Question: plz help me the #4 problem. Thx 3. Using arbitrage arguments explain why the price of an American call option on a stock paying no

plz help me the #4 problem. Thx

plz help me the #4 problem. Thx

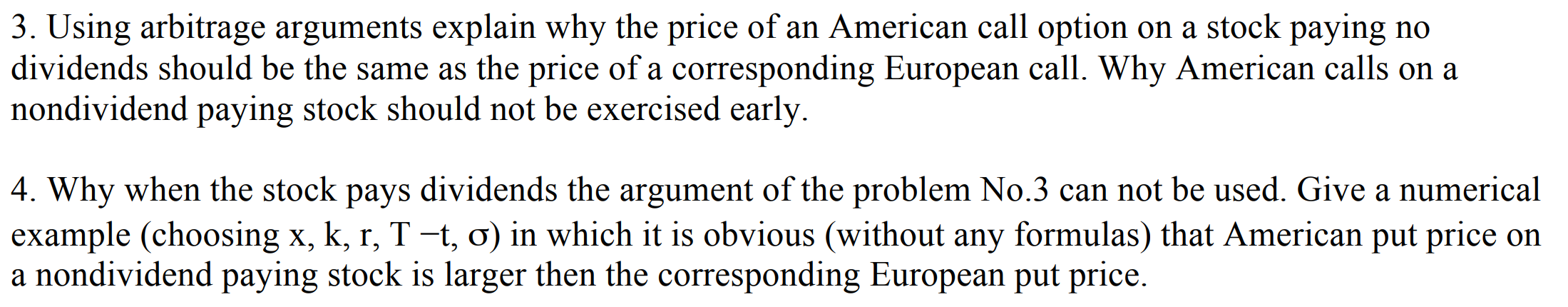

3. Using arbitrage arguments explain why the price of an American call option on a stock paying no dividends should be the same as the price of a corresponding European call. Why American calls on a nondividend paying stock should not be exercised early. 4. Why when the stock pays dividends the argument of the problem No.3 can not be used. Give a numerical example (choosing x, k, r, T-t, o) in which it is obvious (without any formulas) that American put price on a nondividend paying stock is larger then the corresponding European put price. 3. Using arbitrage arguments explain why the price of an American call option on a stock paying no dividends should be the same as the price of a corresponding European call. Why American calls on a nondividend paying stock should not be exercised early. 4. Why when the stock pays dividends the argument of the problem No.3 can not be used. Give a numerical example (choosing x, k, r, T-t, o) in which it is obvious (without any formulas) that American put price on a nondividend paying stock is larger then the corresponding European put price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts