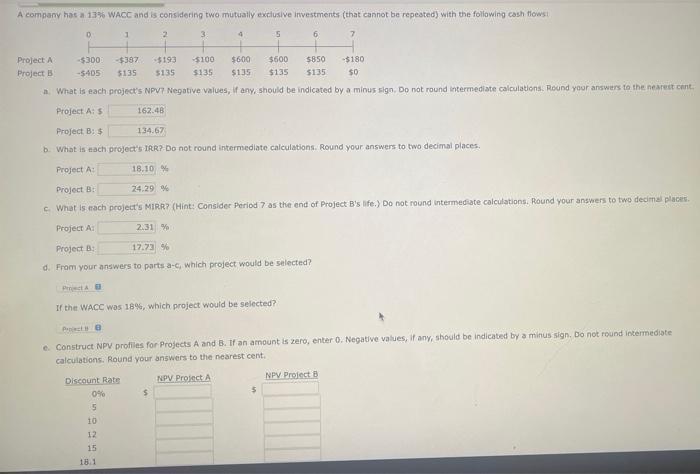

Question: plz answer d-e. if u could check that the first 3 are right & show any steps that u can use a finance calculator for,

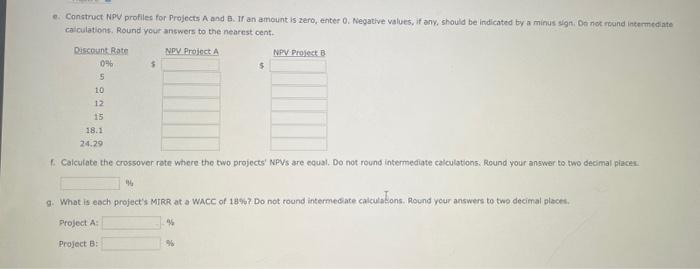

a. What is each project's NPV? Negative values, if any, should be indicated by a minus sign, Do not round lntermediate calculatlons. Round your answers to the nearest cnnt. Project A:5 Project Bis b. What is tach project's itk? -Do not round intermediate calculations. Round your answers to two decimal places. Project A Project B: c. What is frach project's MiRR? (Hint: Consider Period 7 as the end of Project B's life.) Do not round intermediate calculations. Round your answers to two decime placeis. Project A Project 8: d. Fram your answers to parts a-c, which project would be selected? If the WACC was 18%, which project would be selected? e. Construct NPU profiles for Projects A and B. If an amount is zero, enter 0 . Negative values, if any, should be indicated by a minus sign. Do not reund intermediate. calculationsi. Round your answers to the nearest cent. e. Constroct NPV profiles for Projects A and B. If an amount is zero, enter Q. Negative values, if any, should be indicated by a minus slgn. Dei not round intermediate caiculations. Round your answers to the nearest cent. 1. Calculate the crossover rate where the two projects' NPVs are equal. Do not round intermediate calculations. Round your answer to two decimal piacer. g. What is eoch profect's MTRR at a WACC of 189 ? Do not round intermecate calculatyons. Round your answers to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts