Question: plz help. for question 3 i only need help with C thank you there is no extra information Trent, Incorporated needs an additional worker on

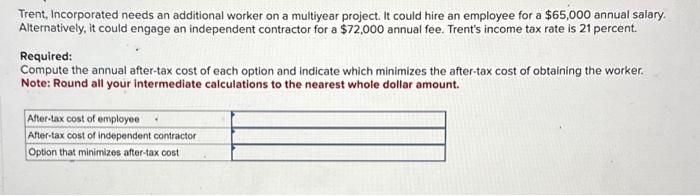

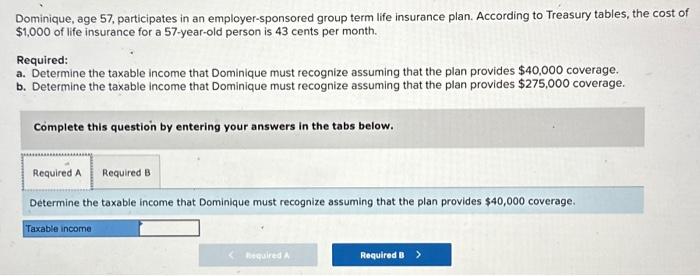

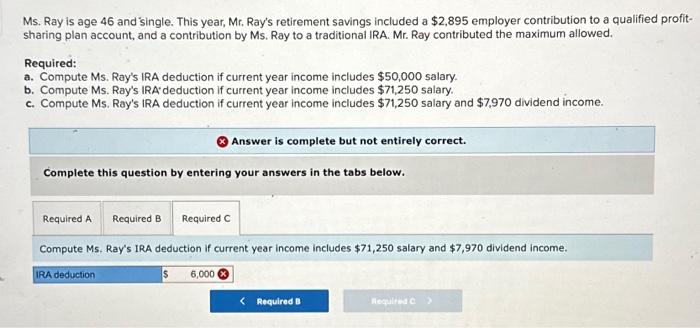

Trent, Incorporated needs an additional worker on a multiyear project. It could hire an employee for a $65,000 annual salary. Alternatively, it could engage an independent contractor for a $72,000 annual fee. Trent's income tax rate is 21 percent. Required: Compute the annual after-tax cost of each option and indicate which minimizes the after-tax cost of obtaining the worker. Note: Round all your intermediate calculations to the nearest whole dollar amount. Dominique, age 57, participates in an employer-sponsored group term life insurance plan. According to Treasury tables, the cost of $1,000 of life insurance for a 57 -year-old person is 43 cents per month. Required: a. Determine the taxable income that Dominique must recognize assuming that the plan provides $40,000 coverage. b. Determine the taxable income that Dominique must recognize assuming that the plan provides $275,000 coverage. Complete this question by entering your answers in the tabs below. Determine the taxable income that Dominique must recognize assuming that the plan provides $40,000 coverage. Ms. Ray is age 46 and 'single. This year, Mr. Ray's retirement savings included a $2,895 employer contribution to a qualified profitsharing plan account, and a contribution by Ms. Ray to a traditional IRA. Mr. Ray contributed the maximum allowed. Required: a. Compute Ms. Ray's IRA deduction if current year income includes $50,000 salary. b. Compute Ms. Ray's IRA' deduction if current year income includes $71,250 salary. c. Compute Ms. Ray's IRA deduction if current year income includes $71,250 salary and $7,970 dividend income. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Compute Ms. Ray's IRA deduction if current year income includes $71,250 salary and $7,970 dividend income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts