Question: PLZ PLZ HELP. ONLY THE CORRECT ANSWER fect Question 6 0/2 pts If you invest in a risk-free zero-coupon bond with the annualized zero-rate of

PLZ PLZ HELP. ONLY THE CORRECT ANSWER

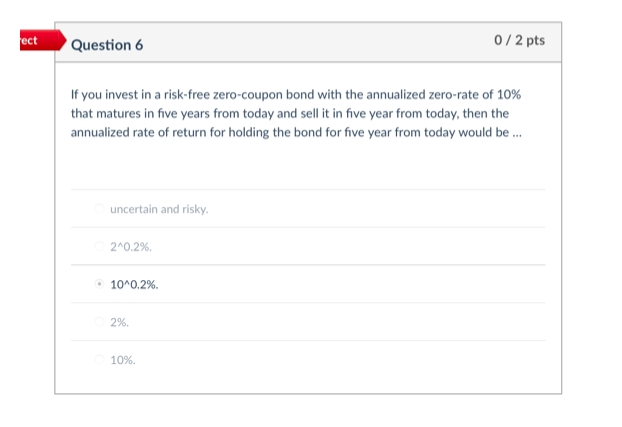

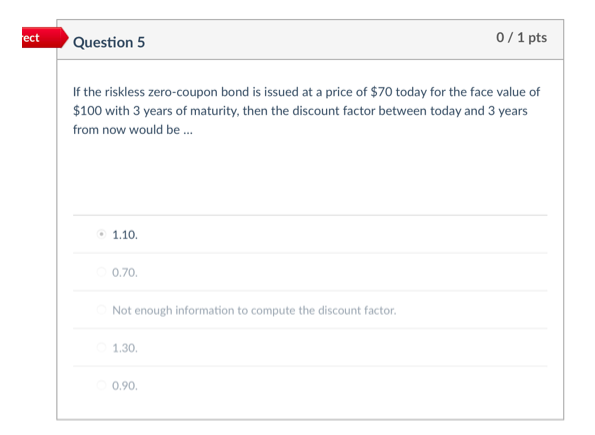

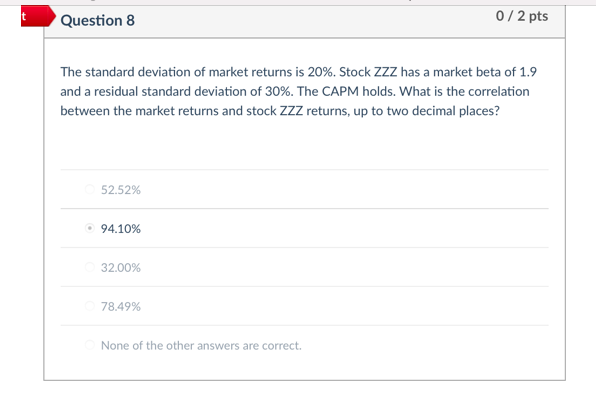

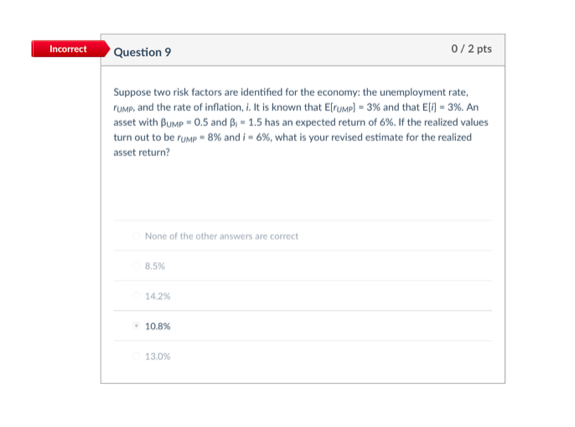

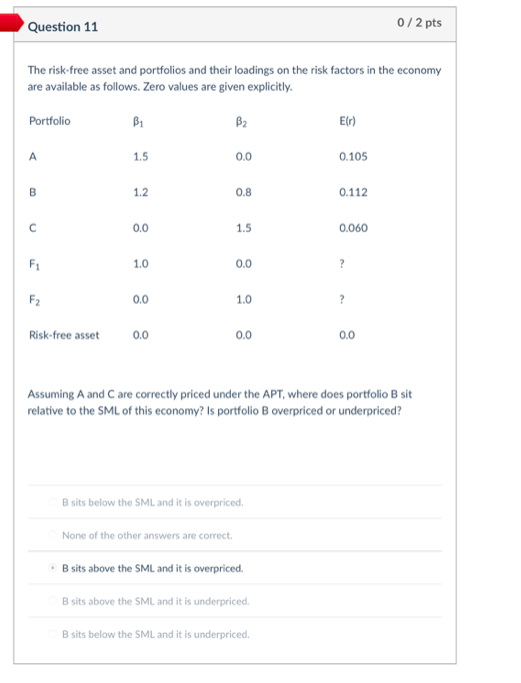

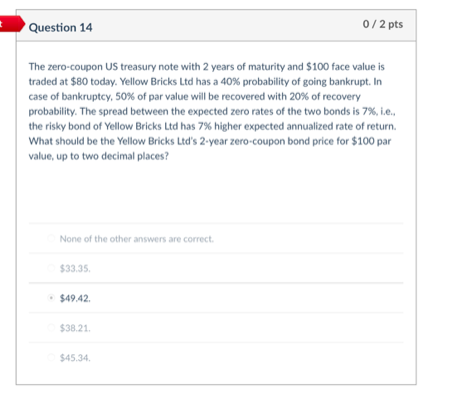

fect Question 6 0/2 pts If you invest in a risk-free zero-coupon bond with the annualized zero-rate of 10% that matures in five years from today and sell it in five year from today, then the annualized rate of return for holding the bond for five year from today would be ... uncertain and risky 240.2% . 10^0.2% 2%. 10%. fect Question 5 0/1 pts If the riskless zero-coupon bond is issued at a price of $70 today for the face value of $100 with 3 years of maturity, then the discount factor between today and 3 years from now would be ... 1.10. 0.70 Not enough information to compute the discount factor. 1.30. 0.90. Question 8 0/2 pts The standard deviation of market returns is 20%. Stock ZZZ has a market beta of 1.9 and a residual standard deviation of 30%. The CAPM holds. What is the correlation between the market returns and stock ZZZ returns, up to two decimal places? 52.52% 94.10% 32.00% 78.49% None of the other answers are correct. Incorrect Question 9 0/2 pts Suppose two risk factors are identified for the economy: the unemployment rate, rump, and the rate of inflation, i. It is known that Etrump] - 3% and that E[- 3%. An asset with Bump - 0.5 and B - 1.5 has an expected return of 6%. If the realized values turn out to be rump- 8% and i - 6%, what is your revised estimate for the realized asset return? None of the other answers are correct 8.5% 14.2% 10.8% 13.0% Question 11 0/2 pts The risk-free asset and portfolios and their loadings on the risk factors in the economy are available as follows. Zero values are given explicitly. Portfolio B1 B2 En 1.5 0.0 0.105 B 1.2 0.8 0.112 0.0 1.5 0.060 F1 1.0 0.0 ? F2 0.0 1.0 ? Risk-free asset 0.0 0.0 0.0 Assuming A and Care correctly priced under the APT, where does portfolio B sit relative to the SML of this economy? Is portfolio B overpriced or underpriced? B sits below the SML and it is overpriced, None of the other answers are correct, B sits above the SML, and it is overpriced. B sits above the SML and it is underpriced, B sits below the SML and it is underpriced. Question 14 0/2 pts The zero-coupon US treasury note with 2 years of maturity and $100 face value is traded at $80 today. Yellow Bricks Ltd has a 40% probability of going bankrupt. In case of bankruptcy, 50% of par value will be recovered with 20% of recovery probability. The spread between the expected zero rates of the two bonds is 7%, i.e. the risky bond of Yellow Bricks Ltd has 7% higher expected annualized rate of return What should be the Yellow Bricks Ltd's 2-year zero-coupon bond price for $100 par value, up to two decimal places? None of the other answers are correct. $33,35 $49.42 $38.21. $45.34

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts