Question: PLZ JUST ANSWARE QUOTATION 2 (Q2). PLZ JUST ANSWARE QUOTATION 2 (Q2). Q1. Q2. Risk Assessment : (10 marks) A. What are the project risk

PLZ JUST ANSWARE QUOTATION 2 (Q2).

PLZ JUST ANSWARE QUOTATION 2 (Q2).

Q1.

Q2. Risk Assessment : (10 marks) A. What are the project risk assessment steps?

B. Apply the steps in question A to perform a risk assessment for a Marketing Campaign project.

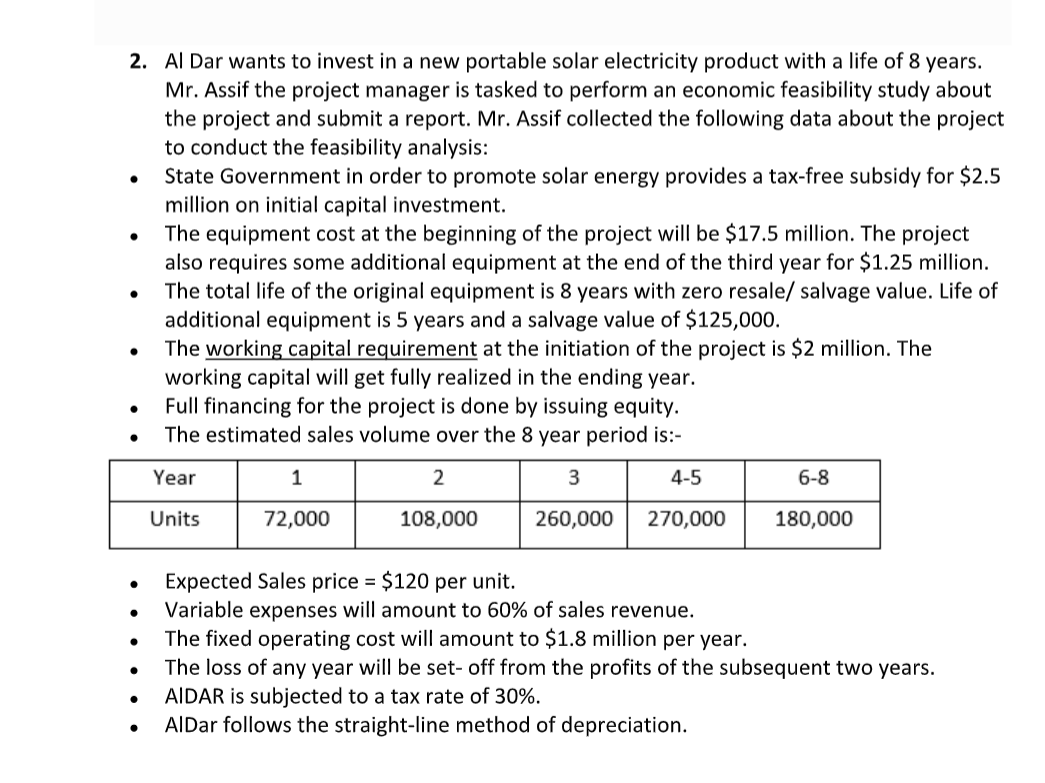

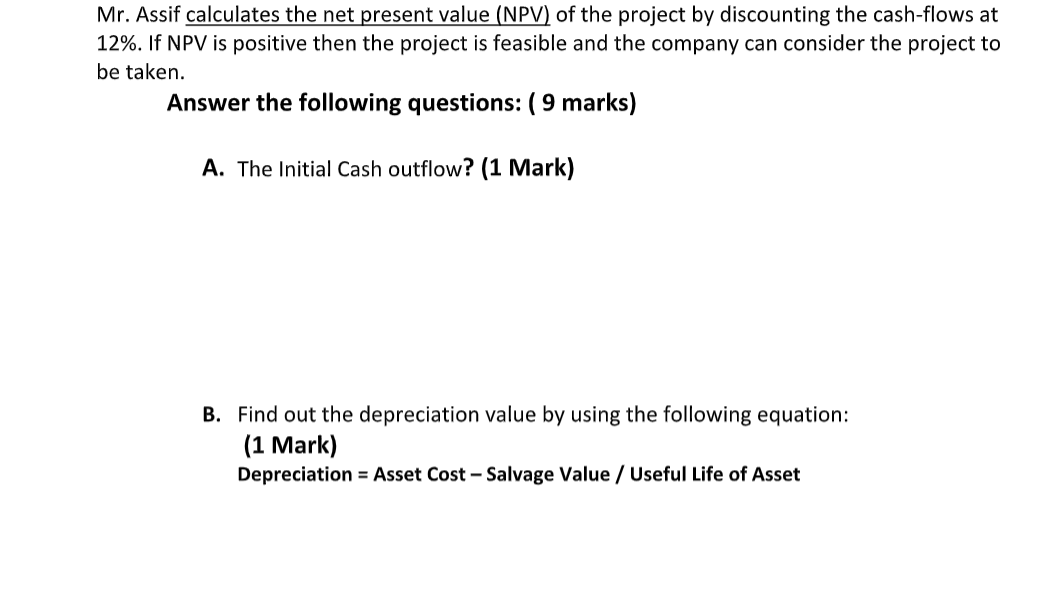

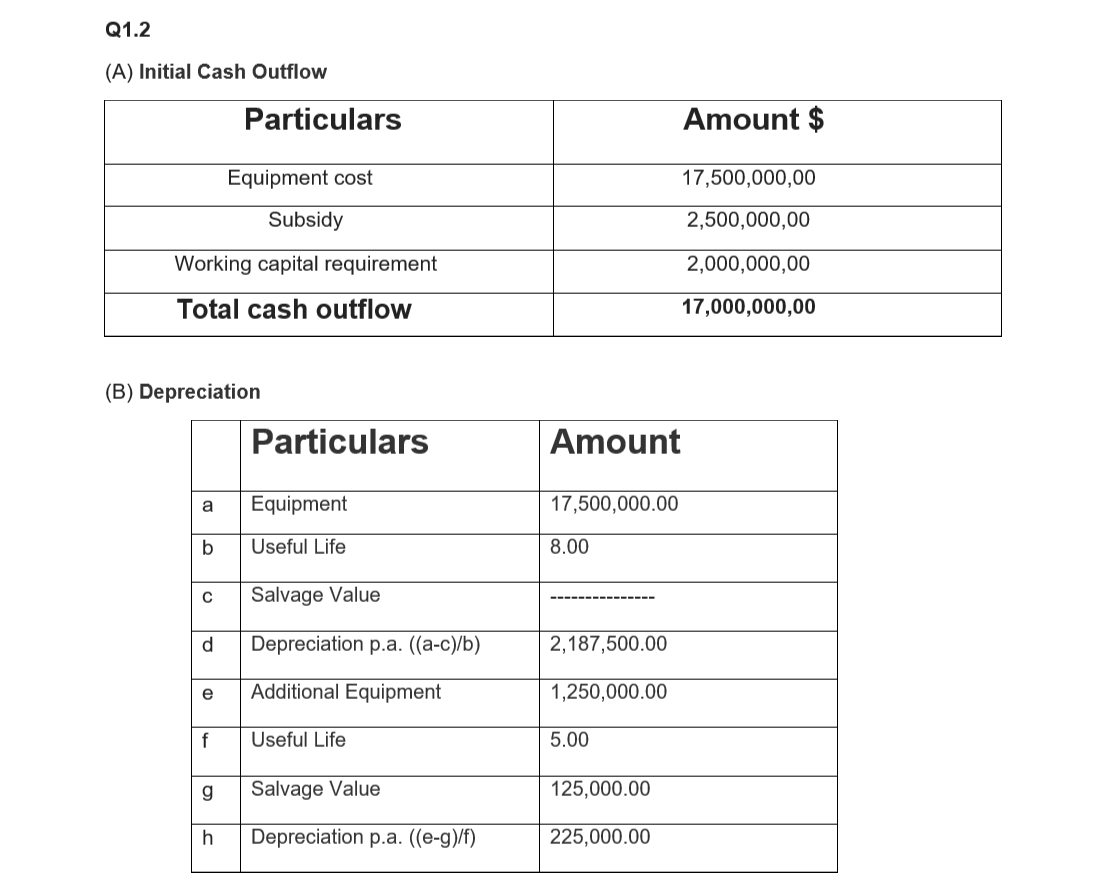

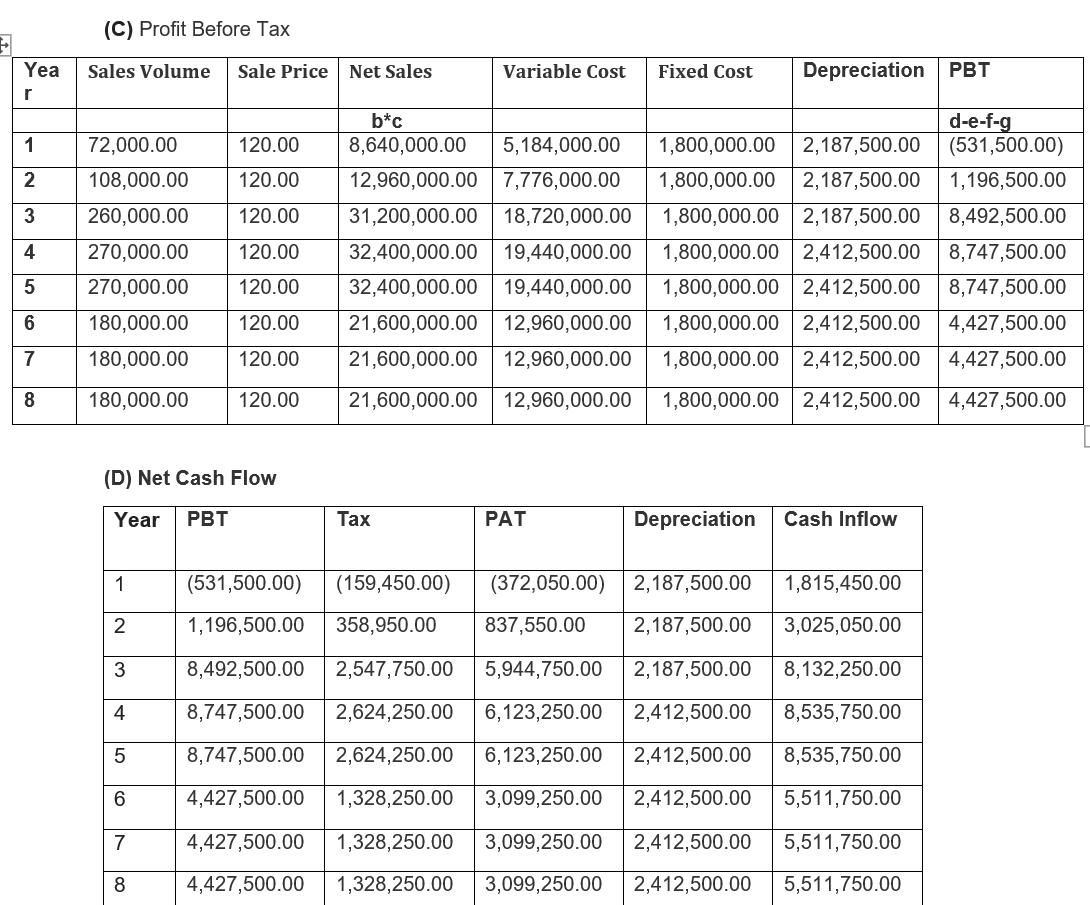

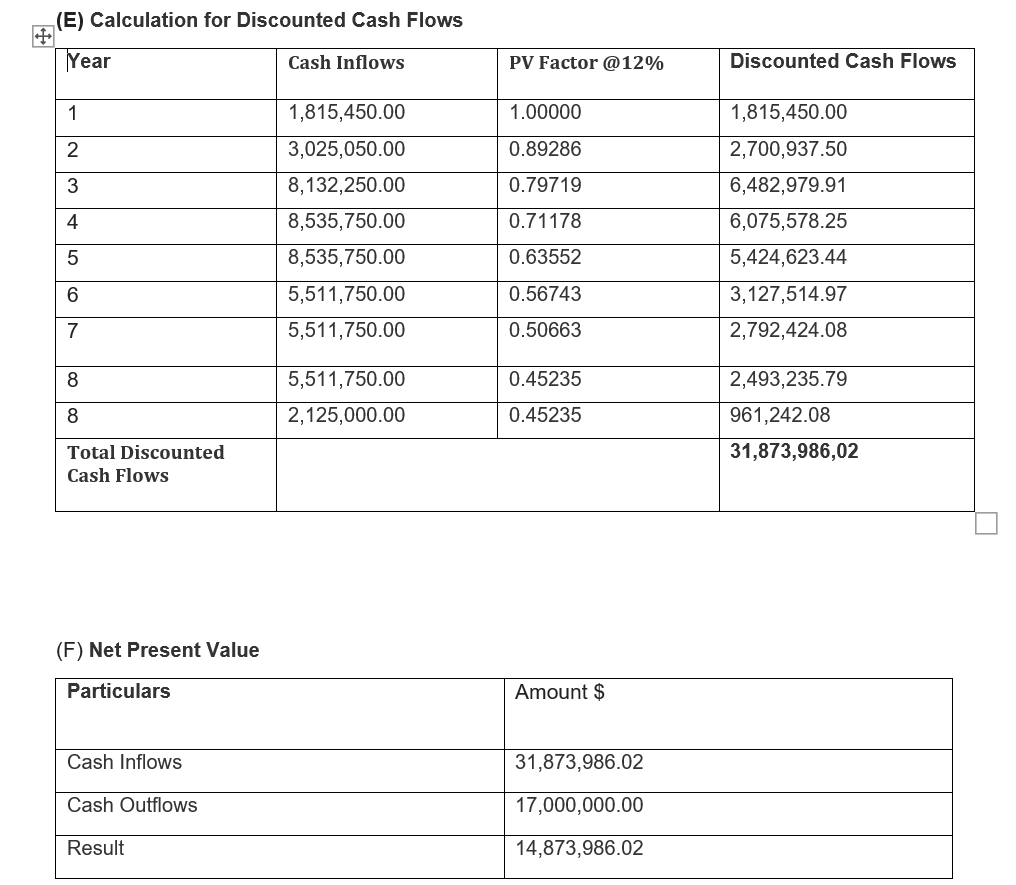

. 2. Al Dar wants to invest in a new portable solar electricity product with a life of 8 years. Mr. Assif the project manager is tasked to perform an economic feasibility study about the project and submit a report. Mr. Assif collected the following data about the project to conduct the feasibility analysis: State Government in order to promote solar energy provides a tax-free subsidy for $2.5 million on initial capital investment. The equipment cost at the beginning of the project will be $17.5 million. The project also requires some additional equipment at the end of the third year for $1.25 million. The total life of the original equipment is 8 years with zero resale/ salvage value. Life of additional equipment is 5 years and a salvage value of $125,000. The working capital requirement at the initiation of the project is $2 million. The working capital will get fully realized in the ending year. Full financing for the project is done by issuing equity. The estimated sales volume over the 8 year period is:- . Year 1 2 3 4-5 6-8 Units 72,000 108,000 260,000 270,000 180,000 . Expected Sales price = $120 per unit. Variable expenses will amount to 60% of sales revenue. The fixed operating cost will amount to $1.8 million per year. The loss of any year will be set-off from the profits of the subsequent two years. AIDAR is subjected to a tax rate of 30%. AlDar follows the straight-line method of depreciation. . . Mr. Assif calculates the net present value (NPV) of the project by discounting the cash-flows at 12%. If NPV is positive then the project is feasible and the company can consider the project to be taken. Answer the following questions: ( 9 marks) A. The Initial Cash outflow? (1 Mark) B. Find out the depreciation value by using the following equation: (1 Mark) Depreciation = Asset Cost - Salvage Value / Useful Life of Asset Q1.2 (A) Initial Cash Outflow Particulars Amount $ Equipment cost 17,500,000,00 Subsidy 2,500,000,00 Working capital requirement 2,000,000,00 Total cash outflow 17,000,000,00 (B) Depreciation Particulars Amount a Equipment 17,500,000.00 b Useful Life 8.00 Salvage Value d Depreciation p.a. ((a-c)/b) 2,187,500.00 e Additional Equipment 1,250,000.00 f Useful Life 5.00 g Salvage Value 125,000.00 h Depreciation p.a. ((e-g)/f) 225,000.00 (C) Profit Before Tax Sales Volume Sale Price Net Sales Variable Cost Yea r Fixed Cost Depreciation PBT 1 120.00 2 120.00 3 120.00 4 72,000.00 108,000.00 260,000.00 270,000.00 270,000.00 180,000.00 180,000.00 120.00 b*c 8,640,000.00 5,184,000.00 12,960,000.00 7,776,000.00 31,200,000.00 18,720,000.00 32,400,000.00 19,440,000.00 32,400,000.00 19,440,000.00 21,600,000.00 12,960,000.00 21,600,000.00 12,960,000.00 21,600,000.00 12,960,000.00 d-e-f-g 1,800,000.00 2,187,500.00 (531,500.00) 1,800,000.00 2,187,500.00 1,196,500.00 1,800,000.00 2,187,500.00 8,492,500.00 1,800,000.00 2,412,500.00 8,747,500.00 1,800,000.00 2,412,500.00 8,747,500.00 1,800,000.00 2,412,500.00 4,427,500.00 1,800,000.00 2,412,500.00 4,427,500.00 1,800,000.00 2,412,500.00 4,427,500.00 5 120.00 6 120.00 7 120.00 8 180,000.00 120.00 (D) Net Cash Flow Year PBT Tax PAT Depreciation Cash Inflow 1 (531,500.00) (159,450.00) (372,050.00) 2,187,500.00 1,815,450.00 2 1,196,500.00 358,950.00 837,550.00 2,187,500.00 3,025,050.00 3 8,492,500.00 2,547,750.00 5,944,750.00 2,187,500.00 8,132,250.00 4. 8,747,500.00 2,624,250.00 6,123,250.00 2,412,500.00 8,535,750.00 5 8,747,500.00 2,624,250.00 6,123,250.00 2,412,500.00 8,535,750.00 6 4,427,500.00 1,328,250.00 3,099,250.00 2,412,500.00 5,511,750.00 7 4,427,500.00 1,328,250.00 3,099,250.00 2,412,500.00 5,511,750.00 8 4,427,500.00 1,328,250.00 3,099,250.00 2,412,500.00 5,511,750.00 (E) Calculation for Discounted Cash Flows Year Cash Inflows PV Factor @12% Discounted Cash Flows 1 1.00000 2 0.89286 3 0.79719 4 1,815,450.00 3,025,050.00 8,132,250.00 8,535,750.00 8,535,750.00 5,511,750.00 5,511,750.00 0.71178 1,815,450.00 2,700,937.50 6,482,979.91 6,075,578.25 5,424,623.44 3,127,514.97 2,792,424.08 5 0.63552 6 0.56743 7 0.50663 8 0.45235 5,511,750.00 2,125,000.00 8 0.45235 2,493,235.79 961,242.08 31,873,986,02 Total Discounted Cash Flows (F) Net Present Value Particulars Amount $ Cash Inflows 31,873,986.02 Cash Outflows 17,000,000.00 Result 14,873,986.02Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock