Question: Plz do it in EXCEl Thank you so much 3. Excel Question. Download the spreadsheet portfolio_optimizer_holden.xlsx posted on the course website. (a) What happens to

Plz do it in EXCEl Thank you so much

Plz do it in EXCEl Thank you so much

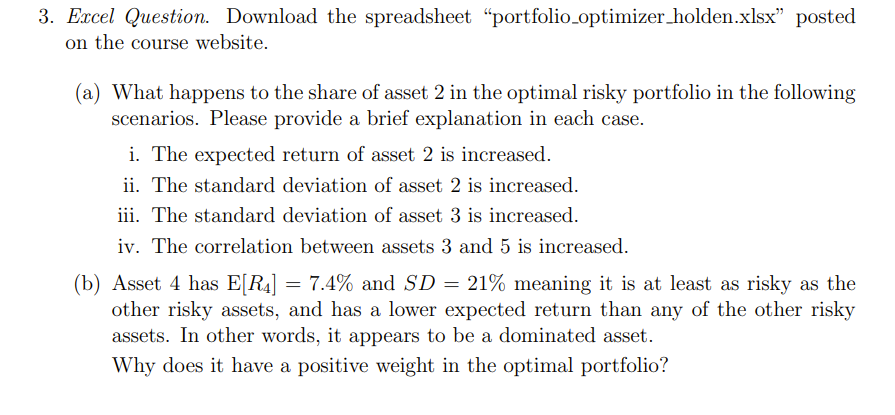

3. Excel Question. Download the spreadsheet "portfolio_optimizer_holden.xlsx" posted on the course website. (a) What happens to the share of asset 2 in the optimal risky portfolio in the following scenarios. Please provide a brief explanation in each case. i. The expected return of asset 2 is increased. ii. The standard deviation of asset 2 is increased. iii. The standard deviation of asset 3 is increased. iv. The correlation between assets 3 and 5 is increased. (b) Asset 4 has E[R4] = 7.4% and SD = 21% meaning it is at least as risky as the other risky assets, and has a lower expected return than any of the other risky assets. In other words, it appears to be a dominated asset. Why does it have a positive weight in the optimal portfolio? 3. Excel Question. Download the spreadsheet "portfolio_optimizer_holden.xlsx" posted on the course website. (a) What happens to the share of asset 2 in the optimal risky portfolio in the following scenarios. Please provide a brief explanation in each case. i. The expected return of asset 2 is increased. ii. The standard deviation of asset 2 is increased. iii. The standard deviation of asset 3 is increased. iv. The correlation between assets 3 and 5 is increased. (b) Asset 4 has E[R4] = 7.4% and SD = 21% meaning it is at least as risky as the other risky assets, and has a lower expected return than any of the other risky assets. In other words, it appears to be a dominated asset. Why does it have a positive weight in the optimal portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts