Question: plz help me answer questions a to e . Name Section Suppose that you bought a December call option on ABC stock with a strike

plz help me answer questions a to e .

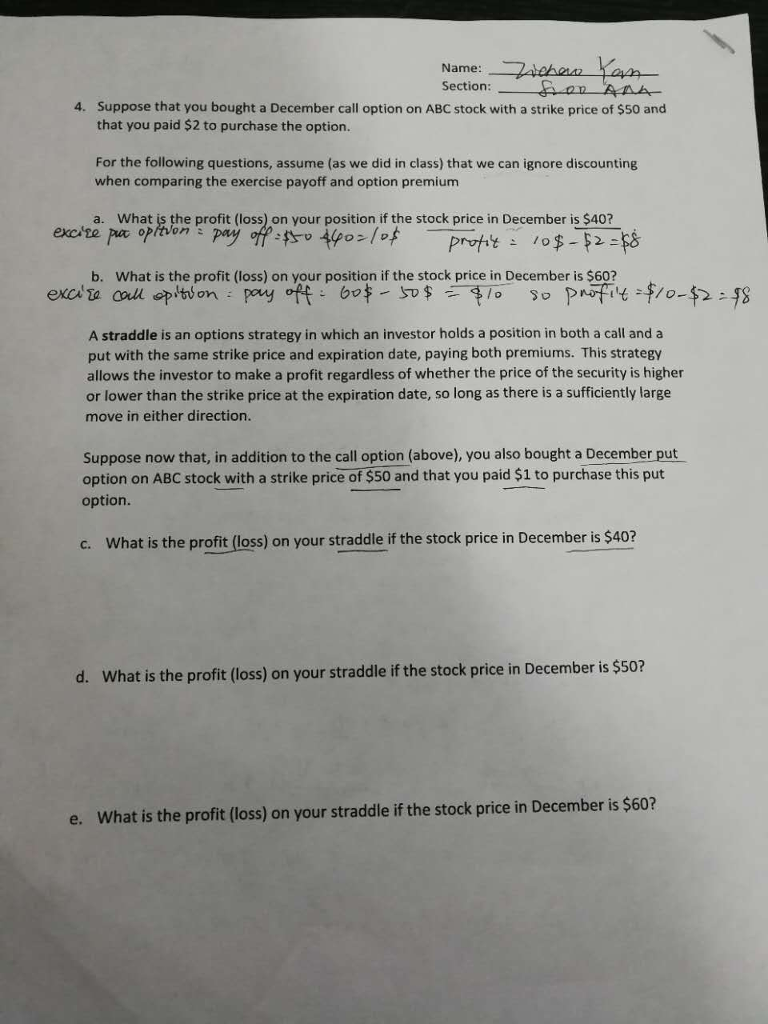

Name Section Suppose that you bought a December call option on ABC stock with a strike price of $50 and that you paid $2 to purchase the option 4. For the following questions, assume (as we did in class) that we can ignore discounting when comparing the exercise payoff and option premium a. What is the profit (loss) on your position if the stock price in December is $40? b. What is the profit (loss) on your position if the stock price in December is $60? A straddle is an options strategy in which an investor holds a position in both a call and a put with the same strike price and expiration date, paying both premiums. This strategy allows the investor to make a profit regardless of whether the price of the security is higher or lower than the strike price at the expiration date, so long as there is a sufficiently large move in either direction. Suppose now that, in addition to the call option (above), you also bought a December put option on ABC stock with a strike price of $50 and that you paid $1 to purchase this put option. c. What is the profit (loss) on your straddle if the stock price in December is $40? d. What is the profit(loss) on your straddle if the stock price in December is $50? e. What is the profit (loss) on your straddle if the stock price in December is $60

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts