Question: plz answer question 13. Current Swiss Franc spot rate = $0.39/SF Call options on Swiss Francs with an Exercise Pnce of $0 40/SF and maturity

plz answer question 13.

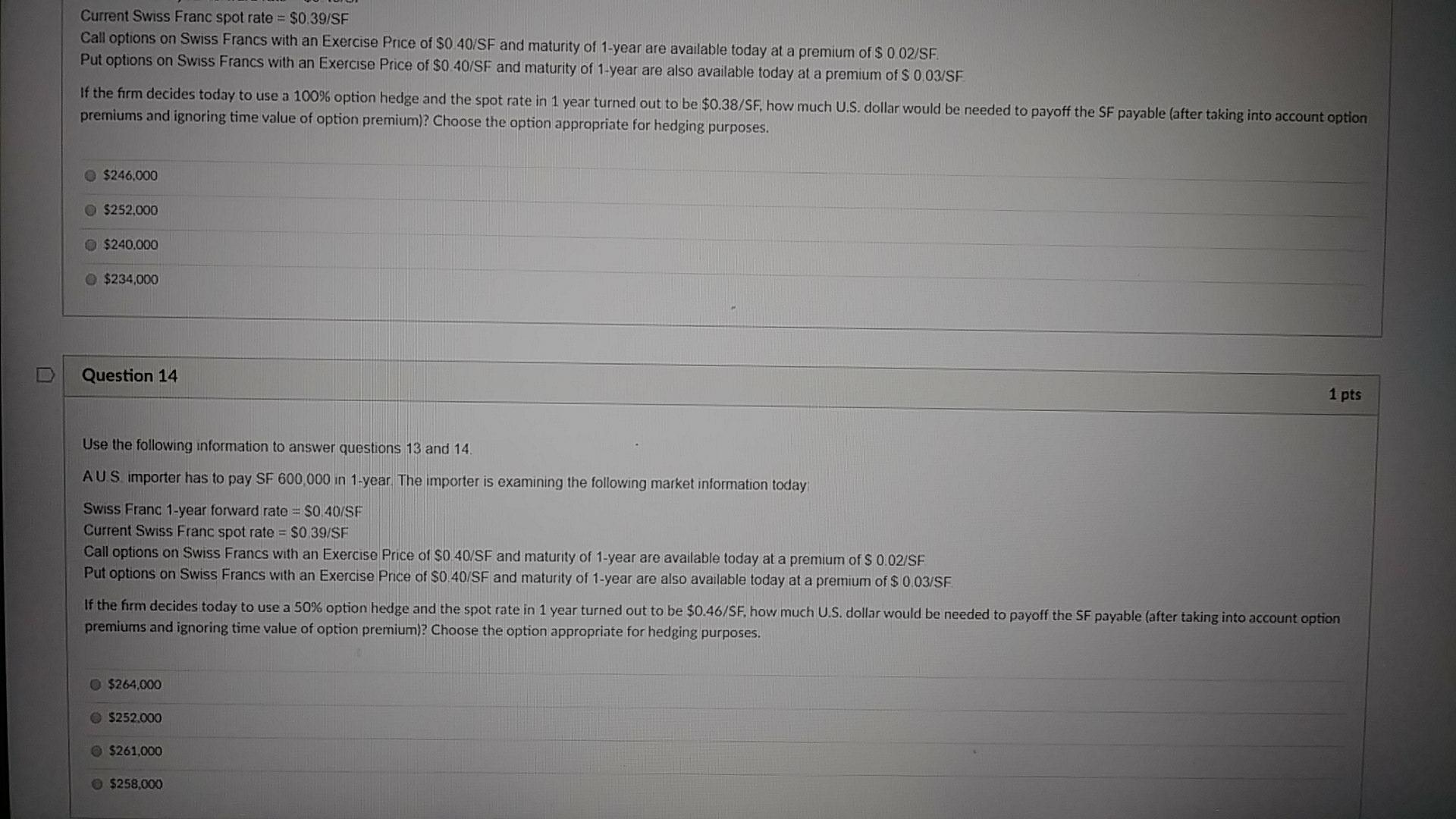

Current Swiss Franc spot rate = $0.39/SF Call options on Swiss Francs with an Exercise Pnce of $0 40/SF and maturity of 1-year are available today at a premium of $ 0 02/SF. Put options on Swiss Francs with an Exercise Price of $0 40/SF and maturity of 1-year are also available today at a premium of $ 0.03/SE If the firm decides today to use a 100% option hedge and the spot rate in 1 year turned out to be $0.38/SF, how much U.S. dollar would be needed to payoff the SF payable (after taking into account option premiums and ignoring time value of option premium)? Choose the option appropriate for hedging purposes. $246.000 O $252.000 $240.000 $234,000 Question 14 1 pts Use the following information to answer questions 13 and 14 AUS importer has to pay SF 600,000 in 1-year The importer is examining the following market information today Swiss Franc 1-year forward rate = $0.40/SF Current Swiss Franc spot rate = $0.39/SF Call options on Swiss Francs with an Exercise Price of $0 40/SF and maturity of 1-year are available today at a premium of S 0.02/SF Put options on Swiss Francs with an Exercise Price of $0.40/SF and maturity of 1-year are also available today at a premium of $ 0.03/SF If the firm decides today to use a 50% option hedge and the spot rate in 1 year turned out to be $0.46/SF. how much U.S. dollar would be needed to payoff the SF payable (after taking into account option premiums and ignoring time value of option premium)? Choose the option appropriate for hedging purposes. O $264.000 $252.000 $261,000 O $258,000 Current Swiss Franc spot rate = $0.39/SF Call options on Swiss Francs with an Exercise Pnce of $0 40/SF and maturity of 1-year are available today at a premium of $ 0 02/SF. Put options on Swiss Francs with an Exercise Price of $0 40/SF and maturity of 1-year are also available today at a premium of $ 0.03/SE If the firm decides today to use a 100% option hedge and the spot rate in 1 year turned out to be $0.38/SF, how much U.S. dollar would be needed to payoff the SF payable (after taking into account option premiums and ignoring time value of option premium)? Choose the option appropriate for hedging purposes. $246.000 O $252.000 $240.000 $234,000 Question 14 1 pts Use the following information to answer questions 13 and 14 AUS importer has to pay SF 600,000 in 1-year The importer is examining the following market information today Swiss Franc 1-year forward rate = $0.40/SF Current Swiss Franc spot rate = $0.39/SF Call options on Swiss Francs with an Exercise Price of $0 40/SF and maturity of 1-year are available today at a premium of S 0.02/SF Put options on Swiss Francs with an Exercise Price of $0.40/SF and maturity of 1-year are also available today at a premium of $ 0.03/SF If the firm decides today to use a 50% option hedge and the spot rate in 1 year turned out to be $0.46/SF. how much U.S. dollar would be needed to payoff the SF payable (after taking into account option premiums and ignoring time value of option premium)? Choose the option appropriate for hedging purposes. O $264.000 $252.000 $261,000 O $258,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts