Question: plz both question if possible Comparative financial statements for Weller Corporation, a merchandising company, for the year ending December 31 appear below. The company did

plz both question if possible

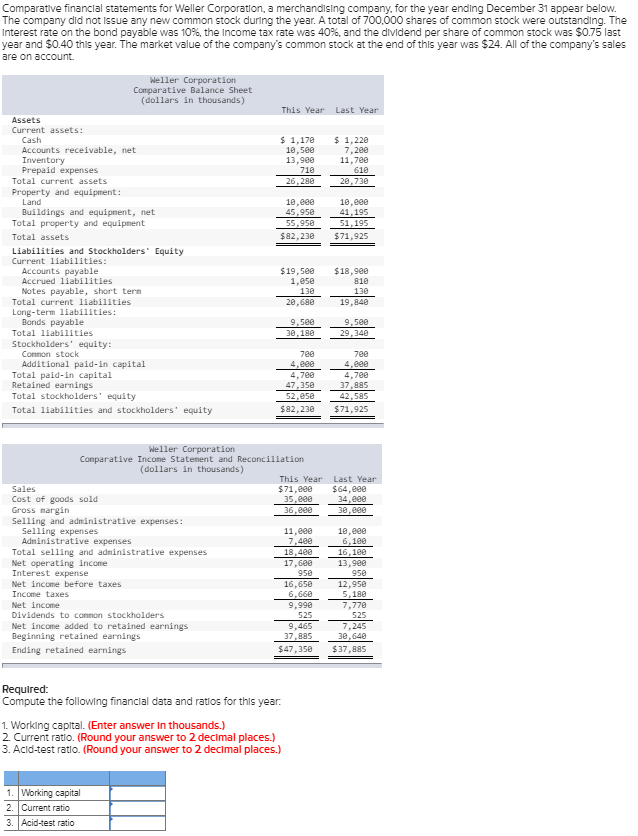

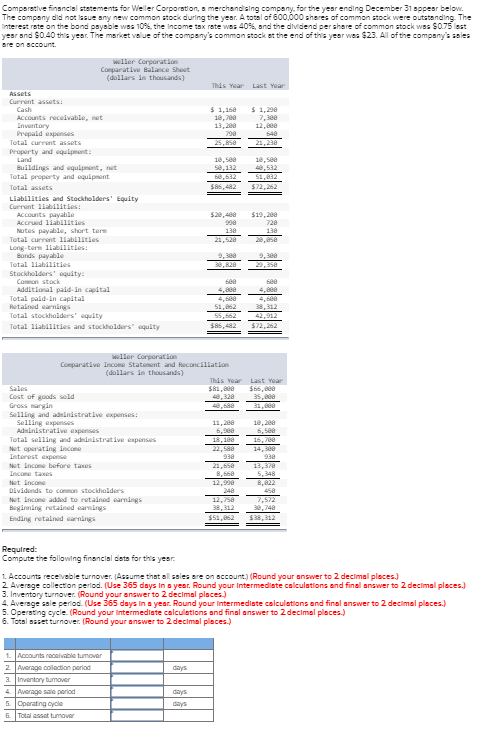

Comparative financial statements for Weller Corporation, a merchandising company, for the year ending December 31 appear below. The company did not issue any new common stock during the year. A total of 700.000 shares of common stock were outstanding. The Interest rate on the bond payable was 10%, the income tax rate was 40%, and the dividend per share of common stock was $0.75 last year and $0.40 this year. The market value of the company's common stock at the end of this year was $24. All of the company's sales are on account. Weller Corporation Comparative Balance Sheet (dollars in thousands) This Year Last Year Assets Current assets: Cash Accounts receivable, net Inventory Prepaid expenses Total current assets Property and equipment: $ 1,170 19.500 13,900 710 26,288 $1,220 7.280 11,700 28.738 10,eee 45,95 55.95 $82,232 10,000 41, 195 51.195 $71,925 $18.900 $19.500 1,85 130 810 130 29,690 19,840 Buildings and equipment, net Total property and equipment Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Accrued liabilities Notes payable, short term Total current liabilities Long-term liabilities: Bonds payable Total liabilities Stockholders' equity: Connon stock Additional paid-in capital Total paid-in capital Retained earnings Total stockholders' equity Total liabilities and stockholders' equity 9,5ee9 .5ee 30, 180 29,348 4. Bee 47.350 4.600 4.700 37,885 42.585 $71,925 2. ese $82,230 Last Year $64.800 34.000 30.800 Weller Corporation Comparative Income Statement and Reconciliation (dollars in thousands) This Year Sales $71,800 Cost of goods sold 35,eee Gross margin 36,800 Selling and administrative expenses: Selling expenses 11.000 Administrative expenses 7.40 Total selling and administrative expenses 18,488 Net operating income 17.6e8 Interest expense 950 Net income before taxes 16,650 Income taxes 6,660 Net Income 9.99 Dividends to common stockholders 525 Net income added to retained earnings 9.465 Beginning retained earnings 37.885 Ending retained earnings $47,350 19. 6, 100 16,100 13.989 95 12,95 5,188 7.778 525 7.245 30,640 $37,885 Required: Compute the following financial data and ratios for this year. 1. Working capital. (Enter answer in thousands.) 2. Current ratio. (Round your answer to 2 decimal places.) 3. Acid-test ratio. (Round your answer to 2 decimal places.) 1. Working capital 2. Current ratio 3. Acid-test ratio Comparative Financial statements for Weler Corporation, a merchandising company for the year ending December 31 appear below The company did not se any new common stock during the year. A total of 600.000 shares of Common w ee g ing The Interest rate on the band payable was 10%. the income tax rate was 40% and the dividend per share of common stock was 5075 year and $0.40 this year. The market value of the company's common stock at the end of the year was $23 Al of the company sales This year Last Qurants Total curtas Party and Total property and at Total Llities and Stockholders' suity Current lite Acord lates Notes pale, short term Total current l ite Total at Stockholders' quity Con stock Additional paldin Capital Total paid in Capital Retained earnings Total stockholders' equity Total abilities and stockholders equity Wuller Corporation Comparative Income Statement and Reconciliation dollars in thousands) Cost of goods sold Gross margin Selling and dinistrative expenses Selling expenses Administrative expenses Total selling and administrative pense utoprating Income Interest export t Income before te Dividends to stockholders t Income and to retained earnings minuta derings Ending retained earnings Required: Compute the following financial cats for this year L Accounts receivable turnover Assume that all sales are on account (Round your answer to 2 decimal places.) 2. Average collection period. Use 365 days in a year Round your intermediate calculations and final answer to 2 decimal places) 3. Inventory turnovec Round your answer to 2 decimal places) 4. Average le period (Use 365 days in a year Round your intermediate calculations and finalenwert 2 decimal places) 5. Operating cyce Round your intermediate calculations and final answer to 2 decimal places) 6. Total se trove Round your answer to 2 decimal places) mer 2 And mer Merge si period Orange

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts