Question: plz help asap thank u in advance !! Based on the case study, which of the following is NOT a viable option for Muesli AG?

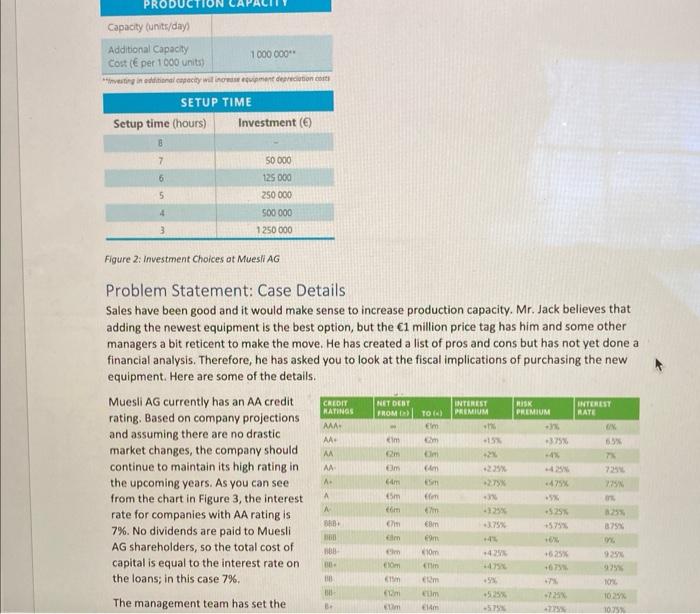

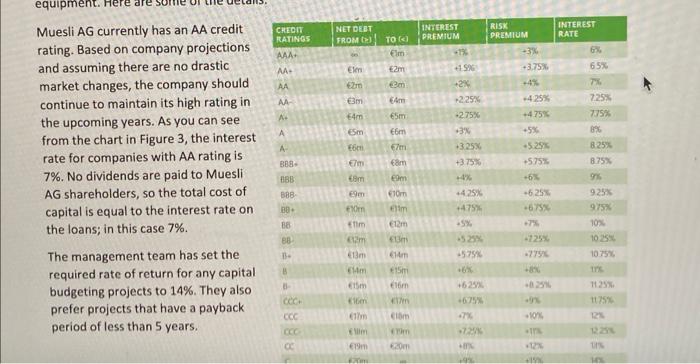

Based on the case study, which of the following is NOT a viable option for Muesli AG? Pay a consultant for 50,000 to reduce set up time by one hour. o Hire a consultant to increase production capacity by 1,000 boxes/day. Hire a consultant to design a way to reduce set up time, allowing for more flexibility to quickly switch flavors. O Purchase new manufacturing equipment for 1 mil Euros. The management team has reviewed and approved the budget you created earlier. If all goes as planned, there will be a cash surplus at the end of the quarter that can be used to pay down the loan and line of credit, invest in productivity improvements, or perhaps both. Recall the following from your interview with the production manager, Mr. Jack. "" understand that one of the mandates you have been given is to evaluate our installed machinery and equipment" says Mr. Jack. "We can purchase extra processing units, or upgrade existing ones to increase our throughput. The machines are very expensive though. We can also hire consultants to evaluate our workflow and factory layout. They can make recommendations for our work practices and machine placement that can improve our efficiency, reducing the number of hours it takes to change over production runs. Before that however, you should consider the length of our production runs. If we don't make too many products, and run the production lines for several days each time we produce a product, then we will only do changeovers once or twice a week. I've been trying to get the sales team to understand this, but they fear losing sales if we don't have the right products available for sale at any given moment." Gube Buivi Figure 1: Manufacturing at Muesli AG Thus, the two choices to invest in improving production throughput are to 1) purchase or upgrade manufacturing equipment at a cost of 1 million or 2) hire a consultant to help reduce setup time. Purchasing or upgrading the equipment will result in an additional 1 million in fixed assets on the balance sheet and an increase in depreciation expense. It will also increase production capacity by 1,000 boxes of muesli per day. The equipment is expected to last 10 years with no salvage value at the end of the 10 years. On the other hand, the cost of the consultant will be an expense on the financial statements and implementation of the consultant's recommendations will reduce the setup time required between production campaigns (batches) therefore providing the flexibility to switch flavors more quickly. PRODUCT Capacity (units/day) Additional Capacity 1 000 000 Cost (E per 1000 units) vesting in additional capacity will not donc SETUP TIME Setup time (hours) Investment (6) 8 7 50 000 6 5 125 000 250 000 500 000 1 250 000 4 3 Figure 2: Investment Choices at Muesli AG NET DEBT FROM INTEREST PREMIUM RISK PREMIUM INTEREST RATE CREDIT RATINGS : AA TO (4) Elm cim 65% Problem Statement: Case Details Sales have been good and it would make sense to increase production capacity. Mr. Jack believes that adding the newest equipment is the best option, but the 1 million price tag has him and some other managers a bit reticent to make the move. He has created a list pros and cons but has not yet done a financial analysis. Therefore, he has asked you to look at the fiscal implications of purchasing the new equipment. Here are some of the details. Muesli AG currently has an AA credit rating. Based on company projections and assuming there are no drastic +375 market changes, the company should continue to maintain its high rating in the upcoming years. As you can see 729 from the chart in Figure 3, the interest rate for companies with AA rating is 7%. No dividends are paid to Muesli AG shareholders, so the total cost of capital is equal to the interest rate on the loans, in this case 7%. The management team has set the AA Om 151 24 +2393 AA A. Om cm 45m 475% . Cm +579 B7% cm BBB 4 -42 cm Em Em om an om Elim Elm 92 +625% +07 Com mi sum 107 102 10.75 B. -57% equipmen CREDIT RATINGS NET DEBT FROM ) INTEREST PREMIUM INTEREST RATE TO Em RISK PREMIUM -3% +3.75% 6% AAA A. ANA Elen Em 65% AA 527 Em 4m EA -4.25% 7 725% 775% A. Em 65m Em 67m 4 BBB +2.25% -275% *3% +3253 +3.75% 475 -5% -5.25% Muesli AG currently has an AA credit rating. Based on company projections and assuming there are no drastic market changes, the company should continue to maintain its high rating in the upcoming years. As you can see from the chart in Figure 3, the interest rate for companies with AA rating is 7%. No dividends are paid to Muesli AG shareholders, so the total cost of capital is equal to the interest rate on the loans; in this case 7%. The management team has set the required rate of return for any capital budgeting projects to 14%. They also prefer projects that have a payback period of less than 5 years. Em Em Em tam OBB BBB am 10m +575 -6% -6.25% .67 8% 8.25% 8.75% 9 925% 975 10% Em 425% 30 EX Elim BE 12m -5% im cm 13m cm 15m im .57% . -25% -27% -8 10.25 10756 17 B 15 Elon 1125 -10% cer CCC OC Com im 50m 72 Em 79m 1224 HE Based on the case study, which of the following is NOT a viable option for Muesli AG? Pay a consultant for 50,000 to reduce set up time by one hour. o Hire a consultant to increase production capacity by 1,000 boxes/day. Hire a consultant to design a way to reduce set up time, allowing for more flexibility to quickly switch flavors. O Purchase new manufacturing equipment for 1 mil Euros. The management team has reviewed and approved the budget you created earlier. If all goes as planned, there will be a cash surplus at the end of the quarter that can be used to pay down the loan and line of credit, invest in productivity improvements, or perhaps both. Recall the following from your interview with the production manager, Mr. Jack. "" understand that one of the mandates you have been given is to evaluate our installed machinery and equipment" says Mr. Jack. "We can purchase extra processing units, or upgrade existing ones to increase our throughput. The machines are very expensive though. We can also hire consultants to evaluate our workflow and factory layout. They can make recommendations for our work practices and machine placement that can improve our efficiency, reducing the number of hours it takes to change over production runs. Before that however, you should consider the length of our production runs. If we don't make too many products, and run the production lines for several days each time we produce a product, then we will only do changeovers once or twice a week. I've been trying to get the sales team to understand this, but they fear losing sales if we don't have the right products available for sale at any given moment." Gube Buivi Figure 1: Manufacturing at Muesli AG Thus, the two choices to invest in improving production throughput are to 1) purchase or upgrade manufacturing equipment at a cost of 1 million or 2) hire a consultant to help reduce setup time. Purchasing or upgrading the equipment will result in an additional 1 million in fixed assets on the balance sheet and an increase in depreciation expense. It will also increase production capacity by 1,000 boxes of muesli per day. The equipment is expected to last 10 years with no salvage value at the end of the 10 years. On the other hand, the cost of the consultant will be an expense on the financial statements and implementation of the consultant's recommendations will reduce the setup time required between production campaigns (batches) therefore providing the flexibility to switch flavors more quickly. PRODUCT Capacity (units/day) Additional Capacity 1 000 000 Cost (E per 1000 units) vesting in additional capacity will not donc SETUP TIME Setup time (hours) Investment (6) 8 7 50 000 6 5 125 000 250 000 500 000 1 250 000 4 3 Figure 2: Investment Choices at Muesli AG NET DEBT FROM INTEREST PREMIUM RISK PREMIUM INTEREST RATE CREDIT RATINGS : AA TO (4) Elm cim 65% Problem Statement: Case Details Sales have been good and it would make sense to increase production capacity. Mr. Jack believes that adding the newest equipment is the best option, but the 1 million price tag has him and some other managers a bit reticent to make the move. He has created a list pros and cons but has not yet done a financial analysis. Therefore, he has asked you to look at the fiscal implications of purchasing the new equipment. Here are some of the details. Muesli AG currently has an AA credit rating. Based on company projections and assuming there are no drastic +375 market changes, the company should continue to maintain its high rating in the upcoming years. As you can see 729 from the chart in Figure 3, the interest rate for companies with AA rating is 7%. No dividends are paid to Muesli AG shareholders, so the total cost of capital is equal to the interest rate on the loans, in this case 7%. The management team has set the AA Om 151 24 +2393 AA A. Om cm 45m 475% . Cm +579 B7% cm BBB 4 -42 cm Em Em om an om Elim Elm 92 +625% +07 Com mi sum 107 102 10.75 B. -57% equipmen CREDIT RATINGS NET DEBT FROM ) INTEREST PREMIUM INTEREST RATE TO Em RISK PREMIUM -3% +3.75% 6% AAA A. ANA Elen Em 65% AA 527 Em 4m EA -4.25% 7 725% 775% A. Em 65m Em 67m 4 BBB +2.25% -275% *3% +3253 +3.75% 475 -5% -5.25% Muesli AG currently has an AA credit rating. Based on company projections and assuming there are no drastic market changes, the company should continue to maintain its high rating in the upcoming years. As you can see from the chart in Figure 3, the interest rate for companies with AA rating is 7%. No dividends are paid to Muesli AG shareholders, so the total cost of capital is equal to the interest rate on the loans; in this case 7%. The management team has set the required rate of return for any capital budgeting projects to 14%. They also prefer projects that have a payback period of less than 5 years. Em Em Em tam OBB BBB am 10m +575 -6% -6.25% .67 8% 8.25% 8.75% 9 925% 975 10% Em 425% 30 EX Elim BE 12m -5% im cm 13m cm 15m im .57% . -25% -27% -8 10.25 10756 17 B 15 Elon 1125 -10% cer CCC OC Com im 50m 72 Em 79m 1224 HE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts