Question: PLZ HELP, will vote thumbs up! Determine Tax Payable for Trust under CANADIAN TAX LAW Information provided for the Trust In 2018 Johnny's father passed

PLZ HELP, will vote thumbs up!

Determine Tax Payable for Trust under CANADIAN TAX LAW

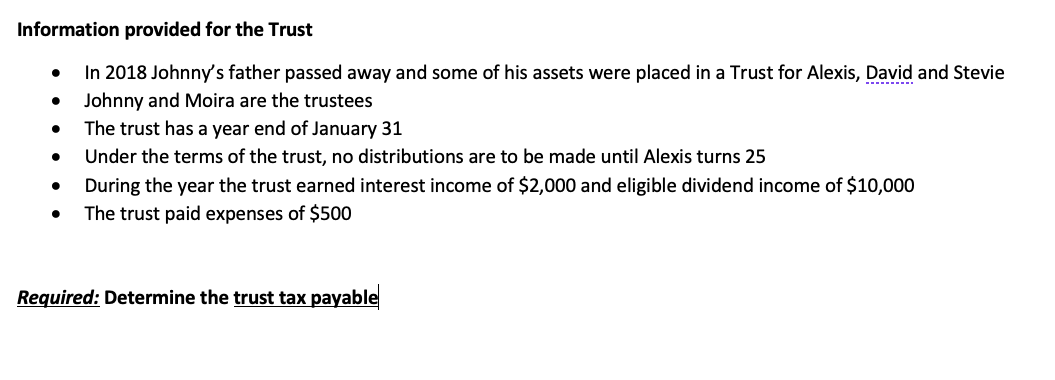

Information provided for the Trust In 2018 Johnny's father passed away and some of his assets were placed in a Trust for Alexis, David and Stevie Johnny and Moira are the trustees The trust has a year end of January 31 Under the terms of the trust, no distributions are to be made until Alexis turns 25 During the year the trust earned interest income of $2,000 and eligible dividend income of $10,000 The trust paid expenses of $500 Required: Determine the trust tax payable

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock