Question: ****@@@@@@@###plz don't copy from chegg study... I already check that and don't provide answer in excel I want proper written detail answer SO I can

****@@@@@@@###plz don't copy from chegg study... I already check that and don't provide answer in excel I want proper written detail answer SO I can understand how you solved that... no knowledge just skip don't waste question otherwise I give you two dislike and report your answer

Only details and written answer Only detail and written answer don't use excel

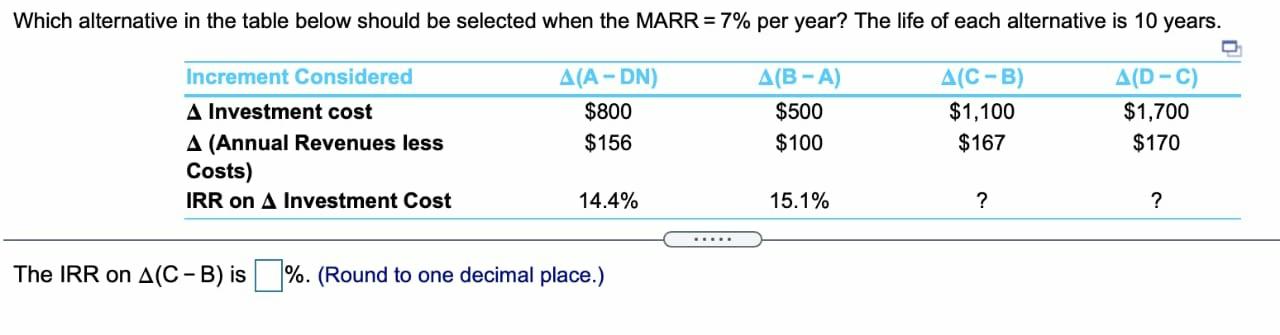

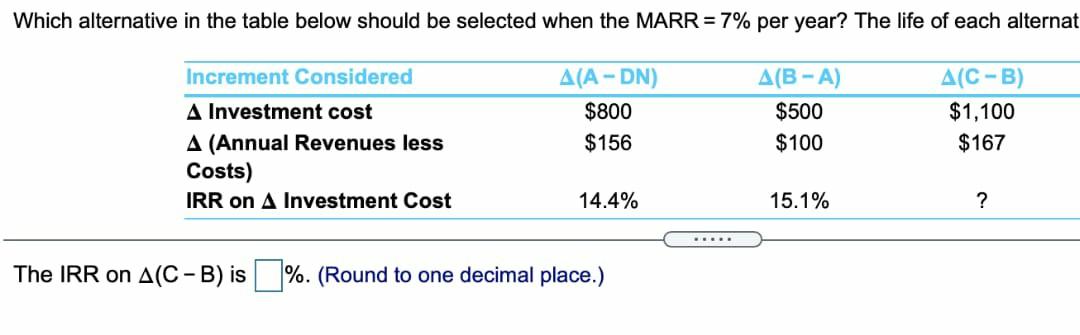

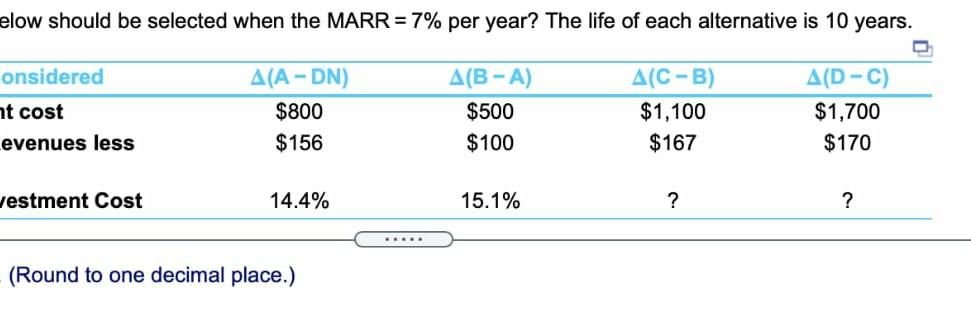

Which alternative in the table below should be selected when the MARR = 7% per year? The life of each alternative is 10 years. Increment Considered A(A-DN) $800 $156 AB-A) $500 $100 A(C-B) $1,100 $167 AD-C) $1,700 $170 A Investment cost A (Annual Revenues less Costs) IRR on A Investment Cost 14.4% 15.1% ? ? The IRR on A(C-B) is %. (Round to one decimal place.) Which alternative in the table below should be selected when the MARR = 7% per year? The life of each alternat Increment Considered A(A-DN) $800 $156 AB-A) $500 $100 A(C-B) $1,100 $167 A Investment cost A (Annual Revenues less Costs) IRR on A Investment Cost 14.4% 15.1% ? The IRR on A(C-B) is %. (Round to one decimal place.) elow should be selected when the MARR = 7% per year? The life of each alternative is 10 years. onsidered nt cost evenues less A(A-DN) $800 $156 A(B-A) $500 $100 A(C-B) $1,100 $167 A(D-C) $1,700 $170 vestment Cost 14.4% 15.1% ? ? (Round to one decimal place.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts