Question: plz answer this question. UIL has a 60% owned subsidiary UXL. In 2023 UXL was allocated $350,000 of the annual business limit and paid a

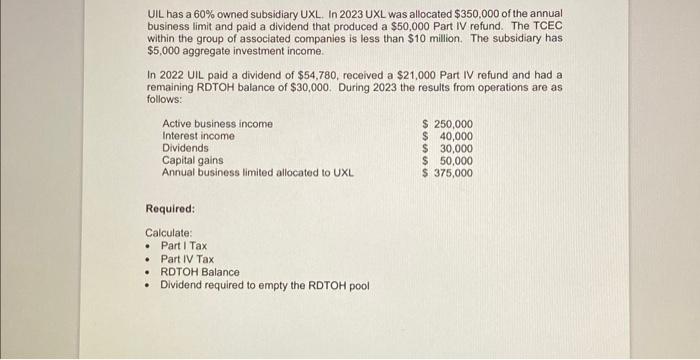

UIL has a 60% owned subsidiary UXL. In 2023 UXL was allocated $350,000 of the annual business limit and paid a dividend that produced a $50,000 Part IV refund. The TCEC within the group of associated companies is less than $10 million. The subsidiary has $5,000 aggregate investment income. In 2022 UIL paid a dividend of $54,780, received a $21,000 Part IV refund and had a remaining RDTOH balance of $30,000. During 2023 the results from operations are as follows: Required: Calculate: - PartITax - Part IV Tax - RDTOH Balance - Dividend required to empty the RDTOH pool

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts