Question: plz answer ! Required information Problem 17-75 (LO 17-5) (Algo) [The following information applies to the questions displayed below.) Randolph Company reported pretax net income

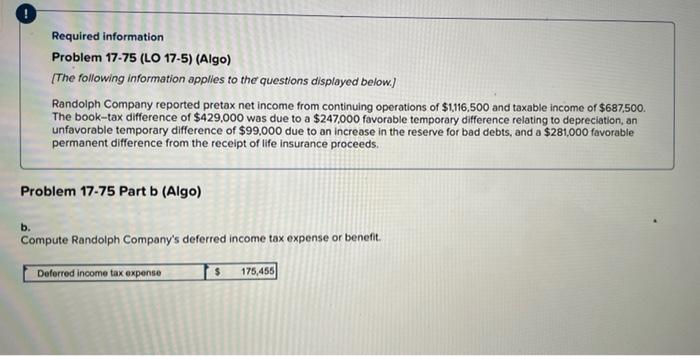

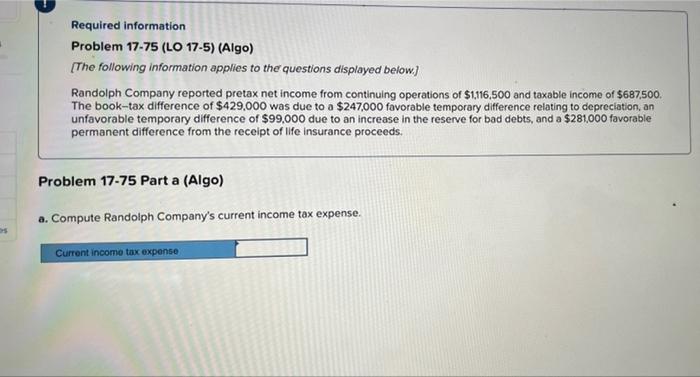

! Required information Problem 17-75 (LO 17-5) (Algo) [The following information applies to the questions displayed below.) Randolph Company reported pretax net income from continuing operations of $1,116,500 and taxable income of $687,500. The book-tax difference of $429,000 was due to a $247,000 favorable temporary difference relating to depreciation, an unfavorable temporary difference of $99,000 due to an increase in the reserve for bad debts, and a $281,000 favorable permanent difference from the receipt of life insurance proceeds. Problem 17-75 Part b (Algo) b. Compute Randolph Company's deferred income tax expense or benefit. Deferred income tax expenso $ 175,455 Required information Problem 17-75 (LO 17-5) (Algo) [The following information applies to the questions displayed below.) Randolph Company reported pretax net income from continuing operations of $1.116,500 and taxable income of $687.500 The book-tax difference of $429,000 was due to a $247,000 favorable temporary difference relating to depreciation, an unfavorable temporary difference of $99.000 due to an increase in the reserve for bad debts, and a $281,000 favorable permanent difference from the receipt of life insurance proceeds. Problem 17-75 Part a (Algo) a. Compute Randolph Company's current income tax expense. Current income tax expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts