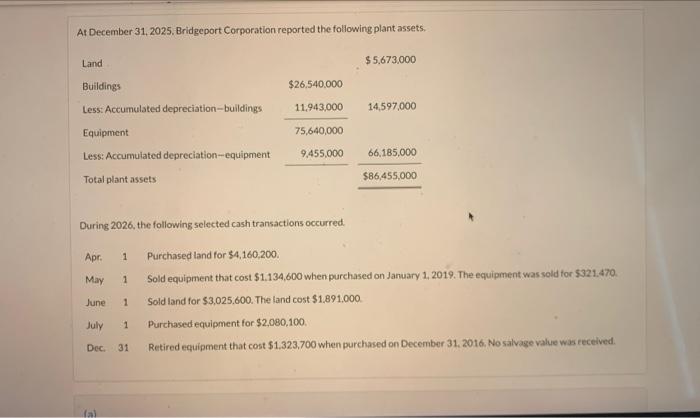

Question: Plz help me with red boxes At December 31, 2025. Bridgeport Corporation reported the following plant assets. During 2026, the following selected cash transactions occurred.

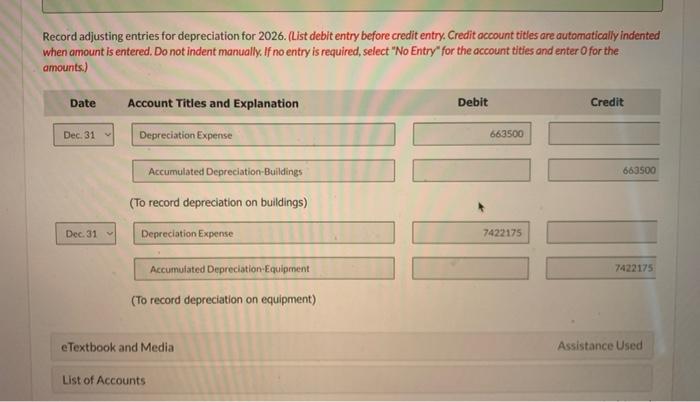

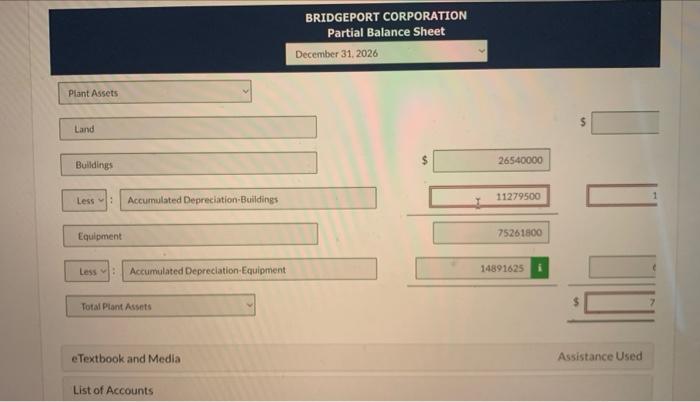

At December 31, 2025. Bridgeport Corporation reported the following plant assets. During 2026, the following selected cash transactions occurred. Apr. 1 Purchased land for $4,160,200. May 1 Sold equipment that cost \$1,134,600 when purchased on January 1, 2019. The equipment was sold for $321.470. June 1 Sold land for $3,025,600. The land cost $1,891,000 July 1 Purchased equipment for $2,080,100. Dec. 31 Retired equipment that cost $1.323,700 when purchased on December 31.2016. No salvage value was received. Record adjusting entries for depreciation for 2026. (List debit entry before credit entry. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account tities and enter O for the amounts.) BRIDGEPORT CORPORATION Partial Balance Sheet December 31,2026 Plant Assets Land Bulldings \( 5 \longdiv { 2 6 5 4 0 0 0 0 } \) Less : Accumulated Depreciation-Buidings Equipment Accumulated Depreciation-Equipment Total Pant Assets eTextbook and Media Assistance Used List of Accounts BRIDGEPORT CORPORATION Partial Balance Sheet December 31,2026 Accumulated Depreciation-Buldings Accumulated Depreciation-Equipment eTextbook and Media Assistance Used List of Accounts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts