Question: plz fast Question three: (25 marks) On Junel, 2019, Sun Construction began construction of a new building for its use. The building was finished and

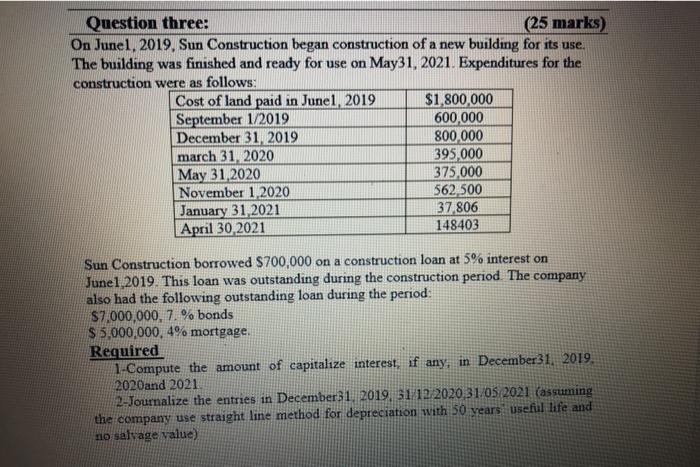

Question three: (25 marks) On Junel, 2019, Sun Construction began construction of a new building for its use. The building was finished and ready for use on May31, 2021. Expenditures for the construction were as follows: Cost of land paid in Junel, 2019 $1,800,000 September 1/2019 600,000 December 31, 2019 800,000 march 31, 2020 395,000 May 31,2020 375,000 November 1, 2020 562,500 January 31, 2021 37,806 April 30, 2021 148403 Sun Construction borrowed $700,000 on a construction loan at 5% interest on June1,2019. This loan was outstanding during the construction period. The company also had the following outstanding loan during the period: $7,000,000, 7. % bonds $ 5.000.000,4% mortgage. Required 1-Compute the amount of capitalize interest, if any, in December 31, 2019. 2020and 2021 2-Journalize the entries in December 31, 2019, 51 12/2020 31.05.2021 (assuming the company use straight line method for depreciation with 50 vears useful life and no salvage value)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts