Question: PLZ HELP IN THESE MCQ QUESTION 1 QUESTION 2 QUESTION 3 QUESTION 4 QUESTION 5 3. If two assets are perfectly negatively correlated, then the

PLZ HELP IN THESE MCQ

QUESTION 1

QUESTION 2

QUESTION 3

QUESTION 4

QUESTION 5

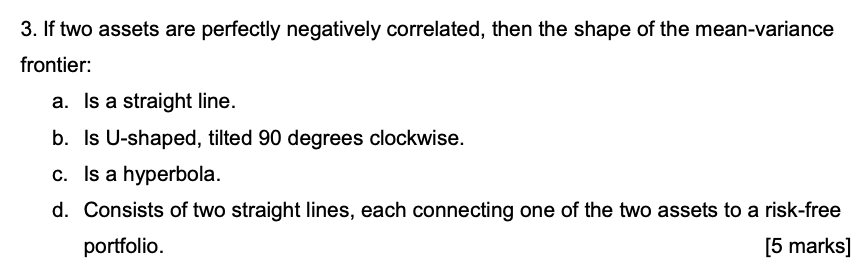

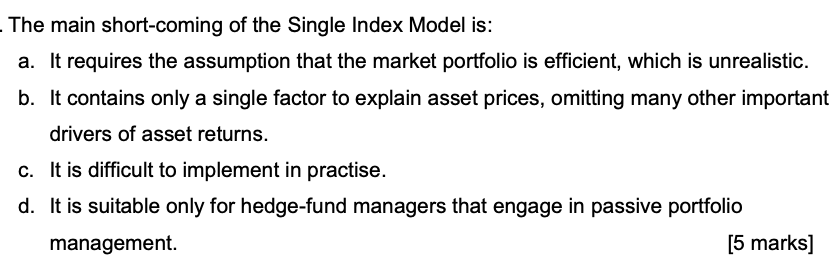

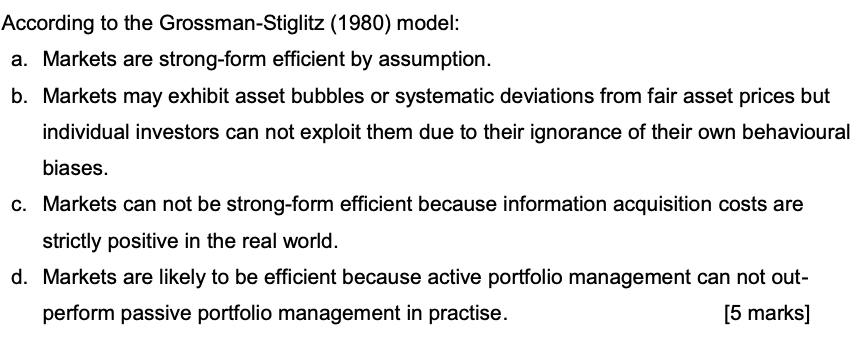

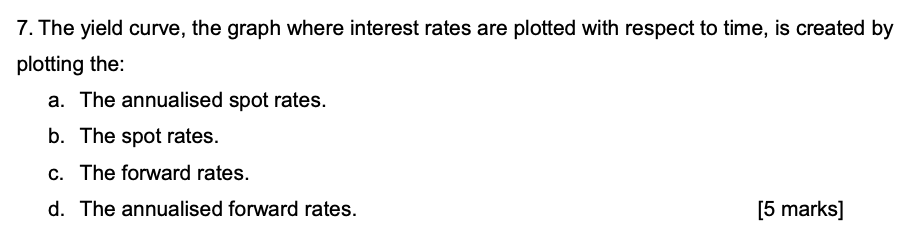

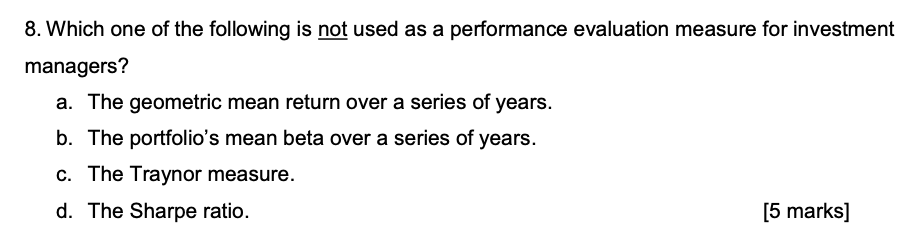

3. If two assets are perfectly negatively correlated, then the shape of the mean-variance frontier: a. Is a straight line. b. Is U-shaped, tilted 90 degrees clockwise. c. is a hyperbola. d. Consists of two straight lines, each connecting one of the two assets to a risk-free portfolio. [5 marks] The main short-coming of the Single Index Model is: a. It requires the assumption that the market portfolio is efficient, which is unrealistic. b. It contains only a single factor to explain asset prices, omitting many other important drivers of asset returns. c. It is difficult to implement in practise. d. It is suitable only for hedge-fund managers that engage in passive portfolio management. [5 marks] According to the Grossman-Stiglitz (1980) model: a. Markets are strong-form efficient by assumption. b. Markets may exhibit asset bubbles or systematic deviations from fair asset prices but individual investors can not exploit them due to their ignorance of their own behavioural biases. C. Markets can not be strong-form efficient because information acquisition costs are strictly positive in the real world. d. Markets are likely to be efficient because active portfolio management can not out- perform passive portfolio management in practise. [5 marks] 7. The yield curve, the graph where interest rates are plotted with respect to time, is created by plotting the: a. The annualised spot rates. b. The spot rates. c. The forward rates. d. The annualised forward rates. [5 marks] 8. Which one of the following is not used as a performance evaluation measure for investment managers? a. The geometric mean return over a series of years. b. The portfolio's mean beta over a series of years. c. The Traynor measure. d. The Sharpe ratio. [5 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts