Question: PLZ PLZ HELP ASAP QUESTIONS Based on the information provided above for Clare Windsor: B1- Required: Calculate the taxable trading profit for the partnership for

PLZ PLZ HELP ASAP

QUESTIONS

Based on the information provided above for Clare Windsor: B1- Required: Calculate the taxable trading profit for the partnership for the four-month period ended 30th April 2023 and the trading profit which Clare will be taxed on in the 2022/2023 basis period. B1.1 - Required: Explain how Clare's Christmas lottery winnings will be treated for tax purposes. B2 - Required: Calculate Clare Windsor's income tax payable for the tax year 2022/2023 and specify the date by which she must file her online SA100 income tax return

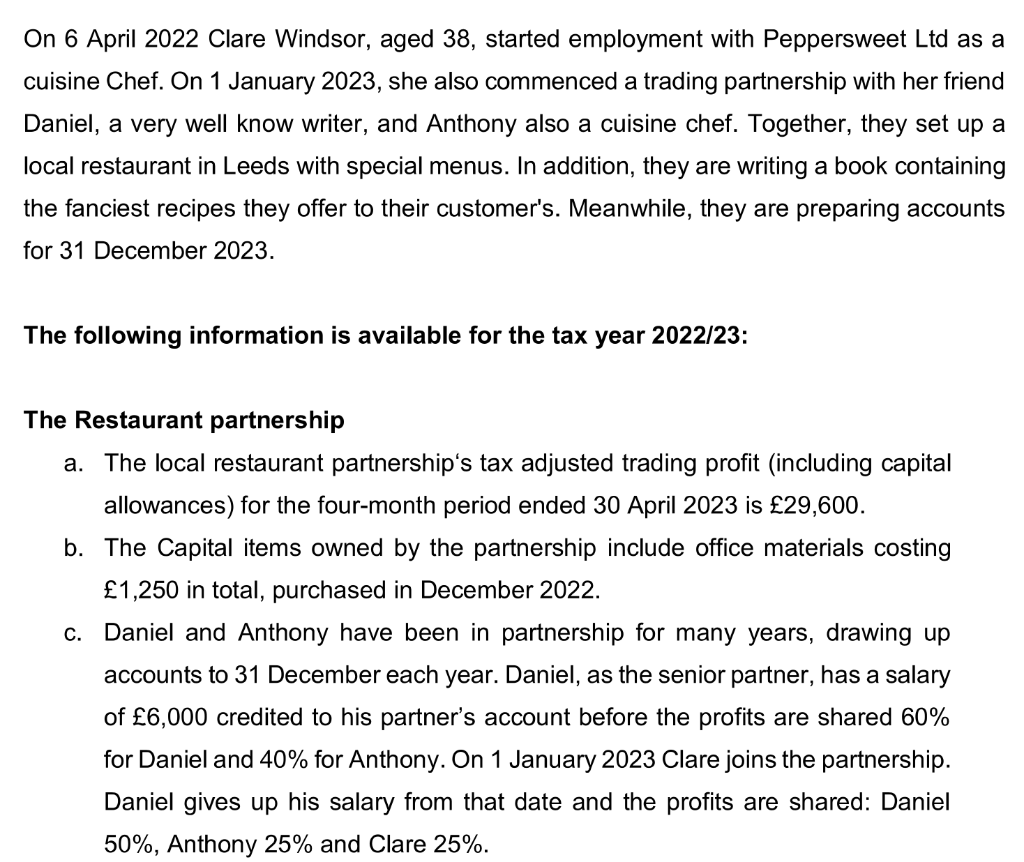

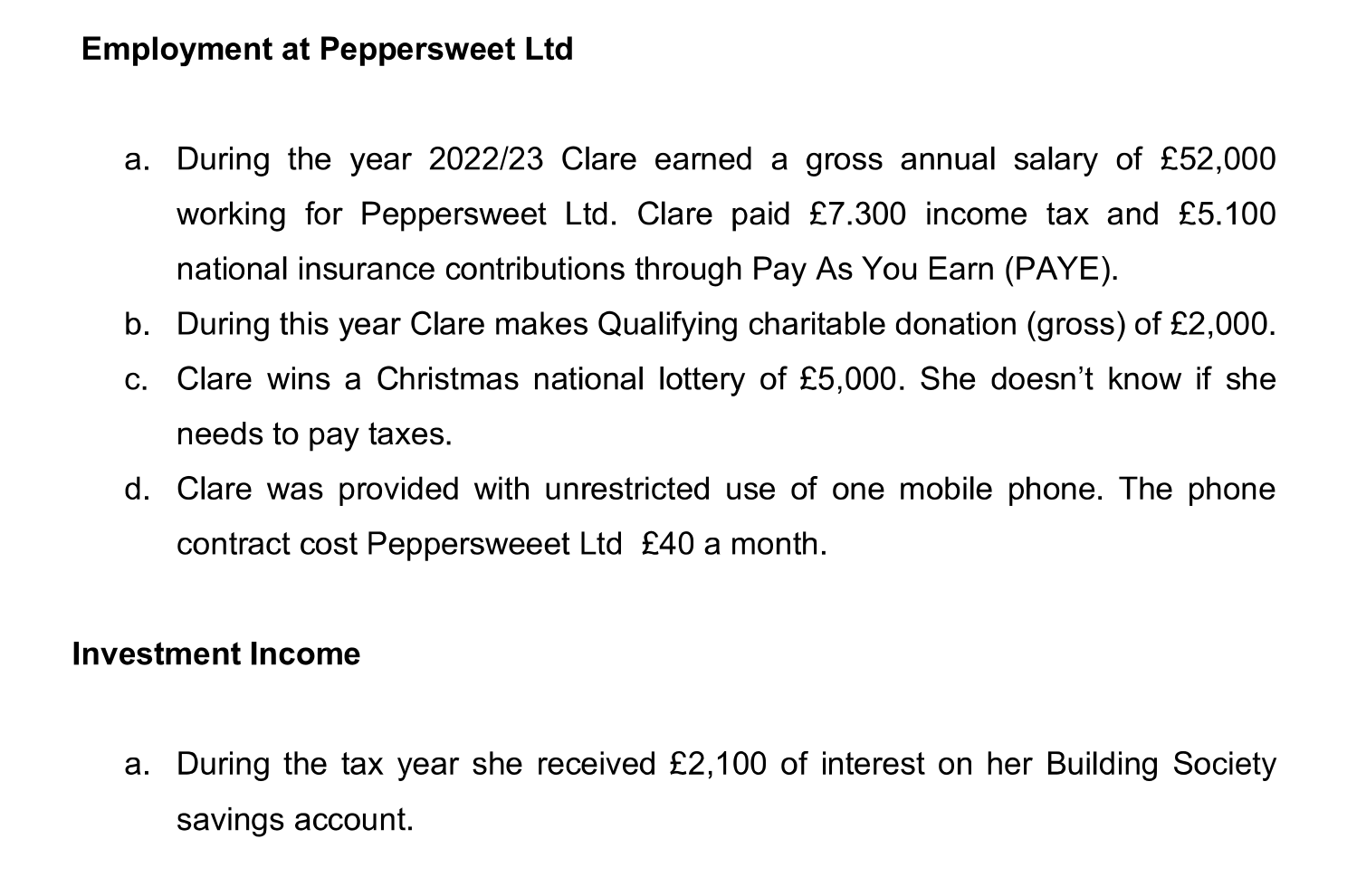

On 6 April 2022 Clare Windsor, aged 38, started employment with Peppersweet Ltd as cuisine Chef. On 1 January 2023, she also commenced a trading partnership with her frien Daniel, a very well know writer, and Anthony also a cuisine chef. Together, they set up local restaurant in Leeds with special menus. In addition, they are writing a book containin the fanciest recipes they offer to their customer's. Meanwhile, they are preparing account for 31 December 2023. The following information is available for the tax year 2022/23 : The Restaurant partnership a. The local restaurant partnership's tax adjusted trading profit (including capital allowances) for the four-month period ended 30 April 2023 is 29,600. b. The Capital items owned by the partnership include office materials costing 1,250 in total, purchased in December 2022. c. Daniel and Anthony have been in partnership for many years, drawing up accounts to 31 December each year. Daniel, as the senior partner, has a salary of 6,000 credited to his partner's account before the profits are shared 60% for Daniel and 40\% for Anthony. On 1 January 2023 Clare joins the partnership. Daniel gives up his salary from that date and the profits are shared: Daniel 50%, Anthony 25% and Clare 25%. Employment at Peppersweet Ltd a. During the year 2022/23 Clare earned a gross annual salary of 52,000 working for Peppersweet Ltd. Clare paid 7.300 income tax and 5.100 national insurance contributions through Pay As You Earn (PAYE). b. During this year Clare makes Qualifying charitable donation (gross) of 2,000. c. Clare wins a Christmas national lottery of 5,000. She doesn't know if she needs to pay taxes. d. Clare was provided with unrestricted use of one mobile phone. The phone contract cost Peppersweeet Ltd 40 a month. Investment Income a. During the tax year she received 2,100 of interest on her Building Society savings account

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts