Question: plz answer this Q with correct explanations. 10. Austin, a single individual (not in the military) with a salary of $100,000, incurred and paid the

plz answer this Q with correct explanations.

plz answer this Q with correct explanations.

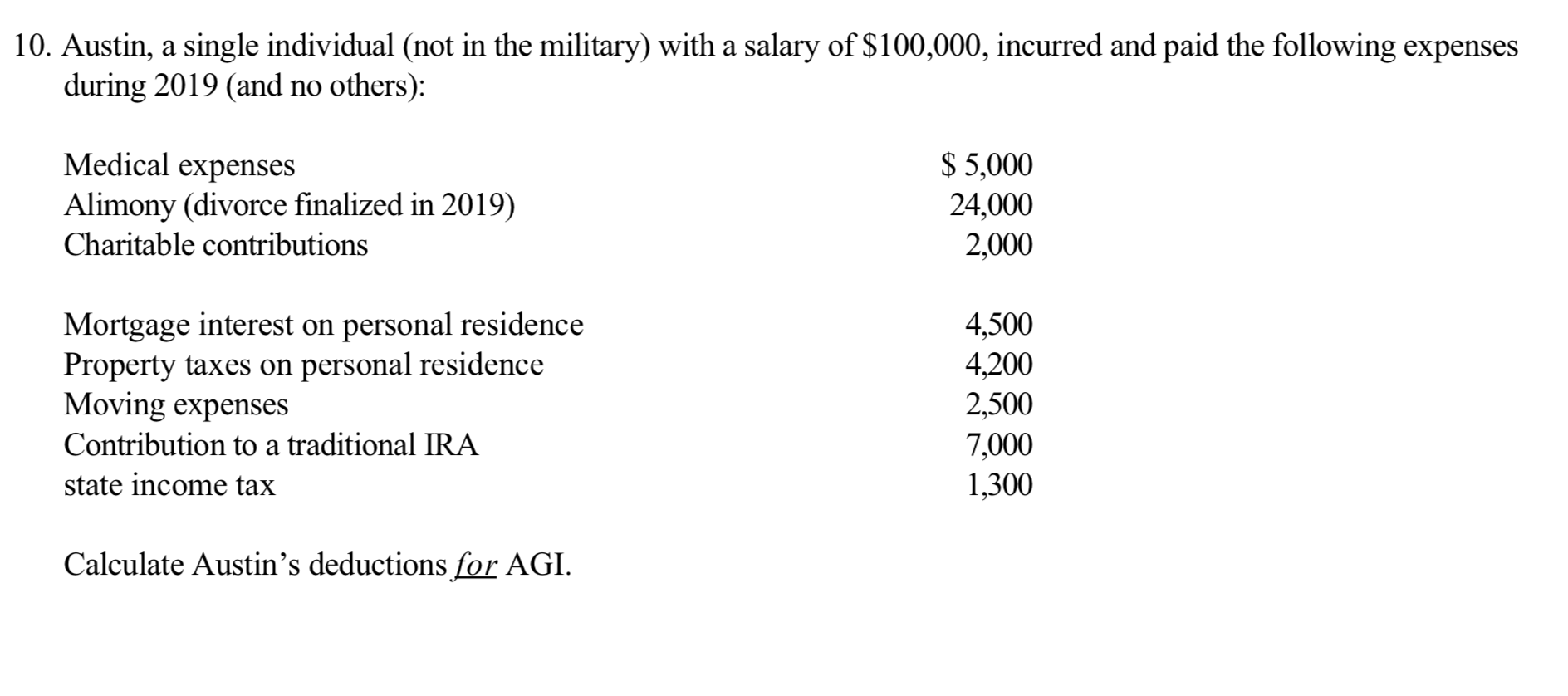

10. Austin, a single individual (not in the military) with a salary of $100,000, incurred and paid the following expenses during 2019 (and no others): Medical expenses Alimony (divorce finalized in 2019) Charitable contributions $ 5,000 24,000 2,000 Mortgage interest on personal residence Property taxes on personal residence Moving expenses Contribution to a traditional IRA state income tax 4,500 4,200 2,500 7,000 1,300 Calculate Austin's deductions for AGI

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts