Question: plz answer fast with all steps and formulas. need formulas Investment Opportunity A requires an initial cash outlay of $60,000. Thereafter, it is expected to

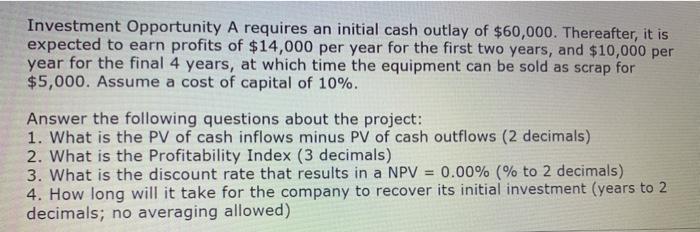

Investment Opportunity A requires an initial cash outlay of $60,000. Thereafter, it is expected to earn profits of $14,000 per year for the first two years, and $10,000 per year for the final 4 years, at which time the equipment can be sold as scrap for $5,000. Assume a cost of capital of 10%. Answer the following questions about the project: 1. What is the PV of cash inflows minus PV of cash outflows (2 decimals) 2. What is the Profitability Index (3 decimals) 3. What is the discount rate that results in a NPV = 0.00% (% to 2 decimals) 4. How long will it take for the company to recover its initial investment (years to 2 decimals; no averaging allowed)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts