Question: plz help me in those questions its ( quantitative analysis ) Food and Beverages at Southwestern University Football Games Southwestem University (SWU), a large state

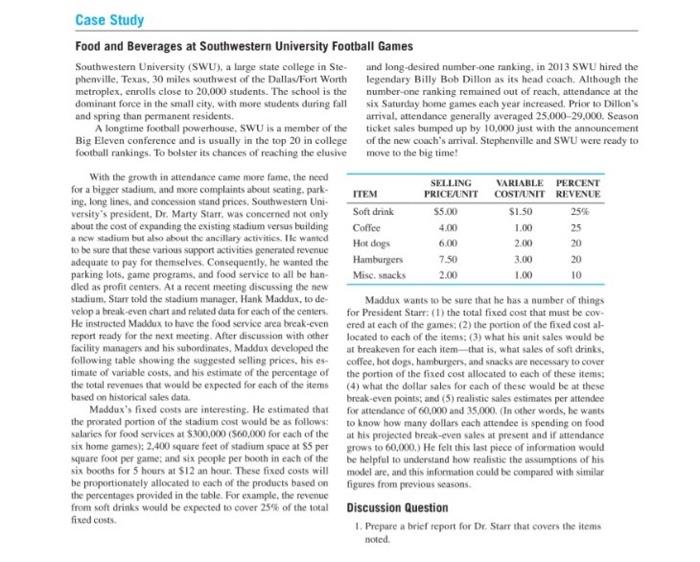

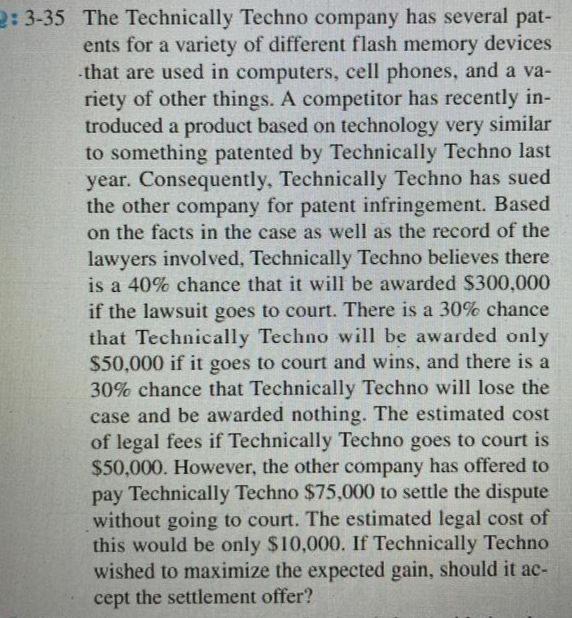

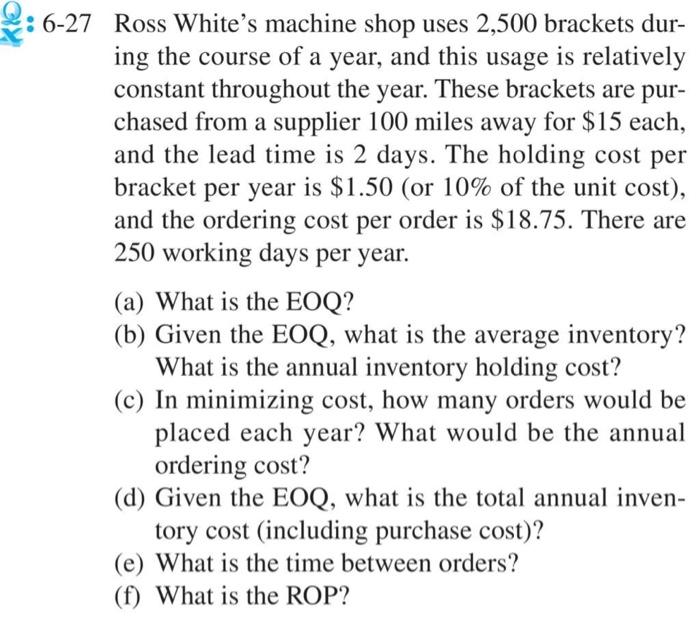

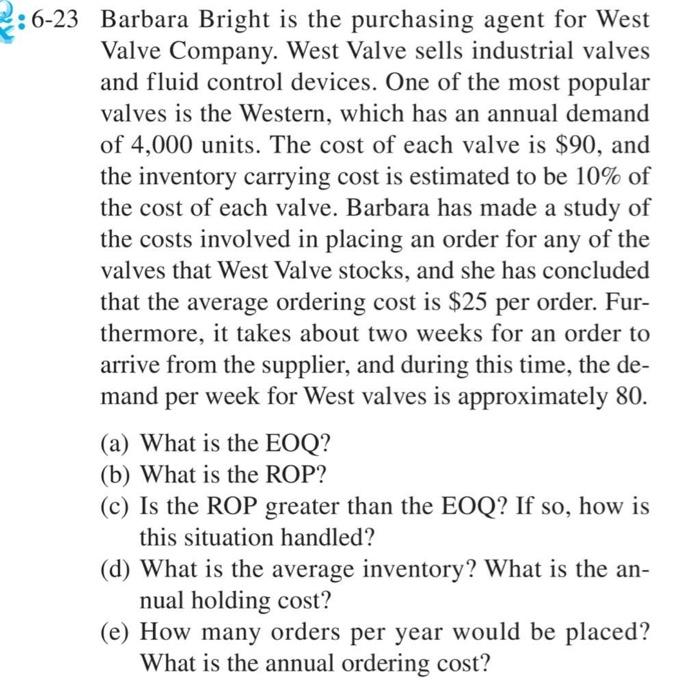

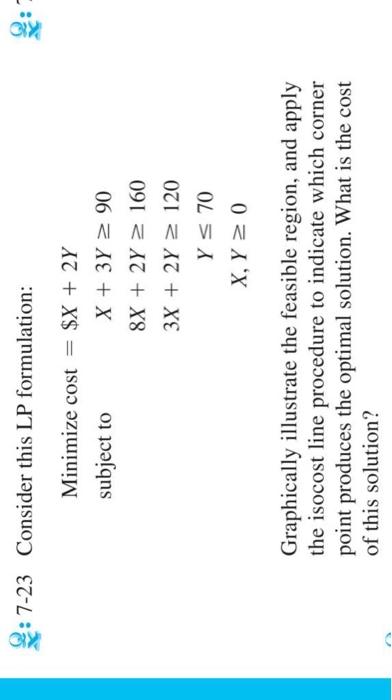

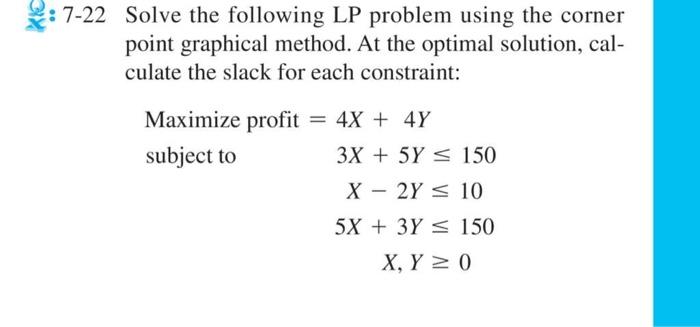

Food and Beverages at Southwestern University Football Games Southwestem University (SWU), a large state college in Ste- and long-desired number-one ranking, in 2013 SWU hired the phenville, Texas, 30 miles southwest of the Dallav/Fort Worth legendary Billy Bob Dillon as its head coach. Although the metroplex, enrolls close to 20,000 students. The school is the number-one ranking remained out of reach, attendance at the dominant force in the shall city, with alore students during fall six Saturday home games each year increased. Prior to Dillon's and spring than permanent residents. arrival, attendance generally averaged 25,000-29,000. Season A longtime football powerhouse, SWU is a member of the ticket sales bumped up by 10,000 just with the announcement Big Eleven conference and is usually in the top 20 in college of the new cosch's arrival. Stephenville and SWU were ready to football rankings. To bolster its chances of reaching the elusive move to the big time! With the growth in attendance came more fame, the need for a bigger stadium, and more complaints about seating. purking, long lines, and concession stand prices, Southwestern University's president, Dr. Marty Starr. was concerned not enly about the cost of expanding the existing stadium versas building a new stadium but also about the aacillary activitics. Ile wanted to be sure that these various support activities generated revenue adequate to pay for thenselves. Consequently. he wanted the parking lots, game programs, and food service to all be handiled as profit centers. At a recent meeting discussing the new stadium. Star told the stadium manager. Hank Maddux, to develop a break-even chart and related data for each of the centers. for President Starr: ( 1 ) the total fixed cost that must be covered at each of the games; (2) the portion of the fixed cost althe nest mocting.After to each of the items; (3) what his anit sales would be following table showing the suggested selling prices, his es- coffee, hot dogs, hamburgen, and snacks are necesary to cover timate of variable costs, and his estimate of the percentage of the portion of the fixed cost allocated to each of these itens: the total revenues that would be expected for each of the items (4) what the dollar sales for each of these would be at these based on historical sales data. break-even points; and (5) realistic sales estimates per attendee Maddux's fixed costs are interesting. He eatimated that for atendance of 60,000 and 35,000. (In other words, he wants the prorated portion of the stadium cost would be as follows: to know how many dollars each attendee is spending on food ealaries for food services at $300,000 ( $60,000 for each of the at his projected break-even sales at present and if anendance six home games): 2,400 square feet of stadium space at $5 per grows to 60,000 .) He felt this last picce of informatioa would Mquare foot per game; and six people per booth in each of the be helpful to understand how realistic the assumptions of his six booths for 5 hours at $12 an hour. These fixed costs will mokel are, and this information could be compared with similar be proportionately allocated to each of the products based on figures from previous seasons. the percentages provided in the table. For example, the revenue from soft drinks would be expected to cover 25% of the total Discussion Question fixed costs. 1. Prepare a brief teport for Dr. Starr that covers the items noted. -3-19 The Lubricant is an expensive oil newsletter to which many as giants subscribe, including Ken Brown (see Problem 3-17 for details). In the last issue, the letter described how the demand for oil products would be extremely high. Apparently, the American consumer will continue to use oil products even if the price of these products doubles. Indeed, one of the articles in the Lubricant states that the chance of a favorable market for oil products was 70%, while the chance of an unfavorable market was only 30%. Ken would like to use these probabilities in determining the best decision. (a) What is the most that Allen would be willing to pay for a newsletter? (b) Allen now believes that a good market will give a return of only 11% instead of 14%. Will this information change the amount that Allen would be willing to pay for the newsletter? If your answer is yes, determine the most that Allen would be willing to pay, given this new information. 3-23 In Problem 3-22, you helped Allen Young determine the best investment strategy. Now, Allen is thinking about paying for a stock market newsletter. A friend of Allen said that these types of letters could predict very accurately whether the market would be good, fair, or poor. Then, based on these predictions, Allen could make better investment decisions. 5 The Technically Techno company has several patents for a variety of different flash memory devices that are used in computers, cell phones, and a variety of other things. A competitor has recently introduced a product based on technology very similar to something patented by Technically Techno last year. Consequently, Technically Techno has sued the other company for patent infringement. Based on the facts in the case as well as the record of the lawyers involved, Technically Techno believes there is a 40% chance that it will be awarded $300,000 if the lawsuit goes to court. There is a 30% chance that Technically Techno will be awarded only $50,000 if it goes to court and wins, and there is a 30% chance that Technically Techno will lose the case and be awarded nothing. The estimated cost of legal fees if Technically Techno goes to court is $50,000. However, the other company has offered to pay Technically Techno $75,000 to settle the dispute without going to court. The estimated legal cost of this would be only $10,000. If Technically Techno wished to maximize the expected gain, should it accept the settlement offer? Ross White's machine shop uses 2,500 brackets during the course of a year, and this usage is relatively constant throughout the year. These brackets are purchased from a supplier 100 miles away for $15 each, and the lead time is 2 days. The holding cost per bracket per year is $1.50 (or 10% of the unit cost), and the ordering cost per order is $18.75. There are 250 working days per year. (a) What is the EOQ? (b) Given the EOQ, what is the average inventory? What is the annual inventory holding cost? (c) In minimizing cost, how many orders would be placed each year? What would be the annual ordering cost? (d) Given the EOQ, what is the total annual inventory cost (including purchase cost)? (e) What is the time between orders? (f) What is the ROP? 23 Barbara Bright is the purchasing agent for West Valve Company. West Valve sells industrial valves and fluid control devices. One of the most popular valves is the Western, which has an annual demand of 4,000 units. The cost of each valve is $90, and the inventory carrying cost is estimated to be 10% of the cost of each valve. Barbara has made a study of the costs involved in placing an order for any of the valves that West Valve stocks, and she has concluded that the average ordering cost is $25 per order. Furthermore, it takes about two weeks for an order to arrive from the supplier, and during this time, the demand per week for West valves is approximately 80 . (a) What is the EOQ? (b) What is the ROP? (c) Is the ROP greater than the EOQ? If so, how is this situation handled? (d) What is the average inventory? What is the annual holding cost? (e) How many orders per year would be placed? What is the annual ordering cost? Q: 7-23 Consider this LP formulation: Minimizecost=$X+2YsubjecttoX+3Y908X+2Y1603X+2Y120Y70X,Y0 Graphically illustrate the feasible region, and apply the isocost line procedure to indicate which corner point produces the optimal solution. What is the cost of this solution? -22 Solve the following LP problem using the corner point graphical method. At the optimal solution, calculate the slack for each constraint: Maximizeprofit=4X+4Ysubjectto3X+5Y150X2Y5X+3YX,Y101500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts