Question: plz complete in same format Exercise 23-16 ab The Sports Equipment Division of Bramble Company is operated as a profit center. Sales for the division

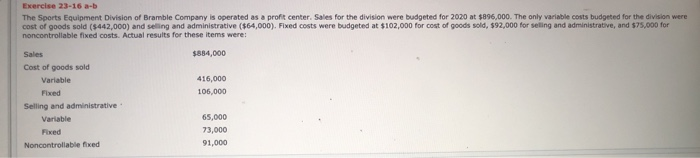

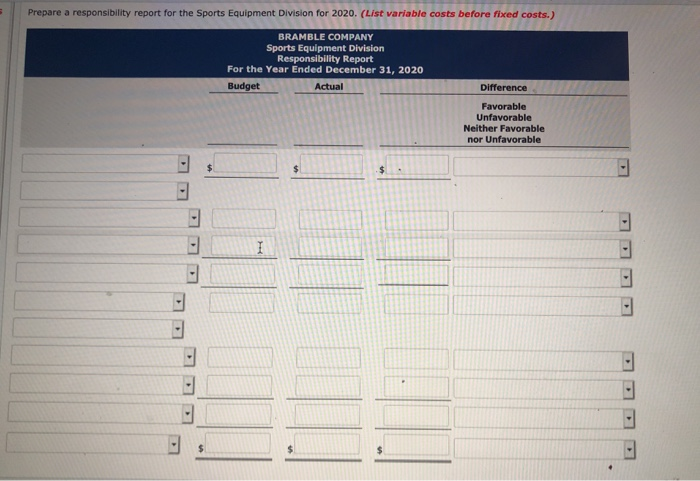

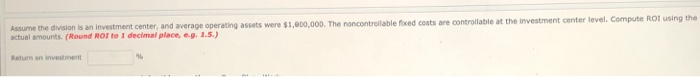

Exercise 23-16 ab The Sports Equipment Division of Bramble Company is operated as a profit center. Sales for the division were budgeted for 2020 at $896,000. The only variable costs budgeted for the division were cost of goods sold ($442,000) and selling and administrative ($64,000). Fixed costs were budgeted at $102,000 for cost of goods sold, $92,000 for selling and administrative, and $75,000 for noncontrollable fixed costs. Actual results for these items were: $884,000 416,000 106,000 Sales Cost of goods sold Variable Fixed Selling and administrative Variable Fixed Noncontrollable fixed 65,000 73,000 91,000 10 Prepare a responsibility report for the Sports Equipment Division for 2020. (List variable costs before fixed costs.) BRAMBLE COMPANY Sports Equipment Division Responsibility Report For the Year Ended December 31, 2020 Budget Actual Difference Favorable Unfavorable Neither Favorable nor Unfavorable $ $ . I Assume the division is an investment center, and average operating assets were $1,000,000. The noncontrollable foxed costs are controllable at the investment center level. Compute ROI using the actual amounts (Round ROT to I decimal place, .g. 1.5.) Return on investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts