Question: plz how to do question #6 Problem #4: What is the price P today of a $100,000 182-day Canadian T-Bill if its quoted yield is

plz how to do question #6

plz how to do question #6

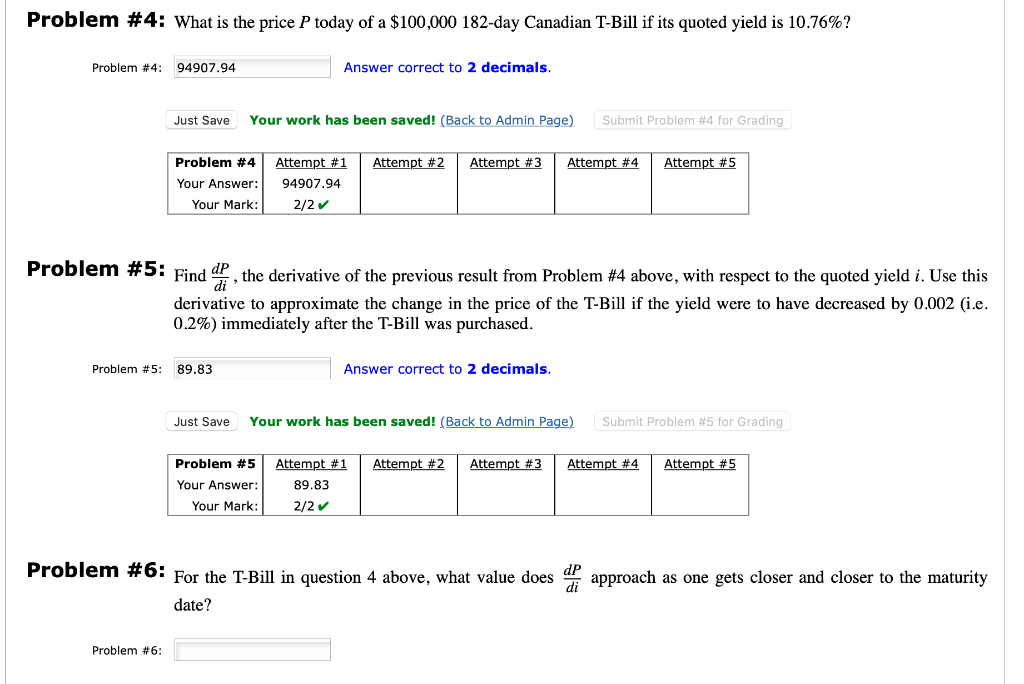

Problem #4: What is the price P today of a $100,000 182-day Canadian T-Bill if its quoted yield is 10.76%? Answer correct to 2 decimals. Problem #4: 94907.94 Your work has been saved! (Back to Admin Page) Submit Problem #4 for Grading Just Save Attempt #2 Attempt #1 Attempt #3 Attempt #4 Attempt #5 Problem #4 Your Answer: 94907.94 2/2 Your Mark: Problem #5: find dP . the derivative of the previous result from Problem #4 above, with respect to the quoted yield i. Use this di derivative to approximate the change in the price of the T-Bill if the yield were to have decreased by 0.002 (i.e. 0.2%) immediately after the T-Bill was purchased Problem #5: 89.83 Answer correct to 2 decimals. Your work has been saved! (Back to Admin Page) Submit Problem #5 for Grading Just Save Attempt #4 Attempt #5 Attempt #2 Attempt #3 Problem #5 Attempt#1 Your Answer: 89.83 Your Mark 2/2 Problem #6: For the T-Bill in question 4 above, what value does " approach as one gets closer and closer to the maturity di date? Problem #6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts