Question: PLZ PLZ HELP ASAP This is the complete question Today is the 50-year-old birthday for Maggie Perlin who is a high-tech optical inventor with an

PLZ PLZ HELP ASAP

This is the complete question

Today is the 50-year-old birthday for Maggie Perlin who is a high-tech optical inventor with an investment portfolio amounting to US$3 million. Her current income is set at US$250,000 per year, which can fully cover the living costs. She plans to retire 10 years later. Both the income and living costs are adjusted annually for inflation at 4%.

Her husband died five years ago and she has three children aged 25 to 31 years old with well- paid jobs. She has participated and paid the whole-life medical insurance plan provided by the existing company which can fully reimburse any medical expenses in the future until her death. Maggie targets to gift US$10 million to all the three children when she expects to die in 80 years old. Maggie is subject to 30% tax rate on any employment income. Ignore any taxes on capital gain and investment income.

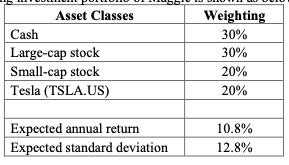

The existing investment portfolio of Maggie is shown as below:

Maggie has invested in the US stock market for 30 years and she is comfortable with moderate levels of market volatility. She has owned stock of Tesla Corporation since 2020 for long-term investment. The average purchase cost of Tesla is US$100 per share and the current market price is US$1,100 per share. She intends to hold the existing investment portfolio before retirement.

-

Calculate the return requirement of the Maggies investment portfolio in her retirement phase.

-

Identify the Liquidity requirement, Time horizons and Unique circumstance(s) for the investment constraint of Maggie.

Asset Classes Cash Large-cap stock Small-cap stock Tesla (TSLA.US) Weighting 30% 30% 20% 20% Expected annual return Expected standard deviation 10.8% 12.8% Asset Classes Cash Large-cap stock Small-cap stock Tesla (TSLA.US) Weighting 30% 30% 20% 20% Expected annual return Expected standard deviation 10.8% 12.8%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts