Question: PLZ HELP WILL UPVOTE 4. (30 points-6 each part) A limited liability firm raises $4 million through debt issues (selling bonds) and $2 million through

PLZ HELP WILL UPVOTE

PLZ HELP WILL UPVOTE

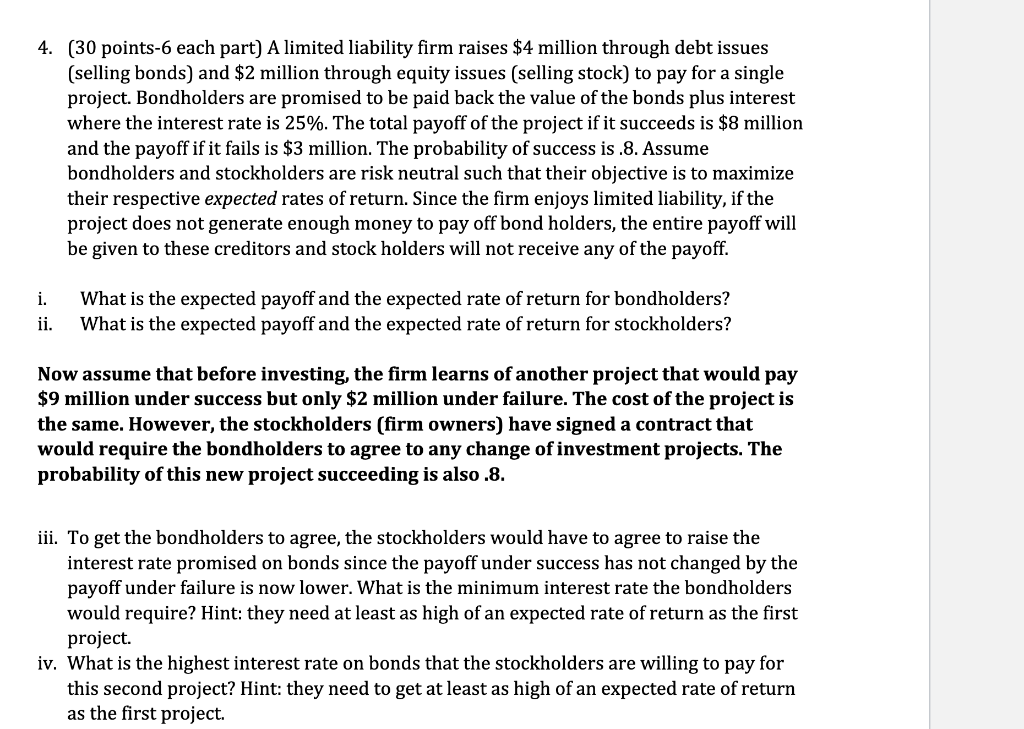

4. (30 points-6 each part) A limited liability firm raises $4 million through debt issues (selling bonds) and $2 million through equity issues (selling stock) to pay for a single project. Bondholders are promised to be paid back the value of the bonds plus interest where the interest rate is 25%. The total payoff of the project if it succeeds is $8 million and the payoff if it fails is $3 million. The probability of success is.8. Assume bondholders and stockholders are risk neutral such that their objective is to maximize their respective expected rates of return. Since the firm enjoys limited liability, if the project does not generate enough money to pay off bond holders, the entire payoff will be given to these creditors and stock holders will not receive any of the payoff. i. ii. What is the expected payoff and the expected rate of return for bondholders? What is the expected payoff and the expected rate of return for stockholders? Now assume that before investing, the firm learns of another project that would pay $9 million under success but only $2 million under failure. The cost of the project is the same. However, the stockholders (firm owners) have signed a contract that would require the bondholders to agree to any change of investment projects. The probability of this new project succeeding is also .8. iii. To get the bondholders to agree, the stockholders would have to agree to raise the interest rate promised on bonds since the payoff under success has not changed by the payoff under failure is now lower. What is the minimum interest rate the bondholders would require? Hint: they need at least as high of an expected rate of return as the first project. iv. What is the highest interest rate on bonds that the stockholders are willing to pay for this second project? Hint: they need to get at least as high of an expected rate of return as the first project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts