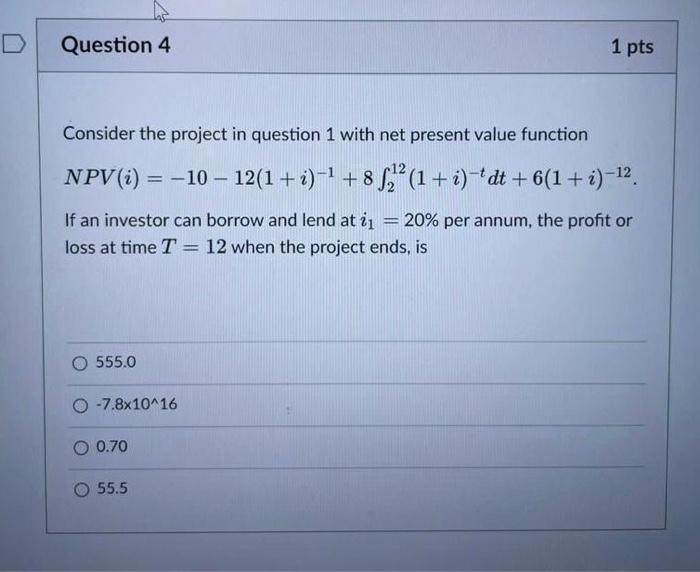

Question: plz answer exactly nothing is missing, it's complete Consider the project in question 1 with net present value function NPV(i)=1012(1+i)1+8212(1+i)tdt+6(1+i)12 If an investor can borrow

Consider the project in question 1 with net present value function NPV(i)=1012(1+i)1+8212(1+i)tdt+6(1+i)12 If an investor can borrow and lend at i1=20% per annum, the profit or loss at time T=12 when the project ends, is 555.0 7.81016 0.70 55.5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts