Question: plz do the question according to the data I provided NEW WIL ICO 19 F TRA 11 AT DE 1 WT MET 11 PUT GE

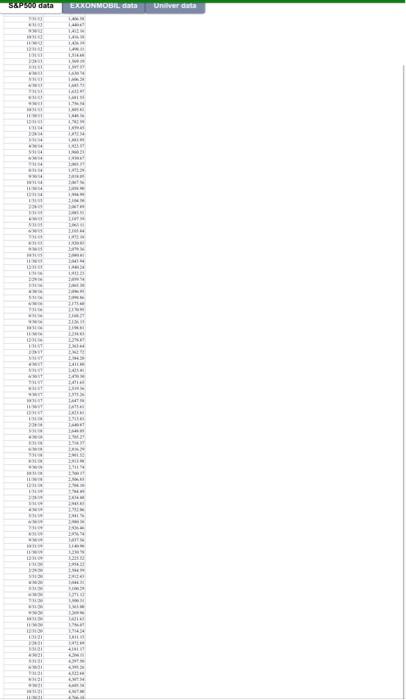

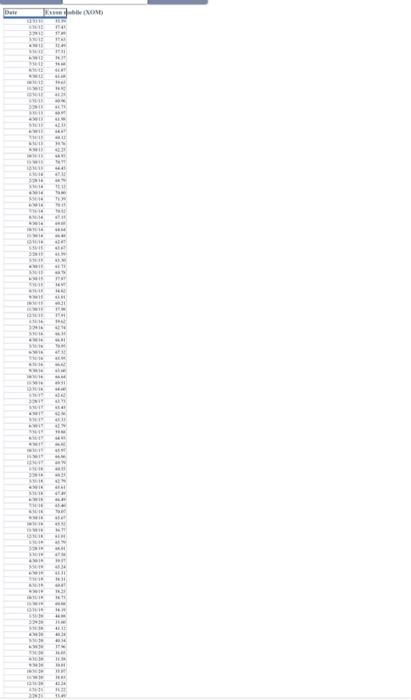

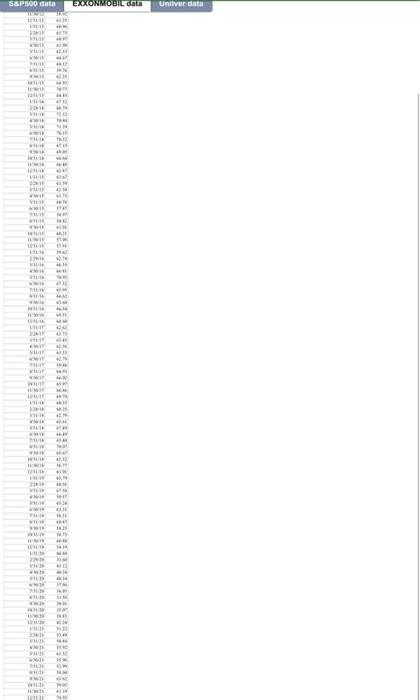

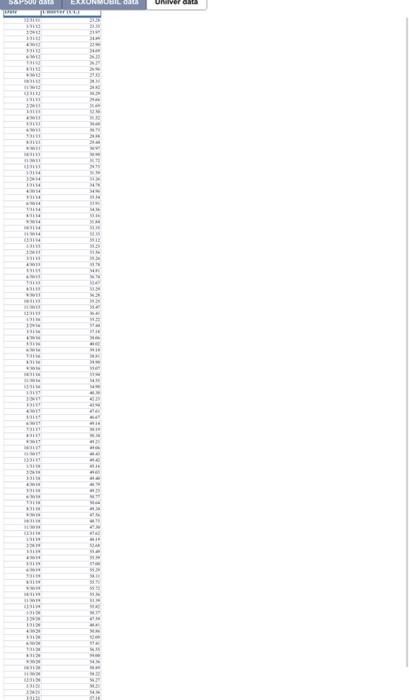

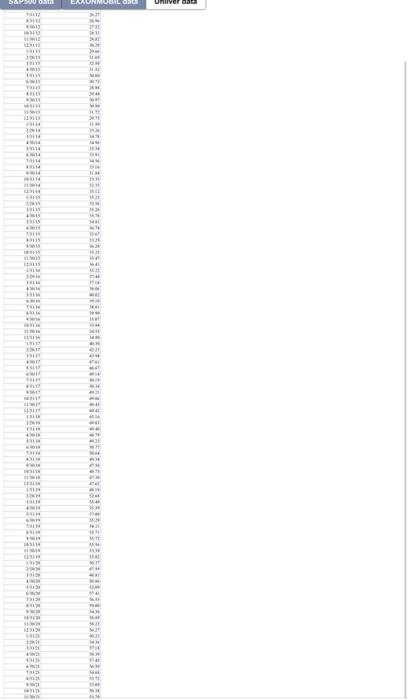

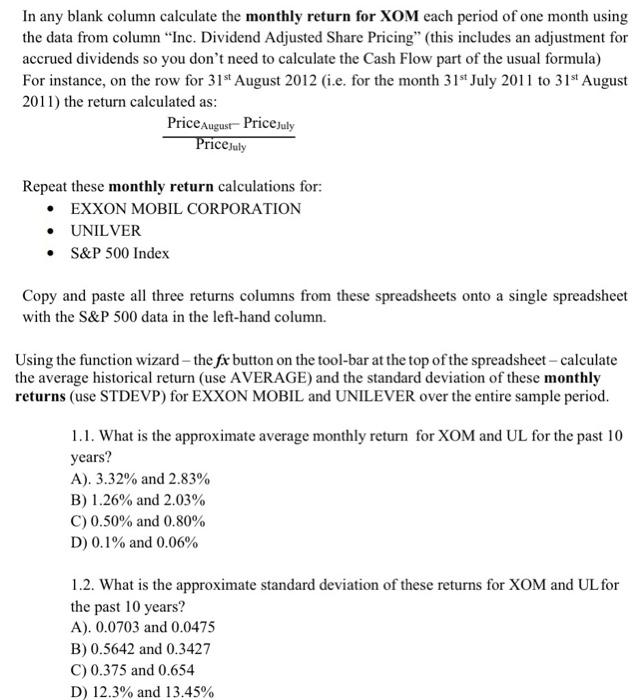

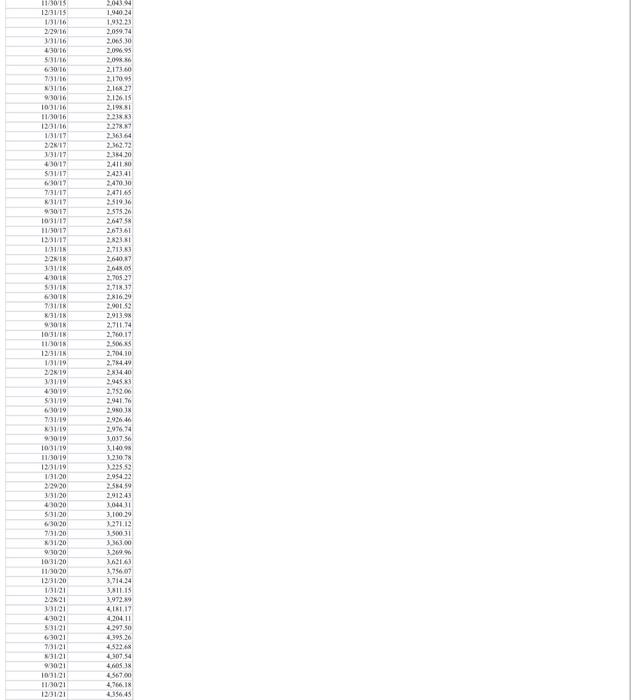

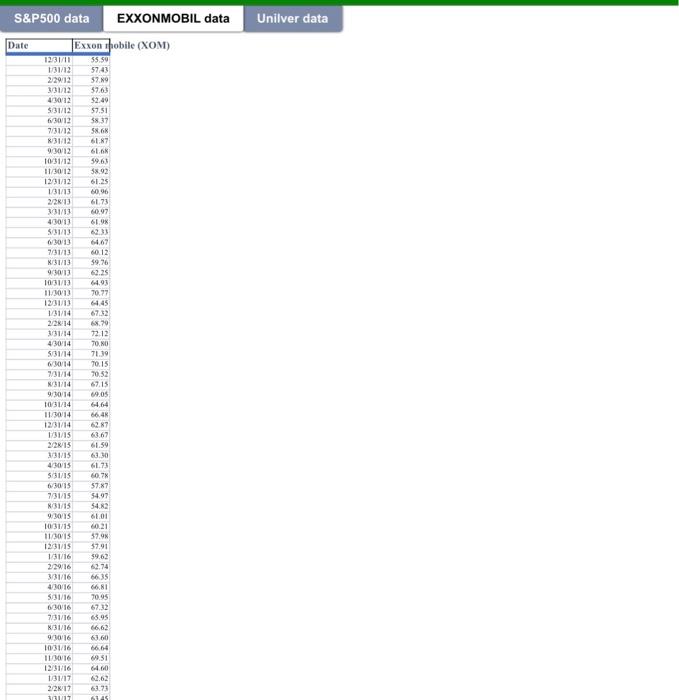

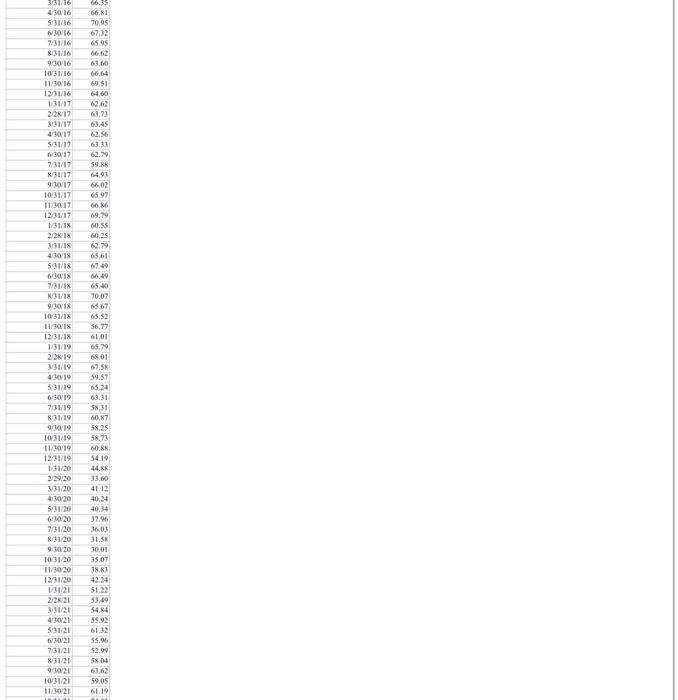

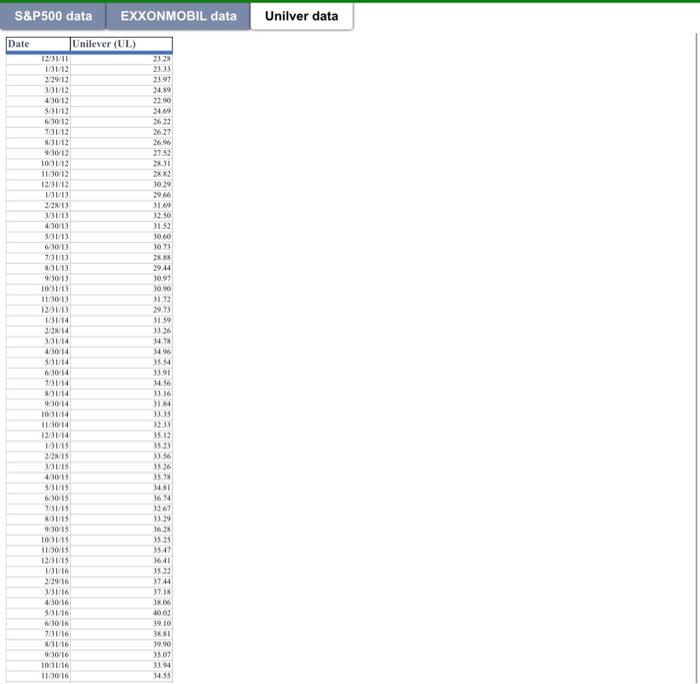

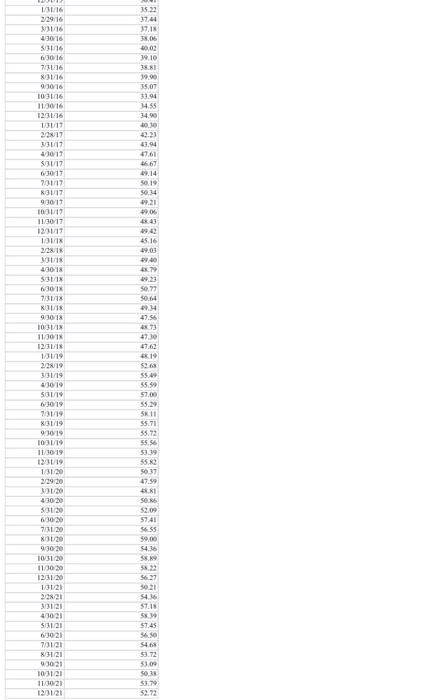

NEW WIL ICO 19 F TRA 11 AT DE 1 WT MET 11 PUT GE WE CH 11 2 HRT 1 1 WIT E TA ET 1. w TE 10 . 40 EN TE ICE 14 L CH NE W! TITLE THE NAPOTOM Dale S&SOU OMA Univer da BONMYYS 11 IT M HR CH IT ILIC HT LA TTLE EN D TA HU HINT HE RE T w RE NIRE TE * NA MINT 11 DH TA Univer data EXXONMOBIL data SPISAO sta NA TI . HEN TE 2 TE 1 AN HE 14 11 11 TET 3 11 H ht 41 GORY W TE MER VINCE AD Swi VID 10 IR 11 16 Il HT TE HET 11 THE I 1 1.1 Univer data EXXONMOBIL data S&P500 data ST MET NIE E ME TET MILE ICE LE TER LIBE LE A LE ME 1 TER M GT PET FLE SH RE HET TIL Univer data ERRON MOBIL WODOS LICE IL HEN HER TEE CIE HREE 5 w 11 16 NE WER TEM HITE LE TE LITE C M SITETI SUTE SI ME HETI 14 PETER HE HE 1 LICE CE TET 11 CE pe Ballun ERANNOBIL Data O CARS In any blank column calculate the monthly return for XOM each period of one month using the data from column "Inc. Dividend Adjusted Share Pricing (this includes an adjustment for accrued dividends so you don't need to calculate the Cash Flow part of the usual formula) For instance, on the row for 31st August 2012 (i.e. for the month 31st July 2011 to 31st August 2011) the return calculated as: Price August- Price July PriceJuly Repeat these monthly return calculations for: EXXON MOBIL CORPORATION UNILVER S&P 500 Index Copy and paste all three returns columns from these spreadsheets onto a single spreadsheet with the S&P 500 data in the left-hand column. Using the function wizard - the fx button on the tool-bar at the top of the spreadsheet - calculate the average historical return (use AVERAGE) and the standard deviation of these monthly returns (use STDEVP) for EXXON MOBIL and UNILEVER over the entire sample period. 1.1. What is the approximate average monthly return for XOM and UL for the past 10 years? A). 3.32% and 2.83% B) 1.26% and 2.03% C) 0.50% and 0.80% D) 0.1% and 0.06% 1.2. What is the approximate standard deviation of these returns for XOM and UL for the past 10 years? A). 0.0703 and 0.0475 B) 0.5642 and 0.3427 C) 0.375 and 0.654 D) 12.3% and 13.45% S&P500 data EXXONMOBIL data Unilver data Date S&P500 (GSFC) 12/31/11 1,312.41 131/12 1.365.65 2/29/12 1,408,47 31/12 1.39701 4/30/12 1.310.33 5/11/12 1.162.16 WO/12 1,379,32 7/31/12 1.400.58 31/12 1.440,67 930/12 1.412.16 10:31/12 1,416.18 11/10/12 1:46.19 12/31/12 1,495 11 1/31/03 1,5146 22/13 1.5619 11/13 1.597.57 4/30/13 1.630.74 5/31/13 1.00 28 W30/13 1.665.73 7/31/13 1.612.07 K/31/13 1,651.55 9/30/3 1.756.54 10/31/13 1.KOSI 11/30/13 1.446 12/31/13 1.782.59 1/31/14 1.859.45 V14 1.8724 31/14 IKKJ.95 4136/14 1.92357 $31/14 1.960.21 W30/14 1,93067 7/31/14 2003.37 31/14 1.972.29 W30/14 2,018.05 10/11/14 2.067.56 11/30/14 2.058.00 12/11/14 1,994.99 131/15 2.104.50 2015 2,067.89 W11S 2.055.51 4/30/15 2.107.10 531/15 2.06.11 6/10/15 2.103.4 7/31/15 1.972.IR /31/15 1.930,03 9/10/13 2,0796 10:35 2.00.41 11/2015 2,043.94 12/31/13 1,940.24 1/31/16 1.932.23 2/2016 2.059,94 3/31/16 2,065,30 4/30/16 2016.95 $31/16 2,0986 6/30/16 2,173.60 931/16 2,170.95 R/31/16 2.168.27 9/10/16 2.126.15 1031/16 2.193.11 11/30/16 2,238 12/31/16 2.278.87 1/31/17 2.361,64 22/17 2.162.72 117 2.154.20 41011 POS 11315 12/31/15 1/31/16 2/29/16 31/16 430/16 5/31/16 630/16 W31/16 5/31/16 9106 10/31/16 11/30/16 131/16 1/31/17 22:12 131/17 1.940.24 191220 2.059.74 2.015,30 2.09.95 2006 2.173.00 2.170.95 2.168.22 2.12.15 2.1961 22383 2277 26364 22.73 235420 24110 243341 2.47010 23471.45 351916 2.575.26 2647.58 2.67361 2218 2.713.3 21/06 $31/17 017 7/31/17 31/17 W30/17 10/31/19 11/30/17 12/31/17 1/31/18 2018 331/18 4/30N 1 LEOPY NDIES 6:30 IR 131/18 W31/18 WIR 10/31/18 11/30/1 12/31/IN 1/31/19 3219 W31/10 4/30/10 $31/19 2.643.08 2.708,27 2.71%. 2X16,29 2.9012 2.913.9% 2.711.74 2.760.19 2506 2,704,10 2.764,49 1440 29451 2.752.00 2.941.76 2.9103 2.92.46 2.976.74 3.037.56 140,95 1.210.78 25.50 2.95432 2584.59 2.912.43 61/06 95 ICHOY 7/31/19 31/19 W3019 10/31/19 11/30/19 19/31/19 1/31/20 32920 3/31/20 1/30/20 3/31/20 630:20 W31/20 31/20 9/30/20 10/31/20 11/3020 12/31/20 1/31/21 221 13121 43021 5/31/21 63021 77/31/21 3.100.29 27113 15001 3363,00 209.9 Y1 3.756.07 3.714.24 381115 3.972.0 4.181,17 4,20411 4.299.50 4.395.26 45248 40107.54 41 456700 4.766.18 56:45 IZIEN W3021 103121 11/3021 12/31/21 Unilver data S&P500 data EXXONMOBIL data Exxon shobile (XOM) 55.50 Date 5743 57.89 57.63 $2.49 57.51 $837 58.6 61.87 6. 59.63 38.92 61.25 9009 14 19 40.97 61.9% 23 64.67 60.12 $9.76 62.25 64.93 70.77 64.45 67.32 04 89 12/31/11 131/12 22912 3/31/12 4130/12 $31/12 6/30/12 731/12 31/12 9012 10:31/12 11/30/12 12/31/12 1/31/13 2/2013 3/31/13 4/30/13 5/31/13 10/13 731/13 8/31/13 93013 10:31/13 11.2013 12/31/13 1/31/14 2/28:14 3/31/14 4/30/14 5/31/14 (30/14 W31/14 N/31/14 9/30/14 10/31/14 11/30/14 12731/14 1/31/15 228/15 3/31/13 43015 531/15 3015 731/15 8/31/15 9.2015 10/31/15 11/3015 123115 131/16 2/2016 3/31/16 4/2016 5/31/16 6/2016 731/16 31/16 9/30/16 10/31/16 11/2016 12/31/16 1/31/17 226/17 11 72.12 70,0 71.30 70.15 70.52 67.15 09.05 64.64 66.4 6287 61.50 OCES 61.73 60.7 577 $4.97 54.82 1019 60.21 57.93 37.91 $9.62 62.74 6635 66.81 70.95 67.32 63.95 61 60 66.64 69.51 64.00 63.73 0105 91/IDE 66.35 66.81 70.95 67.32 65.95 06.62 63.00 66.64 1969 4/30/16 31/16 6/30/16 731/16 8/31/16 9/10/16 10/31/16 11/30/16 11/16 1/31/17 2/28/17 301/17 473017 5/31/17 6/30/17 731/17 31/17 Q17 10/31/17 11/30/17 12/31/17 1/31/18 2.2018 331/18 4/30/18 5/31/18 6/2018 W31/1 31/18 9/30/18 10/31/18 11/30/18 12/31/18 1/31/19 228/19 31/19 64.60 6262 6.73 6345 62.56 63.11 62.70 59.85 64.00 66.02 65.97 06.16 69.79 60.35 60.25 62.79 65.61 66.40 65.40 70.07 65.67 65.52 56.77 1019 66.70 61/00 61/IES 6/30/19 7731/19 31/19 616 10/31/19 11/30/19 1231/19 131/20 229/30 3/31/20 41020 5/31/20 6/30/20 701/20 8/31/20 9/30/20 1031/20 11/10/20 12/31/20 68.01 67.5 59.57 65.24 63.31 58,31 60.87 58.25 58.73 60.88 54.19 44.88 33,60 41.12 4024 40.34 37.96 36.03 31.5 30.01 35.07 38.1 42.24 51.22 53,49 54.84 55.92 61.32 $5.96 $2.99 58 04 63.62 59.05 61.19 12/11 220/21 33121 43021 53121 30:21 73121 31/21 10/21 10/31/21 11/3021 S&P500 data EXXONMOBIL data Unilver data Date 23333 2199 20 2200 24.60 1622 26 27 26.9 27.52 6 TEX Unilever (UL) 12/31/11 1/31/12 2/30/12 3/31/12 4/30/12 5/31/12 6/30/12 7/31/12 31/12 W30/12 10/31/12 11/30/12 12/31/12 1/31/13 2/28/13 3/31/13 4/30/13 5/31/13 6/30/13 7/31/13 8/31/13 9/30/13 10/3170 13 12/31/13 1/31/14 22/14 3/31/14 4/30/14 3/31/14 w/14 7/31/14 2x X2 10:29 2966 11.00 32.50 31.52 09 DE 10.73 2XXX 19.44 10.97 100 31.72 29.73 11.59 1.26 14. 14. 1554 96 161 PION W/14 10/31/14 11/30/14 12/31/14 131/15 14.56 11.16 34 13:35 1233 35.12 353) 356 35.26 SINDE VIS 4/30/15 3/31/15 CSE SI 14.1 16.74 1267 13:29 NE 9/31/15 w/31/15 9/30/15 10/31/15 11/30/15 12/31/13 3515 LPSE 2/2016 3/31/16 4/30/16 5/31/16 30/16 7/31/16 831/16 W30/16 103/16 11/30/16 36.41 3532 37.44 37.18 306 4002 39.10 3RXI 39.90 3507 1611 34 35 35.22 37.44 37.18 3806 19.10 188 1/31/16 2/29/16 116 4/30/16 531/16 63016 7/31:16 8/31/16 1016 11/16 11/30/16 12/31/16 1/3117 2017 33:17 41011 53117 017 71/17 831/17 9/30/17 102112 11/30/17 12/31/17 19.00 15.07 33.94 14.55 34.90 20.30 42.23 TOET 47.61 16.67 09.14 50.19 50.34 29.21 19.06 ETT 0949 45.16 III 40 47 2/2018 M 10/18 531/18 6301 7/31/18 50.77 50.64 2014 47.56 4673 4710 9/30/18 103VIX 11/30/1 1230/18 1319 22:19 3:31/19 4/01 53119 61-09 231/19 X31/19 930/19 103019 11/30-19 131/19 1/3130 32920 ER 19 56 55:49 55.5 57,00 55.1 5K 11 55.71 55.72 55.56 5319 55.82 56:37 47.59 081 SOR 52.00 59.41 5635 59,00 54.36 0107 4/30/20 33120 6/30/20 711120 30 93020 103120 11/30 30 123120 13021 1280 33121 4/30 21 $1121 6:30 21 70121 83121 1021 10121 11/3021 120121 5832 5621 30:21 54.16 $7.13 58 57.45 56.50 54.6 93.72 510 5033 $0.9 52.72 NEW WIL ICO 19 F TRA 11 AT DE 1 WT MET 11 PUT GE WE CH 11 2 HRT 1 1 WIT E TA ET 1. w TE 10 . 40 EN TE ICE 14 L CH NE W! TITLE THE NAPOTOM Dale S&SOU OMA Univer da BONMYYS 11 IT M HR CH IT ILIC HT LA TTLE EN D TA HU HINT HE RE T w RE NIRE TE * NA MINT 11 DH TA Univer data EXXONMOBIL data SPISAO sta NA TI . HEN TE 2 TE 1 AN HE 14 11 11 TET 3 11 H ht 41 GORY W TE MER VINCE AD Swi VID 10 IR 11 16 Il HT TE HET 11 THE I 1 1.1 Univer data EXXONMOBIL data S&P500 data ST MET NIE E ME TET MILE ICE LE TER LIBE LE A LE ME 1 TER M GT PET FLE SH RE HET TIL Univer data ERRON MOBIL WODOS LICE IL HEN HER TEE CIE HREE 5 w 11 16 NE WER TEM HITE LE TE LITE C M SITETI SUTE SI ME HETI 14 PETER HE HE 1 LICE CE TET 11 CE pe Ballun ERANNOBIL Data O CARS In any blank column calculate the monthly return for XOM each period of one month using the data from column "Inc. Dividend Adjusted Share Pricing (this includes an adjustment for accrued dividends so you don't need to calculate the Cash Flow part of the usual formula) For instance, on the row for 31st August 2012 (i.e. for the month 31st July 2011 to 31st August 2011) the return calculated as: Price August- Price July PriceJuly Repeat these monthly return calculations for: EXXON MOBIL CORPORATION UNILVER S&P 500 Index Copy and paste all three returns columns from these spreadsheets onto a single spreadsheet with the S&P 500 data in the left-hand column. Using the function wizard - the fx button on the tool-bar at the top of the spreadsheet - calculate the average historical return (use AVERAGE) and the standard deviation of these monthly returns (use STDEVP) for EXXON MOBIL and UNILEVER over the entire sample period. 1.1. What is the approximate average monthly return for XOM and UL for the past 10 years? A). 3.32% and 2.83% B) 1.26% and 2.03% C) 0.50% and 0.80% D) 0.1% and 0.06% 1.2. What is the approximate standard deviation of these returns for XOM and UL for the past 10 years? A). 0.0703 and 0.0475 B) 0.5642 and 0.3427 C) 0.375 and 0.654 D) 12.3% and 13.45% S&P500 data EXXONMOBIL data Unilver data Date S&P500 (GSFC) 12/31/11 1,312.41 131/12 1.365.65 2/29/12 1,408,47 31/12 1.39701 4/30/12 1.310.33 5/11/12 1.162.16 WO/12 1,379,32 7/31/12 1.400.58 31/12 1.440,67 930/12 1.412.16 10:31/12 1,416.18 11/10/12 1:46.19 12/31/12 1,495 11 1/31/03 1,5146 22/13 1.5619 11/13 1.597.57 4/30/13 1.630.74 5/31/13 1.00 28 W30/13 1.665.73 7/31/13 1.612.07 K/31/13 1,651.55 9/30/3 1.756.54 10/31/13 1.KOSI 11/30/13 1.446 12/31/13 1.782.59 1/31/14 1.859.45 V14 1.8724 31/14 IKKJ.95 4136/14 1.92357 $31/14 1.960.21 W30/14 1,93067 7/31/14 2003.37 31/14 1.972.29 W30/14 2,018.05 10/11/14 2.067.56 11/30/14 2.058.00 12/11/14 1,994.99 131/15 2.104.50 2015 2,067.89 W11S 2.055.51 4/30/15 2.107.10 531/15 2.06.11 6/10/15 2.103.4 7/31/15 1.972.IR /31/15 1.930,03 9/10/13 2,0796 10:35 2.00.41 11/2015 2,043.94 12/31/13 1,940.24 1/31/16 1.932.23 2/2016 2.059,94 3/31/16 2,065,30 4/30/16 2016.95 $31/16 2,0986 6/30/16 2,173.60 931/16 2,170.95 R/31/16 2.168.27 9/10/16 2.126.15 1031/16 2.193.11 11/30/16 2,238 12/31/16 2.278.87 1/31/17 2.361,64 22/17 2.162.72 117 2.154.20 41011 POS 11315 12/31/15 1/31/16 2/29/16 31/16 430/16 5/31/16 630/16 W31/16 5/31/16 9106 10/31/16 11/30/16 131/16 1/31/17 22:12 131/17 1.940.24 191220 2.059.74 2.015,30 2.09.95 2006 2.173.00 2.170.95 2.168.22 2.12.15 2.1961 22383 2277 26364 22.73 235420 24110 243341 2.47010 23471.45 351916 2.575.26 2647.58 2.67361 2218 2.713.3 21/06 $31/17 017 7/31/17 31/17 W30/17 10/31/19 11/30/17 12/31/17 1/31/18 2018 331/18 4/30N 1 LEOPY NDIES 6:30 IR 131/18 W31/18 WIR 10/31/18 11/30/1 12/31/IN 1/31/19 3219 W31/10 4/30/10 $31/19 2.643.08 2.708,27 2.71%. 2X16,29 2.9012 2.913.9% 2.711.74 2.760.19 2506 2,704,10 2.764,49 1440 29451 2.752.00 2.941.76 2.9103 2.92.46 2.976.74 3.037.56 140,95 1.210.78 25.50 2.95432 2584.59 2.912.43 61/06 95 ICHOY 7/31/19 31/19 W3019 10/31/19 11/30/19 19/31/19 1/31/20 32920 3/31/20 1/30/20 3/31/20 630:20 W31/20 31/20 9/30/20 10/31/20 11/3020 12/31/20 1/31/21 221 13121 43021 5/31/21 63021 77/31/21 3.100.29 27113 15001 3363,00 209.9 Y1 3.756.07 3.714.24 381115 3.972.0 4.181,17 4,20411 4.299.50 4.395.26 45248 40107.54 41 456700 4.766.18 56:45 IZIEN W3021 103121 11/3021 12/31/21 Unilver data S&P500 data EXXONMOBIL data Exxon shobile (XOM) 55.50 Date 5743 57.89 57.63 $2.49 57.51 $837 58.6 61.87 6. 59.63 38.92 61.25 9009 14 19 40.97 61.9% 23 64.67 60.12 $9.76 62.25 64.93 70.77 64.45 67.32 04 89 12/31/11 131/12 22912 3/31/12 4130/12 $31/12 6/30/12 731/12 31/12 9012 10:31/12 11/30/12 12/31/12 1/31/13 2/2013 3/31/13 4/30/13 5/31/13 10/13 731/13 8/31/13 93013 10:31/13 11.2013 12/31/13 1/31/14 2/28:14 3/31/14 4/30/14 5/31/14 (30/14 W31/14 N/31/14 9/30/14 10/31/14 11/30/14 12731/14 1/31/15 228/15 3/31/13 43015 531/15 3015 731/15 8/31/15 9.2015 10/31/15 11/3015 123115 131/16 2/2016 3/31/16 4/2016 5/31/16 6/2016 731/16 31/16 9/30/16 10/31/16 11/2016 12/31/16 1/31/17 226/17 11 72.12 70,0 71.30 70.15 70.52 67.15 09.05 64.64 66.4 6287 61.50 OCES 61.73 60.7 577 $4.97 54.82 1019 60.21 57.93 37.91 $9.62 62.74 6635 66.81 70.95 67.32 63.95 61 60 66.64 69.51 64.00 63.73 0105 91/IDE 66.35 66.81 70.95 67.32 65.95 06.62 63.00 66.64 1969 4/30/16 31/16 6/30/16 731/16 8/31/16 9/10/16 10/31/16 11/30/16 11/16 1/31/17 2/28/17 301/17 473017 5/31/17 6/30/17 731/17 31/17 Q17 10/31/17 11/30/17 12/31/17 1/31/18 2.2018 331/18 4/30/18 5/31/18 6/2018 W31/1 31/18 9/30/18 10/31/18 11/30/18 12/31/18 1/31/19 228/19 31/19 64.60 6262 6.73 6345 62.56 63.11 62.70 59.85 64.00 66.02 65.97 06.16 69.79 60.35 60.25 62.79 65.61 66.40 65.40 70.07 65.67 65.52 56.77 1019 66.70 61/00 61/IES 6/30/19 7731/19 31/19 616 10/31/19 11/30/19 1231/19 131/20 229/30 3/31/20 41020 5/31/20 6/30/20 701/20 8/31/20 9/30/20 1031/20 11/10/20 12/31/20 68.01 67.5 59.57 65.24 63.31 58,31 60.87 58.25 58.73 60.88 54.19 44.88 33,60 41.12 4024 40.34 37.96 36.03 31.5 30.01 35.07 38.1 42.24 51.22 53,49 54.84 55.92 61.32 $5.96 $2.99 58 04 63.62 59.05 61.19 12/11 220/21 33121 43021 53121 30:21 73121 31/21 10/21 10/31/21 11/3021 S&P500 data EXXONMOBIL data Unilver data Date 23333 2199 20 2200 24.60 1622 26 27 26.9 27.52 6 TEX Unilever (UL) 12/31/11 1/31/12 2/30/12 3/31/12 4/30/12 5/31/12 6/30/12 7/31/12 31/12 W30/12 10/31/12 11/30/12 12/31/12 1/31/13 2/28/13 3/31/13 4/30/13 5/31/13 6/30/13 7/31/13 8/31/13 9/30/13 10/3170 13 12/31/13 1/31/14 22/14 3/31/14 4/30/14 3/31/14 w/14 7/31/14 2x X2 10:29 2966 11.00 32.50 31.52 09 DE 10.73 2XXX 19.44 10.97 100 31.72 29.73 11.59 1.26 14. 14. 1554 96 161 PION W/14 10/31/14 11/30/14 12/31/14 131/15 14.56 11.16 34 13:35 1233 35.12 353) 356 35.26 SINDE VIS 4/30/15 3/31/15 CSE SI 14.1 16.74 1267 13:29 NE 9/31/15 w/31/15 9/30/15 10/31/15 11/30/15 12/31/13 3515 LPSE 2/2016 3/31/16 4/30/16 5/31/16 30/16 7/31/16 831/16 W30/16 103/16 11/30/16 36.41 3532 37.44 37.18 306 4002 39.10 3RXI 39.90 3507 1611 34 35 35.22 37.44 37.18 3806 19.10 188 1/31/16 2/29/16 116 4/30/16 531/16 63016 7/31:16 8/31/16 1016 11/16 11/30/16 12/31/16 1/3117 2017 33:17 41011 53117 017 71/17 831/17 9/30/17 102112 11/30/17 12/31/17 19.00 15.07 33.94 14.55 34.90 20.30 42.23 TOET 47.61 16.67 09.14 50.19 50.34 29.21 19.06 ETT 0949 45.16 III 40 47 2/2018 M 10/18 531/18 6301 7/31/18 50.77 50.64 2014 47.56 4673 4710 9/30/18 103VIX 11/30/1 1230/18 1319 22:19 3:31/19 4/01 53119 61-09 231/19 X31/19 930/19 103019 11/30-19 131/19 1/3130 32920 ER 19 56 55:49 55.5 57,00 55.1 5K 11 55.71 55.72 55.56 5319 55.82 56:37 47.59 081 SOR 52.00 59.41 5635 59,00 54.36 0107 4/30/20 33120 6/30/20 711120 30 93020 103120 11/30 30 123120 13021 1280 33121 4/30 21 $1121 6:30 21 70121 83121 1021 10121 11/3021 120121 5832 5621 30:21 54.16 $7.13 58 57.45 56.50 54.6 93.72 510 5033 $0.9 52.72

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts