Question: Plz avoid giving half Ans. need full information 3. Bad Debts Customers to whom goods are sold on credit become debtors. Amount not recoverable from

Plz avoid giving half Ans. need full information

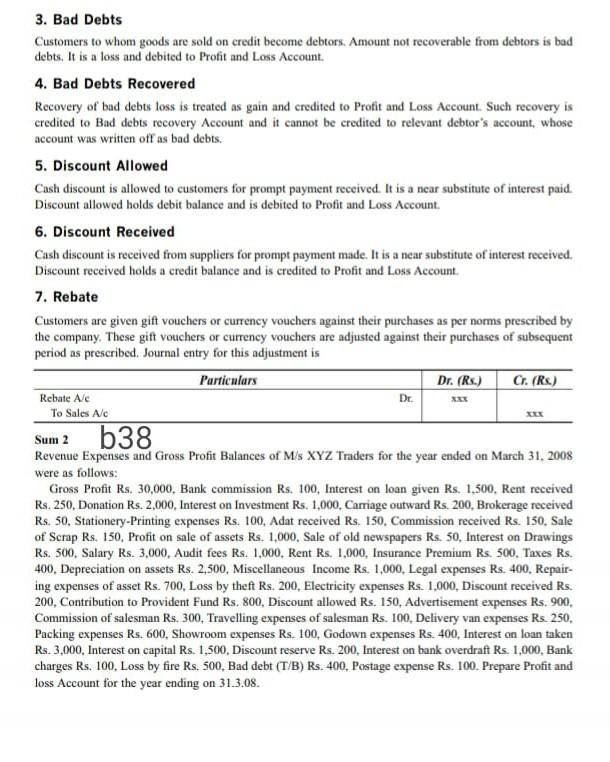

3. Bad Debts Customers to whom goods are sold on credit become debtors. Amount not recoverable from debtors is bad debts. It is a loss and debited to Protit and Loss Account 4. Bad Debts Recovered Recovery of bad debts loss is treated as gain and credited to profit and Loss Account. Such recovery is credited to Bad debts recovery Account and it cannot be credited to relevant debtor's account, whose account was written off as bad debts. 5. Discount Allowed Cash discount is allowed to customers for prompt payment received. It is a near substitute of interest paid. Discount allowed holds debit balance and is debited to Profit and Loss Account 6. Discount Received Cash discount is received from suppliers for prompt payment made. It is a near substitute of interest received. Discount received holds a credit balance and is credited to profit and Loss Account 7. Rebate Customers are given gift vouchers or currency vouchers against their purchases as per norms prescribed by the company. These gift vouchers or currency vouchers are adjusted against their purchases of subsequent period as prescribed. Journal entry for this adjustment is Particulars Dr. (Rs.) Cr. (R) Rebate Ale DE To Sales Ne Sum 2 b38 Revenue Expenses and Gross Profit Balances of M/s XYZ Traders for the year ended on March 31, 2008 were as follows: Gross Profit Rs. 30,000, Bank commission Rs. 100, Interest on loan given Rs. 1.500, Rent received Rs.250, Donation Rs. 2,000, Interest on Investment Rs. 1,000, Carriage outward Rs. 200, Brokerage received Rs. 50, Stationery-Printing expenses Rs. 100. Adat received Rs. 150. Commission received Rs. 150. Sale of Scrap Rs. 150, Profit on sale of assets Rs. 1,000. Sale of old newspapers Rs. 50, Interest on Drawings Rs. 500, Salary Rs. 3,000, Audit fees Rs. 1.000. Rent Rs. 1,000, Insurance Premium Rs. 500. Taxes Rs. 400, Depreciation on assets Rs. 2,500, Miscellaneous Income Rs. 1,000, Legal expenses Rs. 400, Repair- ing expenses of asset Rs. 700, Loss by theft Rs. 200, Electricity expenses Rs. 1.000, Discount received Rs. 200, Contribution to provident Fund Rs. 800, Discount allowed Rs. 150, Advertisement expenses Rs. 900, Commission of salesman Rs. 300, Travelling expenses of salesman Rs. 100. Delivery van expenses Rs. 250, Packing expenses Rs. 600, Showroom expenses Rs. 100, Godown expenses Rs. 400, Interest on loan taken Rs. 3,000, Interest on capital Rs. 1,500, Discount reserve Rs. 200. Interest on bank overdraft Rs. 1,000, Bank charges Rs. 100. Loss by fire Rs. 500, Bad debt (T/B) Rs. 400, Postage expense Rs. 100. Prepare Profit and loss Account for the year ending on 31.3.08

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts